Shib Is Looking Forward to a Better Month in February After Losing 14.5% in January

![]()

Journalist.

- Despite the price drops, whale trading has increased in recent days.

- At press time, SHIB long positions outnumbered short positions. Shiba Inu (19459040) fell 2.6% in the last 24 hours of trading as the second largest meme coin project continued to struggle. Using CoinMarketCap, AskFX found that the dog-themed token has lost 14.5% of its value over the past week. Although these numbers are not encouraging, it is important to consider the overall market.

The majority of coins are in the red due to a decline caused by Grayscale Bitcoin Trust outflows. SHIB actually performed better than other meme coins. AskFX reported that SHIB is the only meme project that did not see weekly drops as of the release date.

Could a recovery be on the horizon? SHIB traders can feed off popular technical analyst Ali Martinez’s recent bullish predictions. Martinez discovered a buy signal while analyzing TD Sequential, which made him optimistic that SHIB would soon recover. He said: “Be careful because SHIB could rise to $0.010 or even $0.011. AskFX investigated this further and found that Trading View provided some complementary data. The Relative Strength Index gradually rose to a neutral 50 level. This is a sign that selling pressure has eased.

The Moving Average Convergence Divergence line (MACD) has crossed the signal line. This was interpreted by many analysts and traders as a positive buy signal. Whales Sensing Gains

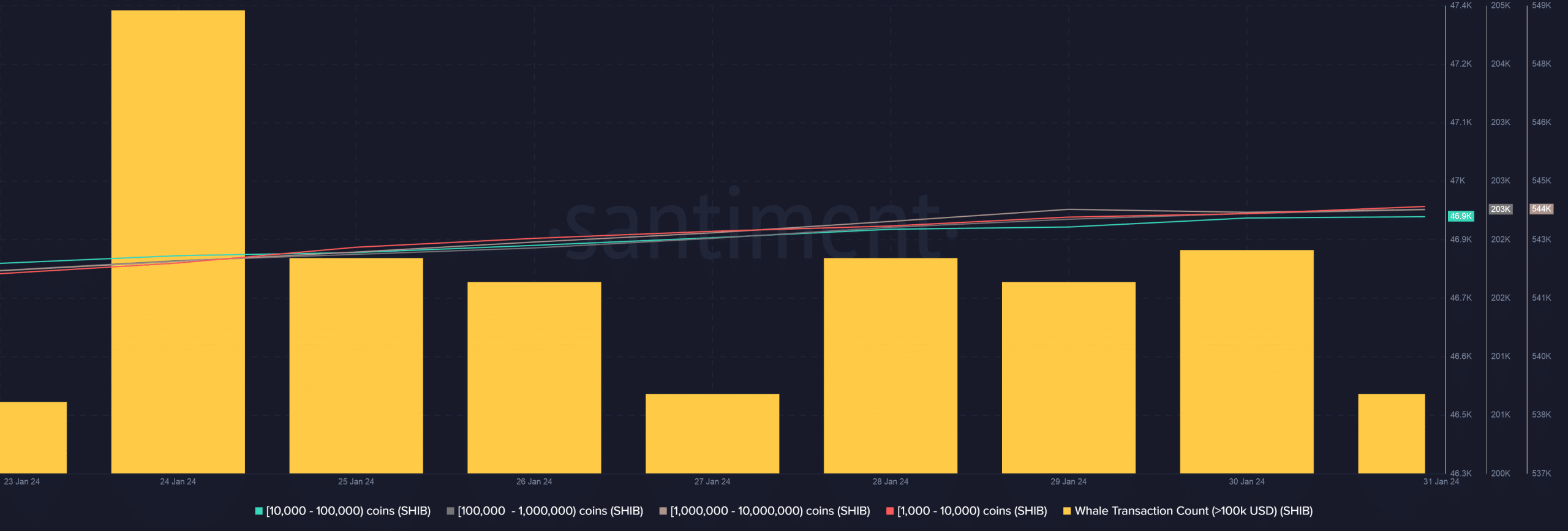

) It appeared that SHIB whales had also made bullish predictions for the meme coin. AskFX’s analysis of Santiment’s data shows that despite the price drop, the number of large transactions above $100,000 has increased over the past four days. Prediction of Shiba Inu [SHIB] . of the 2024-25 prize.

The transactions resulted in an increase in whale cohort addresses. This meant that whales were stockpiling for future profits.

Santiment

According to Coinglass, the number of SHIB long positions has exceeded shorts at this point. This showed that traders wanted a better month of February.

Coin jar