Predictions: XMR Price Supports $115

![]()

Journalist

Posted:

- Monero’s bullish structure has turned dramatically.

- A rise above $115 could give short-term investors hope for further gains, but this may not last.

Monero [XMR] There was a bullish structure in the market in the first week of February. XMR suffered a 39.8% loss in a single trading day on February 6th.

AskFX has already reported on the causes of this crash.

At press time, prices are well below $130, which is the 2023 support level.

A strong negative trend has been observed among holders in recent days, while the futures market has also favored sellers.

How to short XMR?

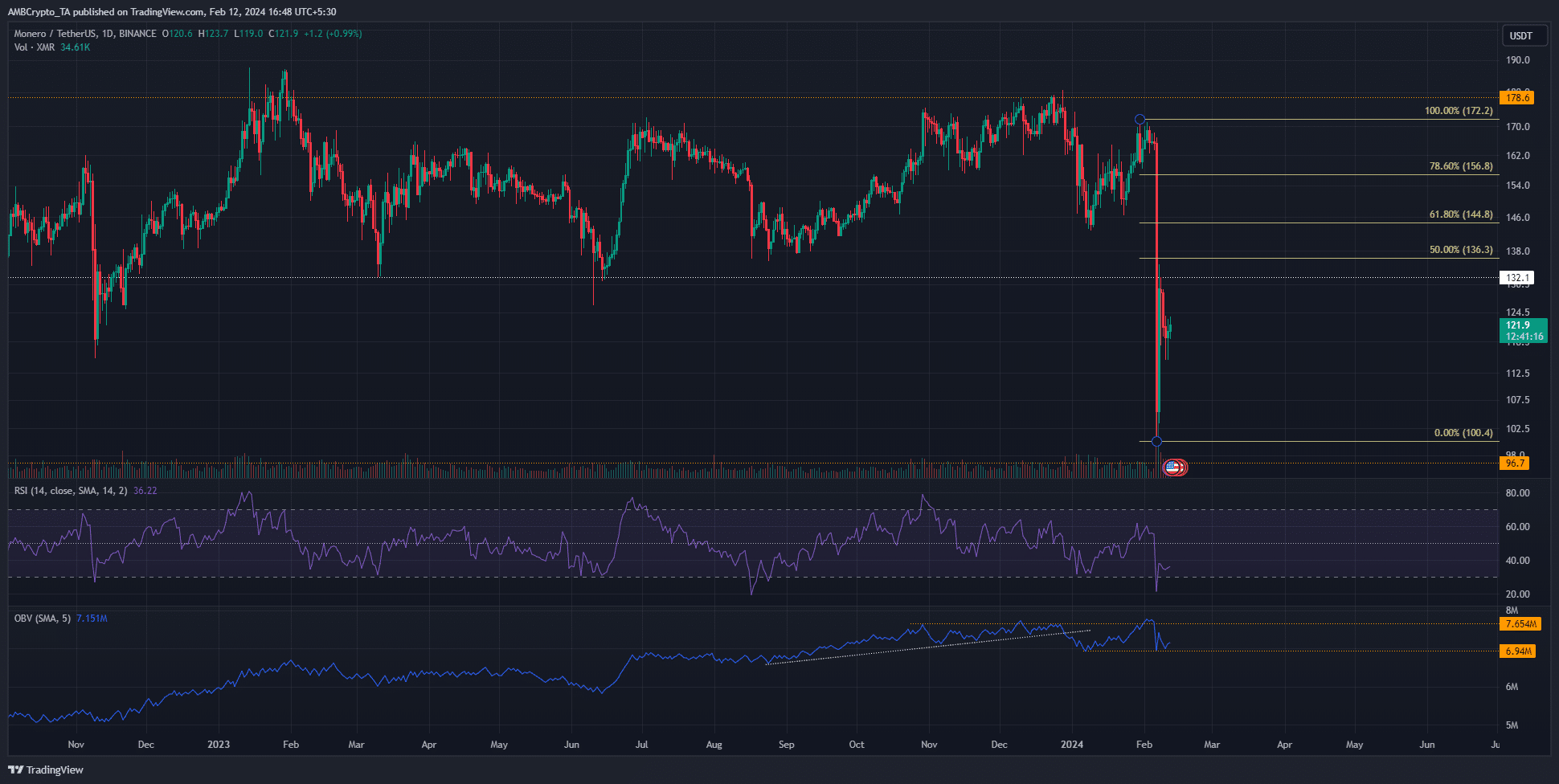

Monero’s market structure is bearish on a daily basis based on the price movement on February 6th. The nearly 40% drop was followed by a 31% rebound the next day.

This jump to $135 could be a return to the previous demand zone.

Source: TradingView – This was a sign of buyer fatigue.

If the local OBV is breached, a downtrend could follow on the chart.

Fibonacci levels of $136 and $144 respectively were important retracement levels. Therefore, they are expected to act vigorously as resistance fighters.

If XMR is able to climb above $156, the idea of a downtrend would be moot.

As things stand, it is likely that we will return to $100 and even lower levels. If prices continue to fall, XMR investors could capitulate and start selling more of their assets.

Futures markets are showing strong bearish sentiment

The price drop on the 6th coincided with a huge increase in open interest per exchange. The futures market was ready to short XMR.

The sharp decline in the funding rate suggested that the XMR market was heavily skewed in favor of bears.

Read Monero’s

Price Prediction for 2024-25 [XMR] At press time, weighted sentiment had fallen to levels not seen in more than a full year. It was only marginally positive.

Combining metrics and price movements, it appeared that Monero would see more of a downward trend than an upward trend over the next few weeks.

Disclaimer: This information is not intended as a source of financial, trading, investment or other advice. It is the author’s sole opinion.

rnrn