Bitcoin Crosses $50,000 Threshold – What’s Next for BTC

![]()

Journalist

Posted:

- The market capitalization of stablecoins has risen sharply in recent weeks.

- The market also received a boost from strong inflows into US Bitcoin ETFs.

Bitcoin [BTC] For the first time in over two years, Bitcoin surpassed the crucial $50,000 mark. This triggered a bullish wave in the digital asset market.

AskFX, using CoinMarketCap, found that the king coin reached $50,000 around 5:20 p.m. UTC on February 12th. It remained at this level until winning diamond hands pushed it to $49,932.

Stablecoins are in high demand

According to Santiment, an on-chain analytics firm, the rally was the result of a sharp increase in market capitalization for stablecoins in recent weeks. That is 5% more than at the beginning of the year.

These increases in stablecoin market cap were a sign of more capital entering the market. Stablecoins are used by most traders in traditional markets to enter and exit crypto exchanges.

Additionally, whale wallets containing more than $5,000,000 worth of stablecoins contributed 2.32% to the total stablecoin supply over the last four weeks. This means that the stablecoin share in the market rose to 51.49% at the time of going to press. This suggested that the whales were on a massive aggregation spree.

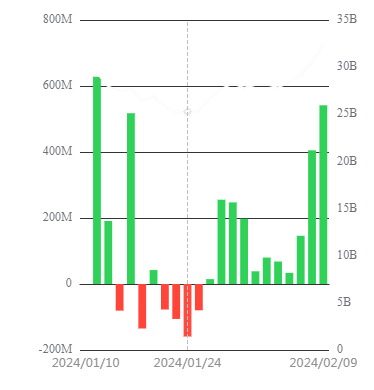

Inflows into spot ETFs increase significantly

The rally coincides with strong inflows into US Bitcoin ETFs. AskFX’s analysis of SoSo Value data shows that net inflows have been steadily increasing over the past two weeks. This has reversed the Grayscale Bitcoin Trust outflow trend.

At the time of publication, there were $32.42 billion worth of Bitcoins in spot ETF markets, representing 3.48% of Bitcoin’s total market capital.

Hang in there! There’s more to come.

“$69,000 doesn’t seem like a lot”

Popular on-chain analytics firm CryptoQuant has predicted that Bitcoin will continue to grow in the long-term bullish direction through 2024 and beyond.

The conclusion was based on a double effect: a shortage of supply (due to the upcoming halving) and an increase in demand (as evidenced by an increase in active wallets), making Bitcoin a perfect store of wealth.

BTC Price Predictions 2024-25

Bullish predictions came from all directions. Shivam Thakral, CEO of Indian cryptocurrency exchange BuyUcoin, shared a statement with AskFX.

The market is driven by macro factors such as the expected rate cut by the US Federal Reserve and the increasing popularity of Bitcoin ETFs in the medium to long term. After the halving, we can expect Bitcoin’s all-time high at $69,000 to be retested.

rnrn