Jup, a Solana-Based Company, Rises 30% as the Market Falls: Does This Mean More Profits

![]()

Journalist

- JUP’s JUP price was $0.97 at press time.

- Social volume has increased, which could suggest that traders are considering being bullish.

Jupiter stock is up a staggering 84.42% in just 30 days. [JUP]The token developed for the Solana blockchain [SOL] almost reached $1. JUP exploded on March 14, climbing to $0.97. This meant that JUP had reached a new all-time high.

This happened at a time when the majority of assets in the market were declining. Jupiter’s upward trend had slowed at the time of publication. AskFX has confirmed that the value has fallen to $0.93 at the time of writing.

The new planet will bring you more benefits

In our opinion, JUP is also in the pricing phase. JUP was launched in 2024 as a native token for Jupiter Exchange, a Solana-based aggregator. JUP has struggled to break out since its launch, trading below $0.60 at times.

The recent breakout suggests that both buyers and sellers agree that the asset’s true value should be higher. Although the cryptocurrency’s performance was impressive, it was still in the price discovery phase and could easily break the new ATH.

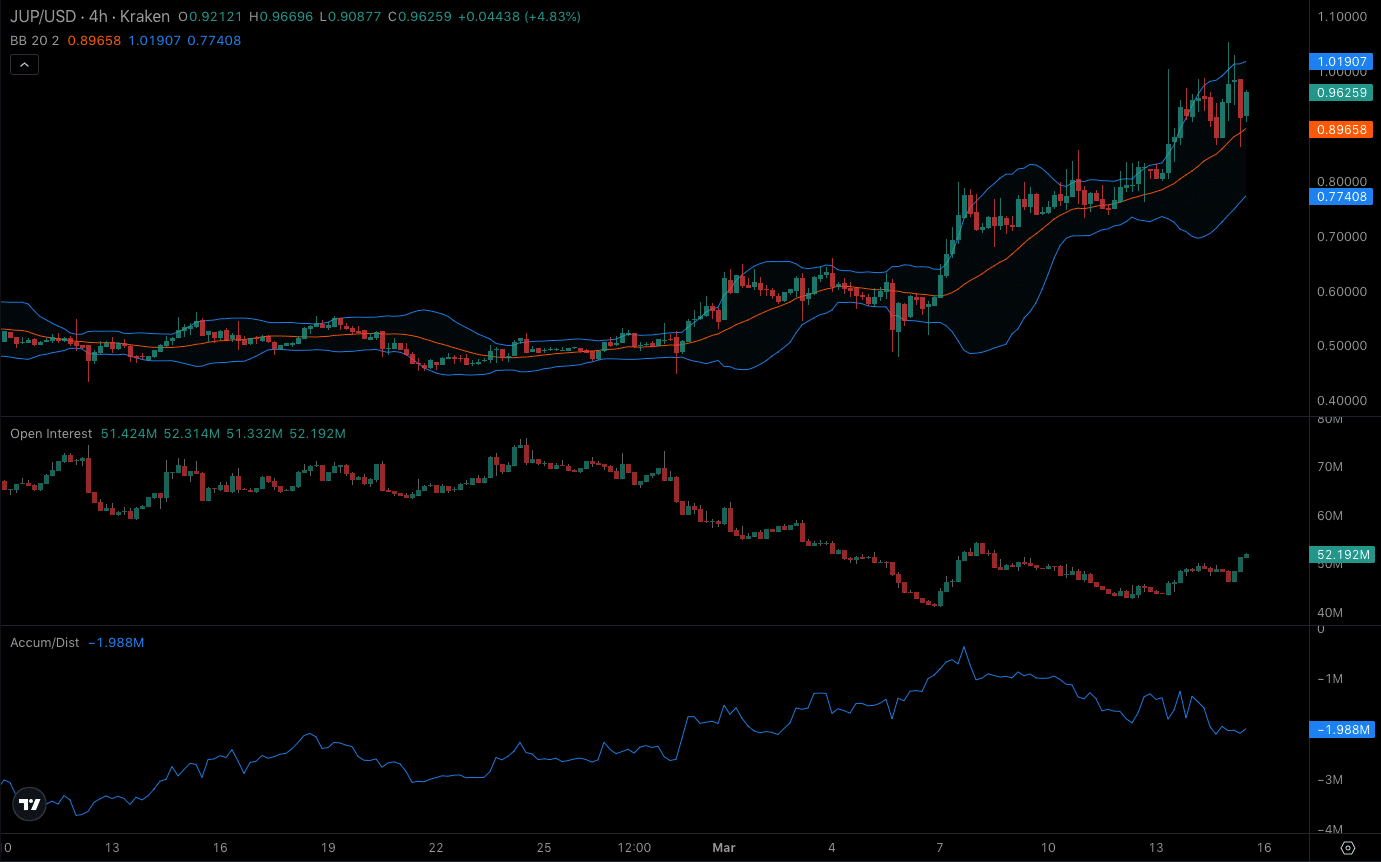

From a technical perspective, the 4-hour chart showed high volatility in the area around the token. In this case, the price could rise above $1.

The Bollinger Bands (BB) also showed that selling pressure could force a major correction.

Additionally, the accumulation/distribution (A/D) suggests that JUP may struggle to break above $1 in the near term.

Source: Coinalyze

Can you change your mind?

The A/D value has fallen since this article was written, suggesting traders are booking profits. If this trend continues, the value of JUP could fall below $0.90. The open interest (OI) around the cryptocurrency grew to $52.10 million.

OI is the sum of all open positions in a specific contract. The price increase suggests that traders are actively trying to profit from JUP’s movement.

If the buying pressure continues, the price could break the $1 mark. SOL is another factor that can affect JUP performance.

JUP and the native Solana token had a strong correlation for a few days. It is therefore likely that an increase in SOL price will lead to an increase in JUP.

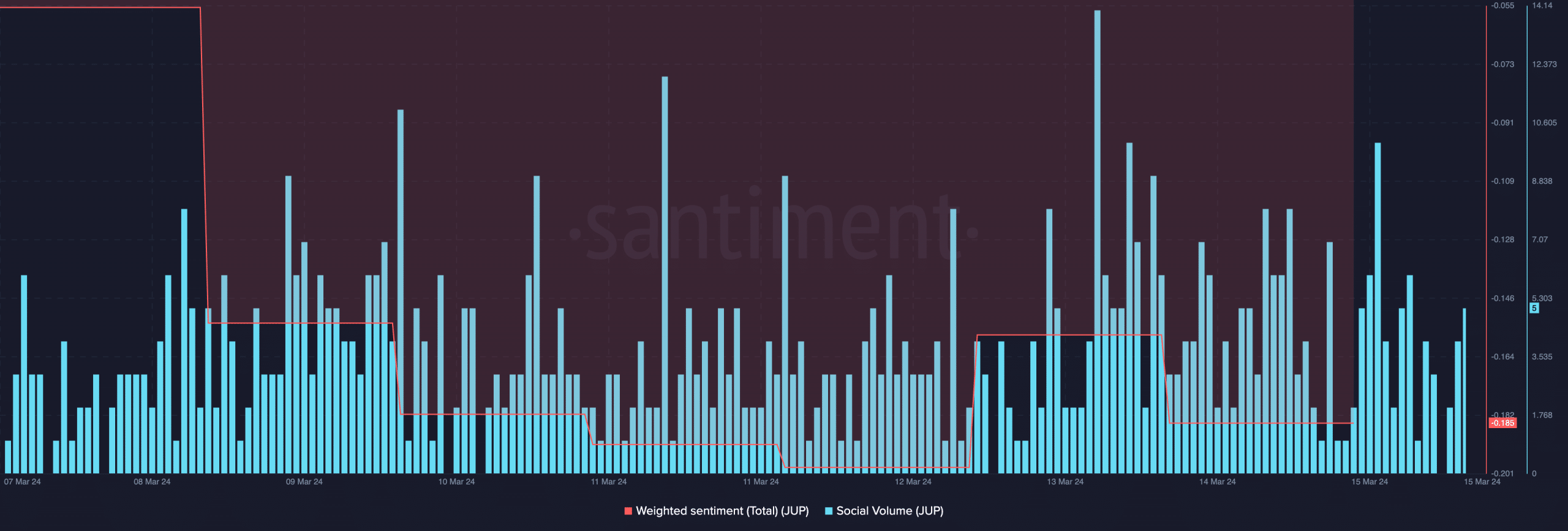

Market participants are still bearish despite the cryptocurrency’s rally. AskFX came to this conclusion by analyzing Santiment’s on-chain data.

Source: Santiment

What is the current value of 1,10,100 JUPs?

At press time, Jupiter’s weighted sentiment reflected a negative sentiment, with most comments being gloomy. Social volume increased despite the fact that the sentiment was negative. At the time of writing, the metric is at its highest level in the last two days.

This increase in volume suggests that JUP is gaining market attention. If recent performance continues, sentiment could turn bullish.