How Bitcoin Inflows Caused 2024 Stats to Be “24%” Higher Than 2021

![]()

Journalist

- Total inflows for 2024 are 24% above the 2021 record.

- Bitcoin will be 97% of the identify tributaries.

Last week, digital asset inflows into investment products exceeded those of the previous week.

According to the latest report from crypto asset management company CoinShares, institutional investors invested $2.9 billion in cryptocurrency funds last week, extending the winning streak into the seventh week.

Source: CoinShares

2024: the record year

Year-to-date (YTD) inflows have increased to $13.2 billion. That’s 24% more than the total inflows in 2021.

For the first time ever, total assets under management (AuM) reached the magic $100 billion mark this week. Due to the price correction at the end of the week, total assets under management (AuM) fell to $97 billion.

AuM is an important performance indicator for a fund. Higher assets under management generally result in more investments.

Local demand for US ETFs continues to grow.

As seen in recent weeks, the increase was due to large investments in a new Bitcoin spot [BTC] ETFs are available in the United States.

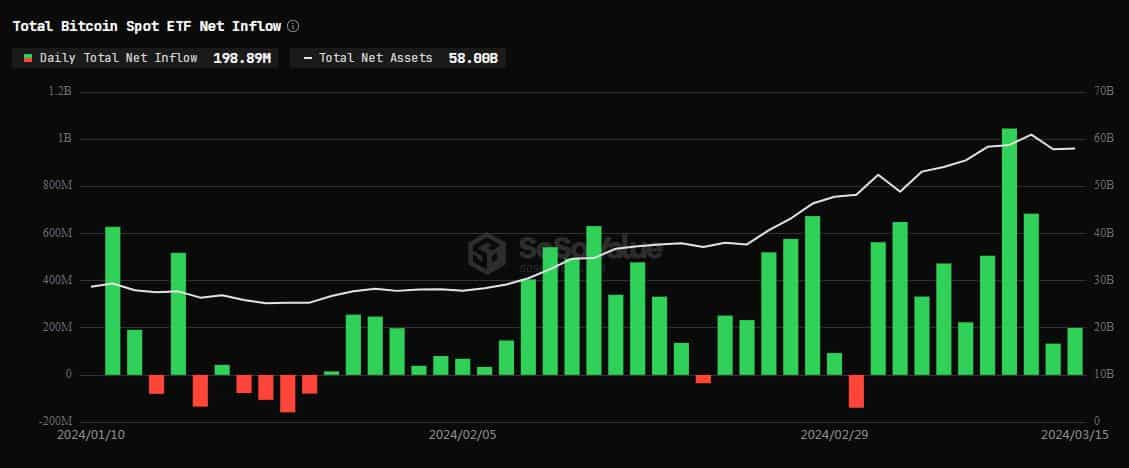

AskFX’s SoSo Value analysis shows that these issuers received $2.57 billion last week.

Source: SoSo Value

The market was relieved to see outflows from Grayscale Bitcoin Trusts (GBTC) once again lagging inflows to other spot ETFs lagged behind, with BlackRock & Fidelity capturing the majority of the investments.

The combined assets under management of all US Bitcoin ETFs were $58 billion as of March 15. This represents 4.35% of the total Bitcoin supply.

Product Performance Assessment

Last week, the largest institutional crypto product, Bitcoin, recorded $2.86 billion in inflows. This brings the total value since the beginning of the year to $12.86 billion.

Bitcoin has been the dominant digital asset inflow this year. They accounted for 97% of all total inflows.

Ethereum, for example, is a popular cryptocurrency with smart contracts linked to it. [ETH] Solana [SOL] There were outflows last week.

While Ethereum-affiliated funds saw a capital outflow of $14 million, Solana’s crypto products experienced a capital outflow of $2.7 million.