Payments, Tech Tumult and Africa’s Digital Crossroads

Payments, tech tumult and Africa’s digital crossroads (19459000)

By: Pedro Ferreira

History tells us that empires built of steel and nations powered by silicon are examples of this. We know that the technological capability of a superpower determines its rise and fall.

Paul, himself a man of inventors, says: Kennedy argued that the rise and fall of the great powers accessibility is the key to dominance. Accessibility is the key to dominance. The benefits of advanced technologies are becoming widespread. The explosive growth of the past.

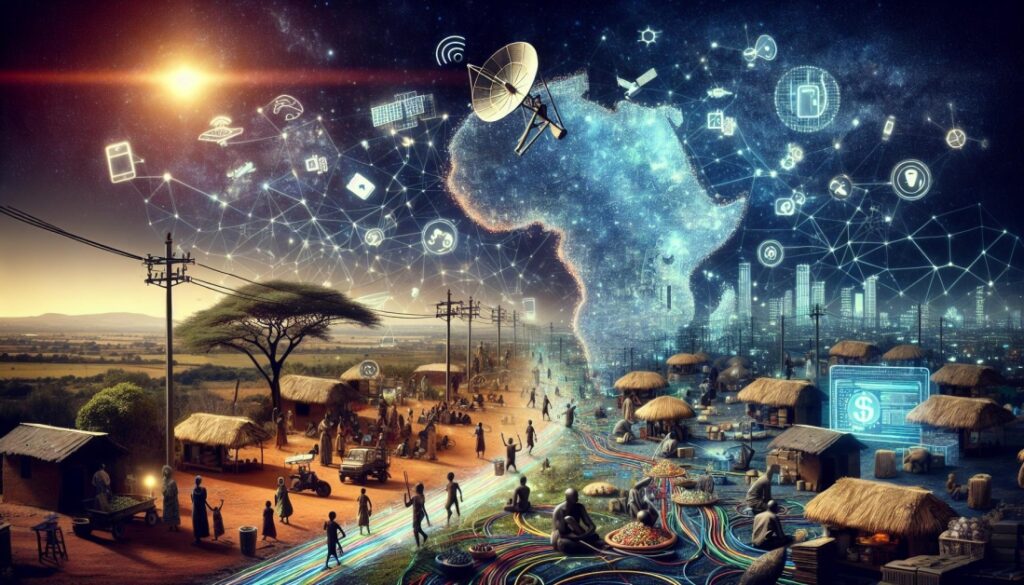

Africa’s payments industry is experiencing similar dynamics. Mobile money and fintech are driving the revolution. While incredibly unbelievable, Africa’s financial prospects are at a crossroads.

Chinese Investments

Chinese and African technology are intertwined. The world’s development aspirations are changing. The continent is a diverse region. The fundamental importance of the telecommunications infrastructure component for digital connectivity has been significantly enhanced through initiatives such as the PEACE submarine cable project. China is the spearhead of the project. This ambitious project, the Digital Silk Road Initiative, promises to revolutionize Africa’s digital future by providing fast and affordable connectivity across the continent.

Chinese influence is evident in everything from e-commerce to logistics infrastructure. undeniable. Africa is using mobile payments to benefit from the success of other countries. Alibaba, for example, has a number of best practices. Partnerships between Chinese fintech giants are working with African financial institutions to foster partnership. Financial inclusion and strengthening indigenous fintech solutions.

The relationship between the two is also important. Chinese telecommunications companies are deeply rooted in Africa’s strategic growth. The reports are diverse. Reports illustrate how Chinese providers are exploiting opportunities in developing countries. Nations use their long-term strategy and price advantage to build them. This is a strategic relationship that Western counterparts overlook. This strategic positioning allows Chinese companies to secure core network contracts. The path is paved for future upgrades and expansions.

Why do telecommunications companies exist?

Enter Mobile Money

Telecommunications giants are involved in the development of Africa’s payments infrastructure. These telecommunications companies are undeniably important players in the financial services sector. These telecommunications companies such as Orange in France, MTN in South Africa and Vodafone in the UK are all involved. Airtel Africa has leveraged its mobile money network to provide essential services. Banks across Africa provide services to millions of people.

Mobile money is important in light of COVID-19. This has led to an increase in the number of transactions and users. It has effectively accelerated the mainstream adoption of mobile money as an alternative financial tool. The service is available in many countries. However, government regulations still posed a revenue challenge for mobile operators. Reduce transaction fees to mitigate the economic impact of lockdowns.

Even as the impact of the pandemic subsided, mobile money services continued. In 2022, the country will experience rapid growth that will exceed pre-COVID levels. This feat sparked a flurry of activity, with African banks launching mobile accounts and telecommunications companies exploring the IPO of their mobile money units as a strategic way to increase profitability. Partnerships and Expansion Opportunities

The State The Industry Report on Mobile Money, 2023 examines the growth path of mobile money post-pandemic and highlights the changing landscape. The wireless industry, its representatives and millions of customers have all embraced it. Money in 2022

Visa and Mastercard enter the ring

Global fintech giants fight for the African payments scene Visa and Mastercard appear to be in a heated dispute. Race to assert dominance. The continent is experiencing rapid change. Both fintech startups and digital transactions are trending. Companies are aggressively expanding their footprint and investing to capture a significant share of the booming market.

The introduction of visas for Africa increased competition. The Fintech Accelerator program in 2023 is being rapidly adopted by the Mastercard Foundation, announcing a fund to be used for local investment channels to boost early-stage companies. Financing early-stage companies through local investment channels. These initiatives marked the beginning of a new era in which the giants of the global payments industry will be competitive. They fought for dominance in Africa.

Mastercard’s strategic acquisition of a staggering $200 was paid for a 3.8% stake in MTN, Africa’s largest telecommunications company. This bold investment sent shockwaves throughout the industry. This bold investment follows similar acquisitions in Airtel Africa’s mobile business, signaling Mastercard’s commitment to securing a strong position in the mobile market in Africa’s financial services sector.

Visa quickly followed suit and invested in various sectors. African fintech startups are integrating their global virtual card network. Kenyans are a diverse group of people. M-Pesa is a major player in Kenya’s mobile payments landscape. Visa has made a concerted effort to exploit Africa. digital revolution.

The conclusion of the article is:

The race for dominance in the African payments industry is heating up. The impact of strategic investments and technological advances is becoming increasingly clear

Chinese involvement in Africa offers enormous opportunities for digital growth, but concerns remain about potential pitfalls such as: B. that excessive dependence on external infrastructure can lead to an erosion of local infrastructure production. Africa can fully benefit from the digital revolution. It is not enough to embrace technology, you also need to create robust industrial capacity, which is crucial for sustainable economic growth.

The entry of global players such as Visa and Mastercard offers new opportunities. If these companies expand their business aggressively, they will be able to add a new dimension to competition. The company has a strong presence in Africa and can leverage its expertise and resources to successfully conquer the market. Significant market share

This competition has a direct impact on African consumers and businesses. Access to innovative financial services and products will be improved. The influx of innovative financial products and services. The continent is poised to benefit from the proliferation of mobile payments and digital transactions, achieving unprecedented growth in financial inclusion and economic development.

Only by managing multiple industrial revolutions at the same time can we achieve this. Can Africa become a global leader by promoting innovation at home? Not only economically successful, but also resilient and independent.

rnrn