Bernie Madoff

Bernard Lawrence Madoff (/ˈmeɪdɔːf/ MAY-dawf; April 29, 1938 – April 14, 2021) was an American fraudster and financier who was the admitted mastermind of the largest Ponzi scheme in history, worth about $64.8 billion. He was at one time chairman of the NASDAQ stock exchange. He advanced the proliferation of electronic trading platforms and the concept of payment for order flow, which has been described as a "legal kickback."

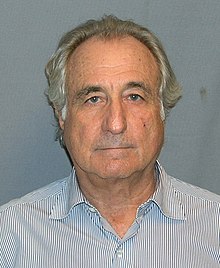

Bernie Madoff | |

|---|---|

U.S. Department of Justice photograph, 2009 | |

| Born | Bernard Lawrence Madoff April 29, 1938 New York City, U.S. |

| Died | April 14, 2021 (aged 82) Butner, North Carolina, U.S. |

| Alma mater |

|

| Occupation | |

| Employer | Bernard L. Madoff Investment Securities (founder) |

| Known for | Being the chairman of NASDAQ and the Madoff investment scandal |

| Criminal status | Deceased |

| Spouse | |

| Children | |

| Conviction(s) | March 12, 2009 (pleaded guilty) |

| Criminal charge | Securities fraud, investment advisor fraud, mail fraud, wire fraud, money laundering, false statements, perjury, making false filings with the SEC, theft from an employee benefit plan |

| Penalty | 150 years in prison, forfeiture of US$17.179 billion, lifetime ban from securities industry |

Madoff founded a penny stock brokerage in 1960, which eventually grew into Bernard L. Madoff Investment Securities. He served as the company's chairman until his arrest on December 11, 2008. That year, the firm was the 6th-largest market maker in S&P 500 stocks.

At the firm, he employed his brother Peter Madoff as senior managing director and chief compliance officer, Peter's daughter Shana Madoff as the firm's rules and compliance officer and attorney, and his now deceased sons Mark Madoff and Andrew Madoff. Peter was sentenced to 10 years in prison in 2012, and Mark hanged himself in 2010, exactly two years after his father's arrest. Andrew died of lymphoma on September 3, 2014.

On December 10, 2008, Madoff's sons Mark and Andrew told authorities that their father had confessed to them that the asset management unit of his firm was a massive Ponzi scheme, and quoted him as saying that it was "one big lie". The following day, agents from the Federal Bureau of Investigation arrested Madoff and charged him with one count of securities fraud. The U.S. Securities and Exchange Commission (SEC) had previously conducted multiple investigations into his business practices but had not uncovered the massive fraud. On March 12, 2009, Madoff pleaded guilty to 11 federal felonies and admitted to turning his wealth management business into a massive Ponzi scheme.

The Madoff investment scandal defrauded thousands of investors of billions of dollars. Madoff said that he began the Ponzi scheme in the early 1990s, but an ex-trader admitted in court to faking records for Madoff since the early 1970s. Those charged with recovering the missing money believe that the investment operation may never have been legitimate. The amount missing from client accounts was almost $65 billion, including fabricated gains. The Securities Investor Protection Corporation (SIPC) trustee estimated actual losses to investors of $18 billion, of which $14.418 billion has been recovered and returned, while the search for additional funds continues. On June 29, 2009, Madoff was sentenced to 150 years in prison, the maximum sentence allowed. On April 14, 2021, he died at the Federal Medical Center, Butner, in North Carolina, from chronic kidney disease.