Bitcoin Miners Are in Crisis: After the Halving, Profits Have Fallen to 2021 Levels

![]()

Journalist

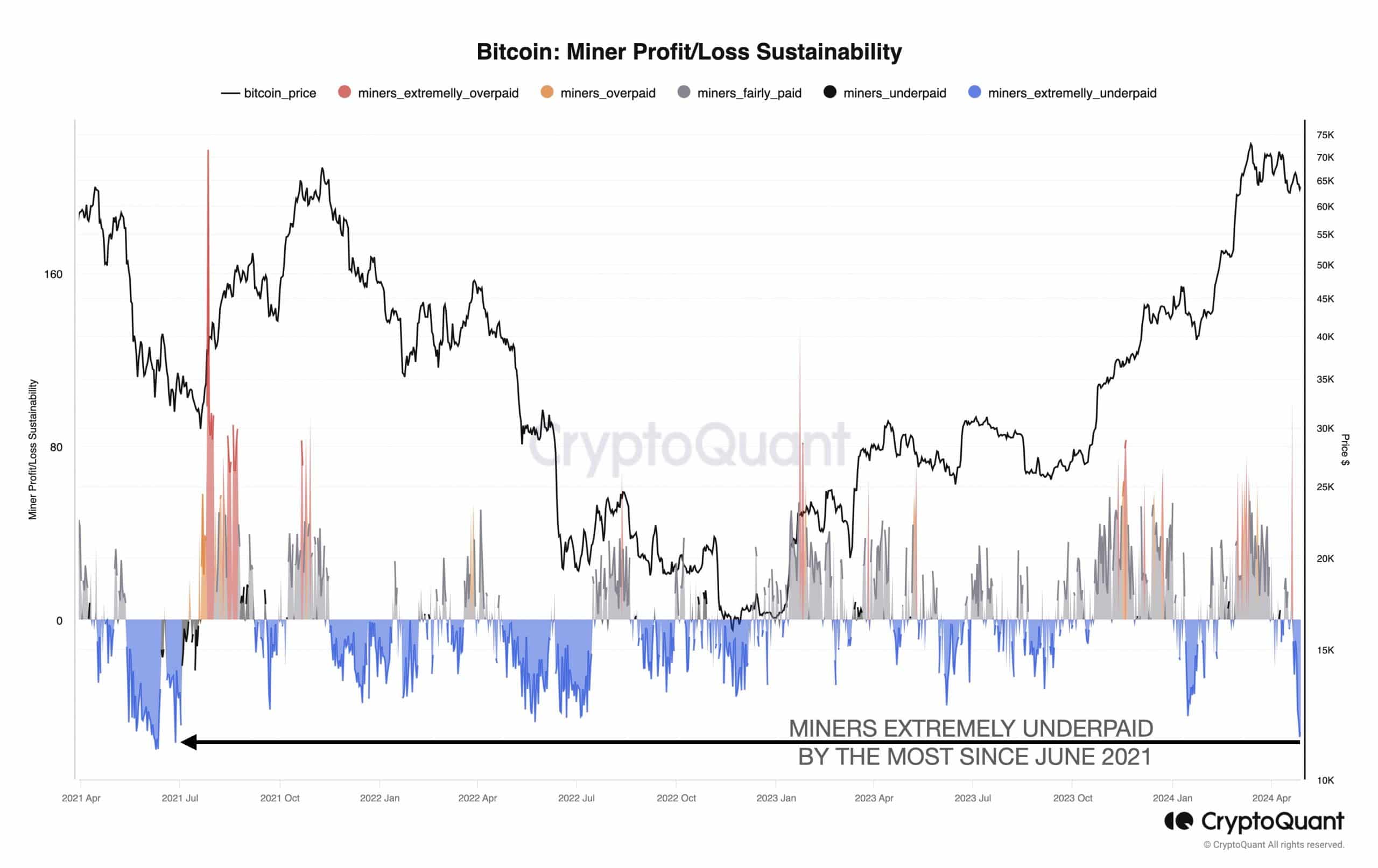

- The sustainability of miners’ profits/losses has fallen to lows not seen since June 2020.

- The decline in profitability has further reduced miners’ selling pressure.

Bitcoin [BTC] Since the halving earlier this month, the mining industry has taken a heavy blow. This sector is crucial to the smooth operation of the world’s largest digital asset.

Miners face losses

In an April 29 X-post, Julio Moreno (Head of Research, on-chain analytics firm CryptoQuant) revealed that the sustainability of miners’ profits/losses has fallen to lows not seen since 2021.

Source: CryptoQuant

The above metric measures the growth in block rewards, a key source of income for miners, against the increase in mining difficulty, which is a measure of cost. The sharp drop in revenue suggested that miners were “extremely unpaid” at the time.

Additional data showed that miners’ daily revenue was significantly lower than the Bitcoin price.

After the recent halving, block rewards were reduced from 6.25 BTC to 3,125 BTC. This meant that miners had to double their investment in mining to even break even.

Small miners will eventually succumb to the storm.

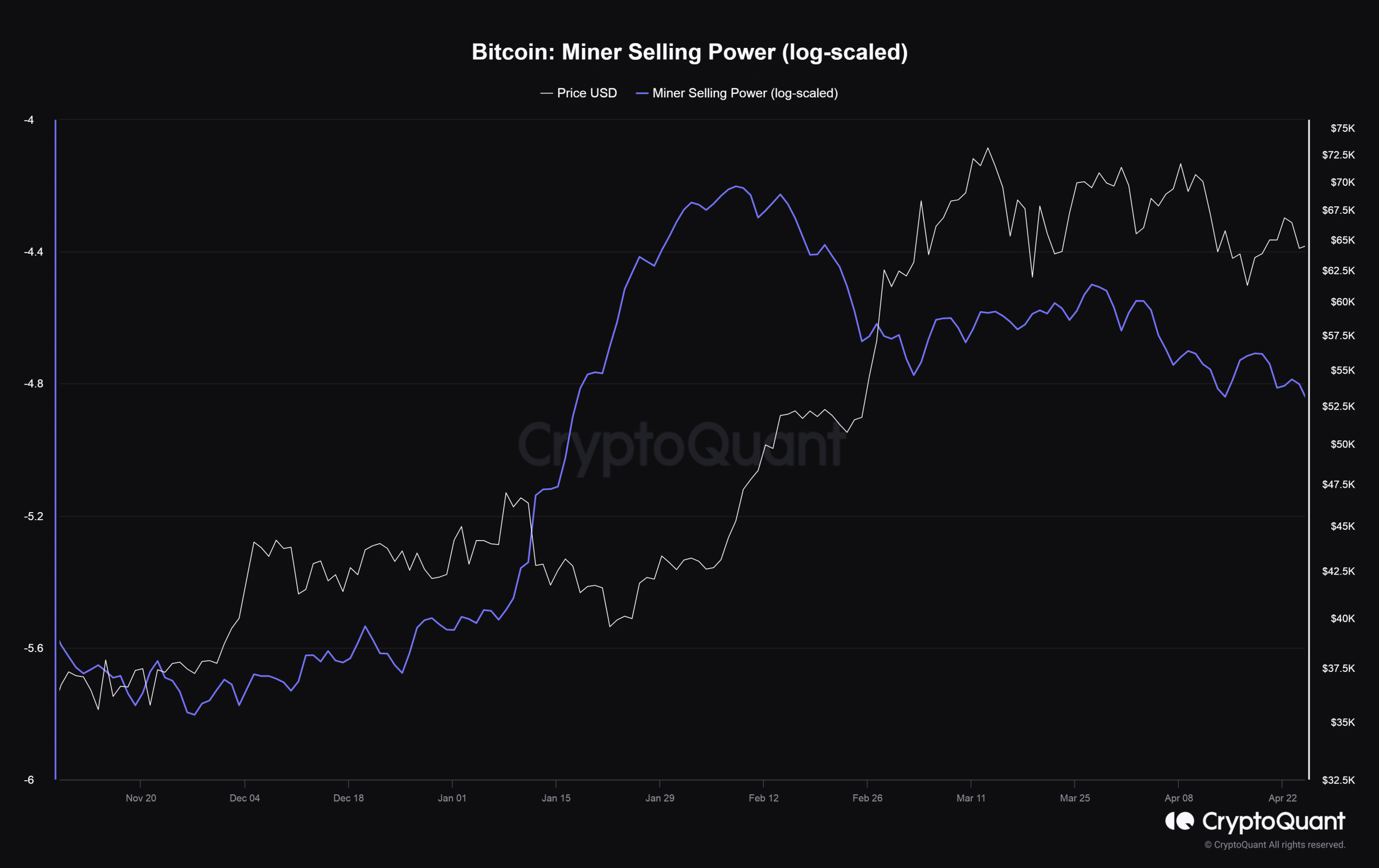

Selling pressure is decreasing

A drop in profitability has caused most miners to resist the urge to monetize their Bitcoins. According to AskFX’s analysis of CryptoQuant’s data, miners’ selling pressure has continued to decrease since the halving.

Source: CryptoQuant

Reduced selling pressure is also evident in the lower number of coins being transferred to exchanges. Since the halving, flows from miners to exchanges have dropped by 70% in the 7-day moving average.

Is your portfolio green? BTC Profit Calculator

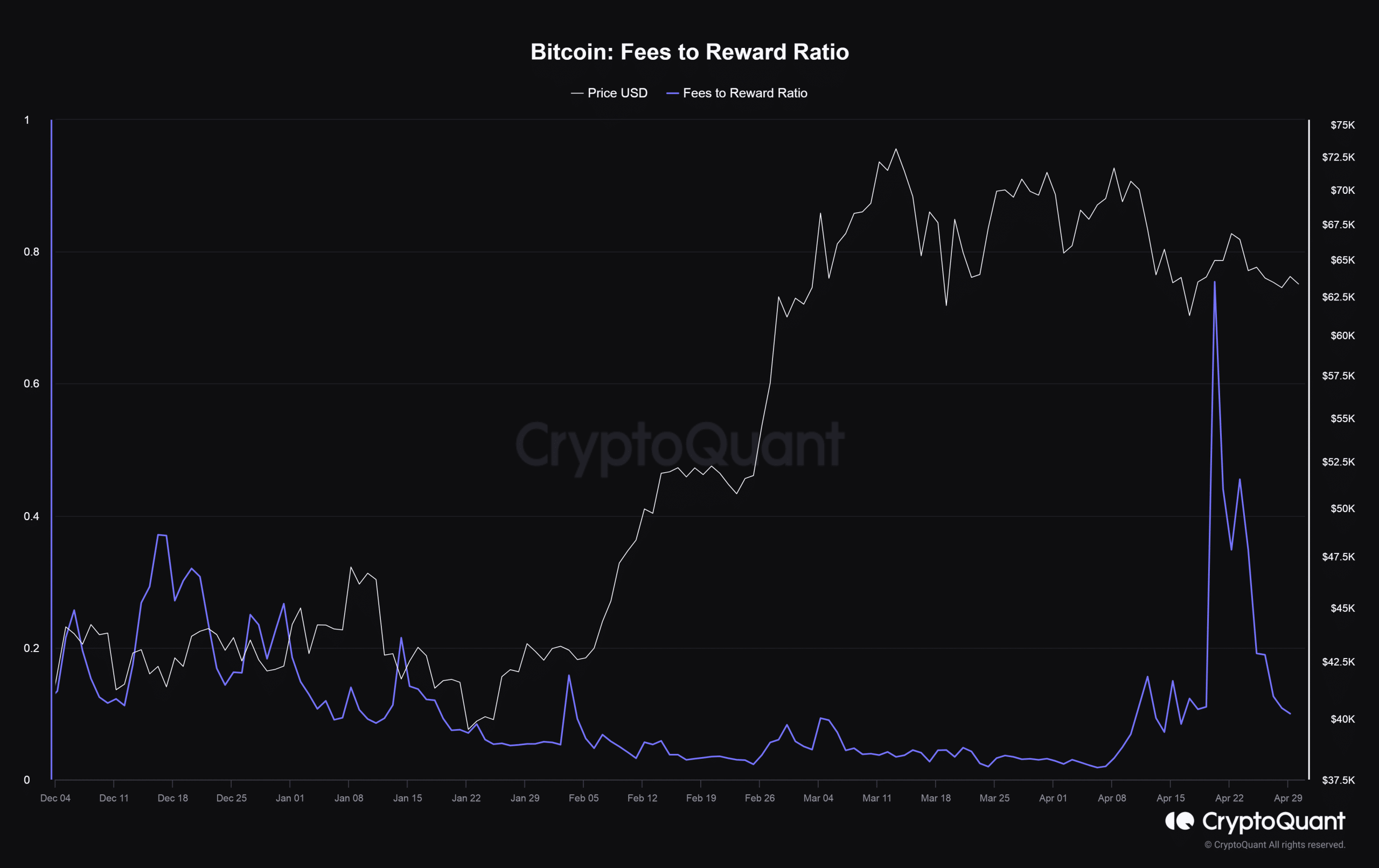

Fees won’t save you

Since the halving day madness, transaction fees have also dropped significantly.

Fees’ share of total block rewards has dropped from 75% to 9% between April 20 and April 29.

Source: CryptoQuant