Mastercard and Nigeria’s Partner Access Bank Launch New Cross-Border Payment Solution

By: Jared Kirui

- Access Bank customers benefit from a new solution that prioritizes security, choice and flexibility.

- Access Bank offers various channels for international payments, including mobile wallets, cards and cash.

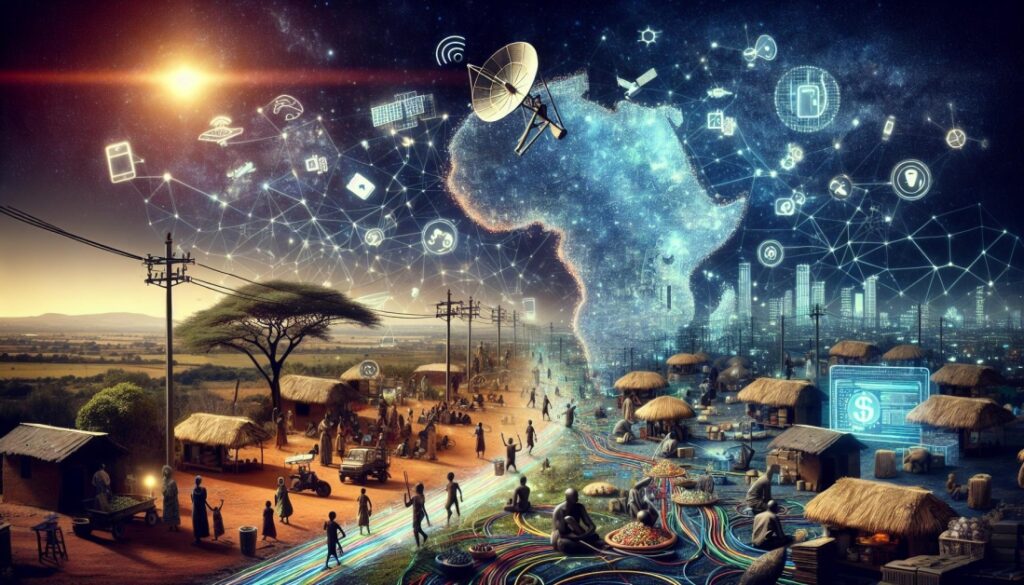

Mastercard and Access Bank Group are a multinational banking partnership to improve cross-border payments. The two companies have launched a solution designed to empower businesses and consumers. Today (Thursday) in Lagos, Nigeria, you can access international transactions from across the African continent.

New Cross-Border Payment Solution Launch

This collaboration was announced in a press release. Accelerating Africa’s integration into the global economy is a portal for individuals and businesses. It promises fast and traceable payments in international transactions. Fast and traceable payments are guaranteed. Payment outgoing and delivery solutions

Mark Elliott, Division President for Africa at Mastercard: “Supporting Access Bank customers with innovative technologies and solutions that prioritize security, choice and flexibility is an achievement and we are very proud of it. This collaboration is a sign of our commitment. It not only provides cutting-edge payment solutions, but can also offer solutions to customers in other countries. Mastercard’s digital and financial ecosystem ensures that millions of underserved customers and communities can actively participate in the financial and digital transformation of the economy.”

Access Bank operates in Africa. The company will offer a variety of channels, including mobile phones, bank accounts and the Internet. Customers can send and receive money across borders via wallets, cards and cash. Payments will be made worldwide.

Drive financial inclusion

Access Bank also aims to optimize capital and liquidity in Mastercard’s network assets and leverage treasury to access markets. Reduce international transaction costs for businesses and consumers. Both parties expect this initiative to play a major role. The role of the CFO in closing the financial gap and creating an inclusive environment is crucial. All Africans can look forward to a prosperous future

Mastercard has extended its partnership with I&M Bank in Kenya for another eight years to improve services for cardholders. The partnership is designed to ensure seamless and secure payment solutions for businesses and individuals across the country, leveraging the technology of the local network and both companies.

The expanded collaboration brings with it a new range of cards. Options include Platinum Debit and World Elite Debit. Card categories include credit cards, multi-currency prepaid cards and other card types. Each card category has its own unique features. Cardholders are offered travel benefits, privileges and experiences. Personalized banking experience

Jared is a financial journalist with a passion for all things forex and CFDs.

- Articles 852

- 11 followers