Uniswap Splits from Ethereum: Can UNI Hold the $9 Mark?

![]()

Journalist

- UNI’s exchange supply is increasing while the Ethereum network has shrunk.

- In the short term, ETH could drop to $9.20 due to a weakening sentiment and falling demand.

UNI was trading at $9.98. This represents a 2.22% increase over the past seven days.

ETH was trading at $3,687. This was a 2.56% decrease over the same period. But that’s not the main issue.

AskFX noticed that the tide was changing quickly using on-chain data from Glassnode.

The correlation is dissolving.

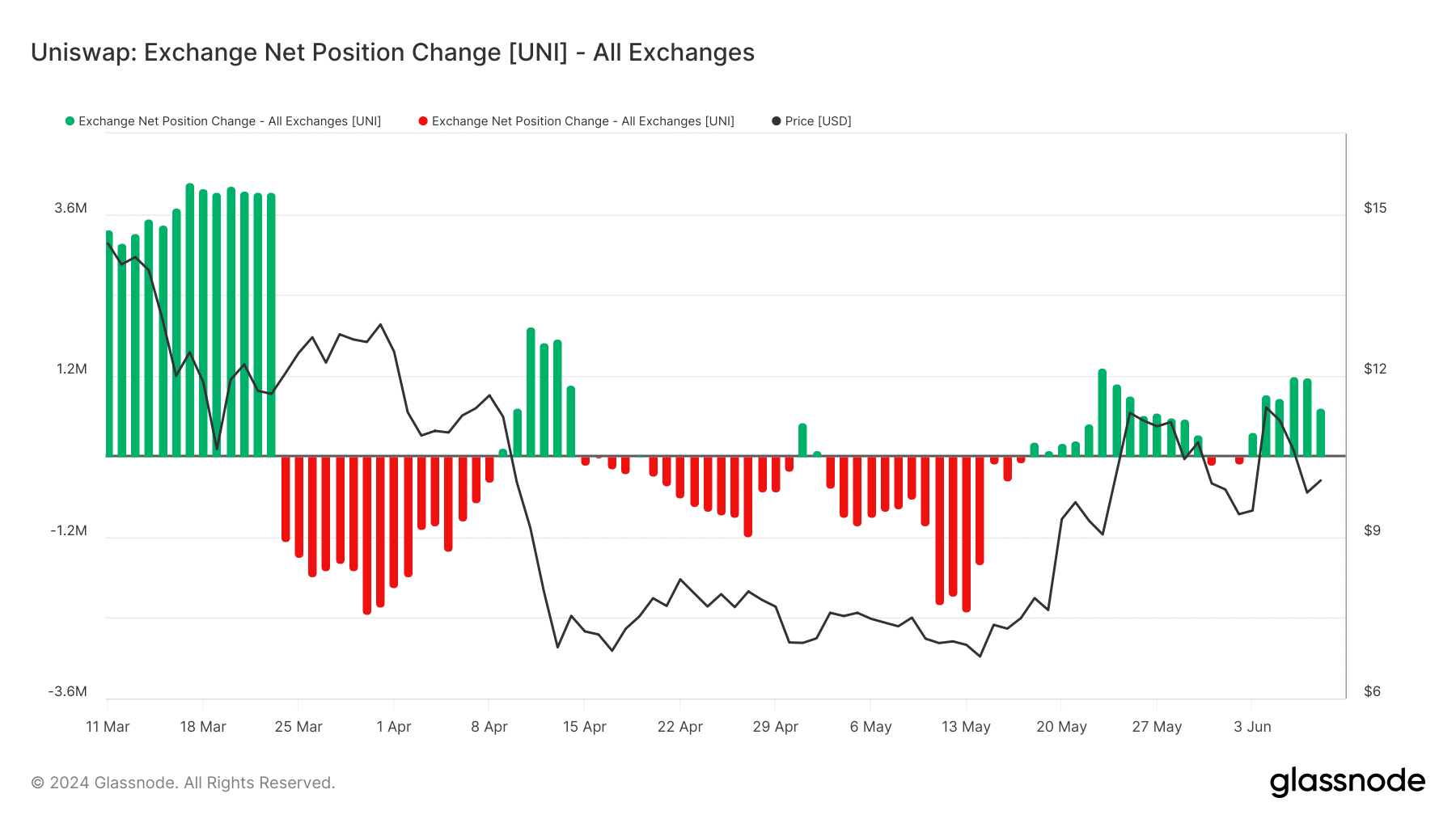

The change in exchange net position was an indication of this. According to our analysis, the net position change on Uniswap exchanges on June 8 was 733,683.

Since June 3, the number of UNI tokens on exchanges has been increasing.

Source: Glassnode

A positive supply could see the price drop below $9. Ethereum was in a completely different league.

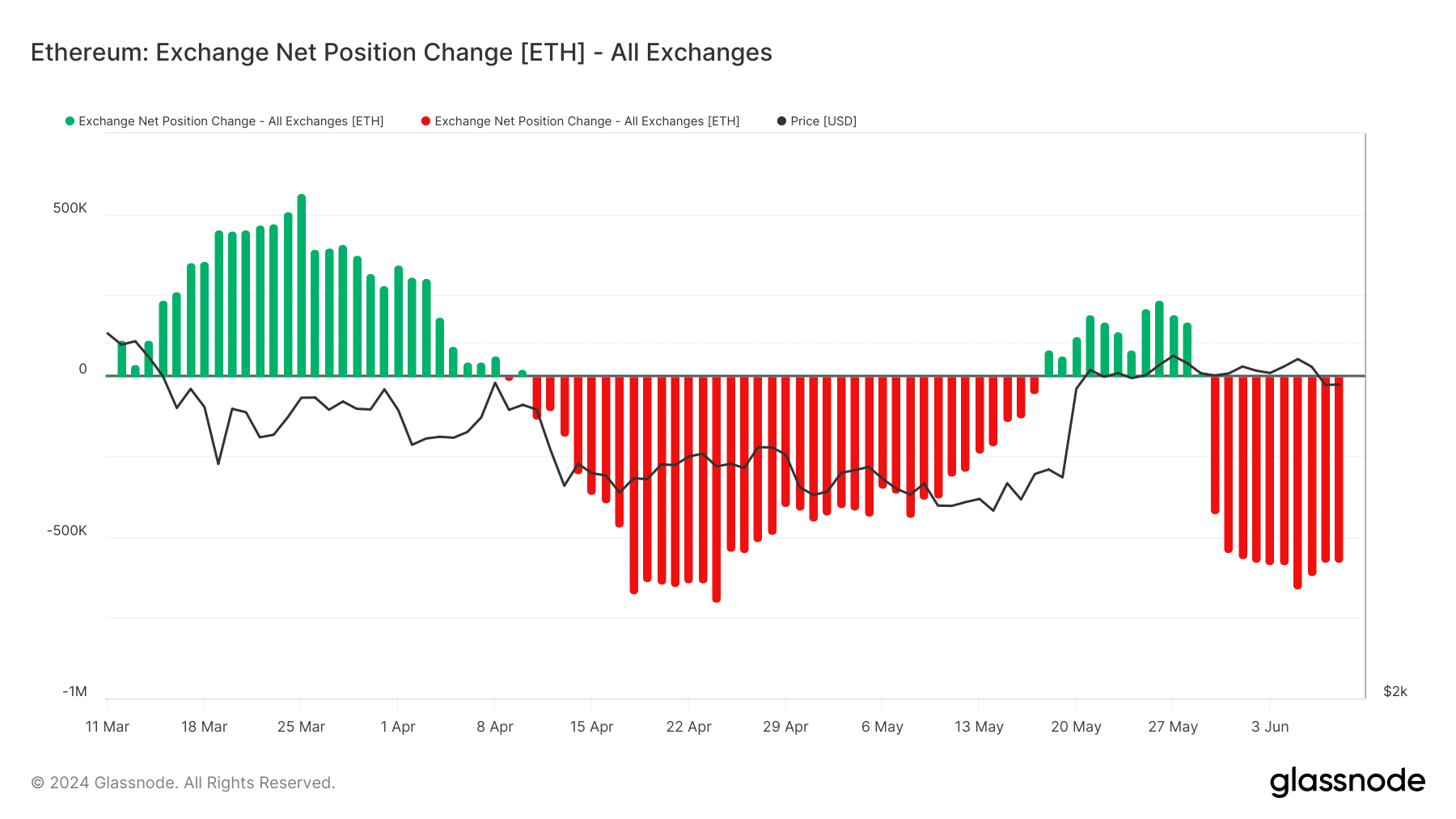

A similar analysis with ETH showed an increase in coins withdrawn from exchanges. Glassnode reports that 733,683 UNI tokens were received and 576,851 ETH were withdrawn on the day in question.

Source: Glassnode

UNI will continue to fall

It is therefore possible that the price of UNI will fall, while ETH could be on its way to a quick recovery.

If confirmed, it could negatively impact the cryptocurrency’s performance as the U.S. Securities and Exchange Commission (SEC) voted to approve spot Ethereum ETFs.

ETH’s value skyrocketed in the days leading up to the announcement. UNI’s connection to the blockchain also ensured that it followed the same trend. How low can UNI fall this time?

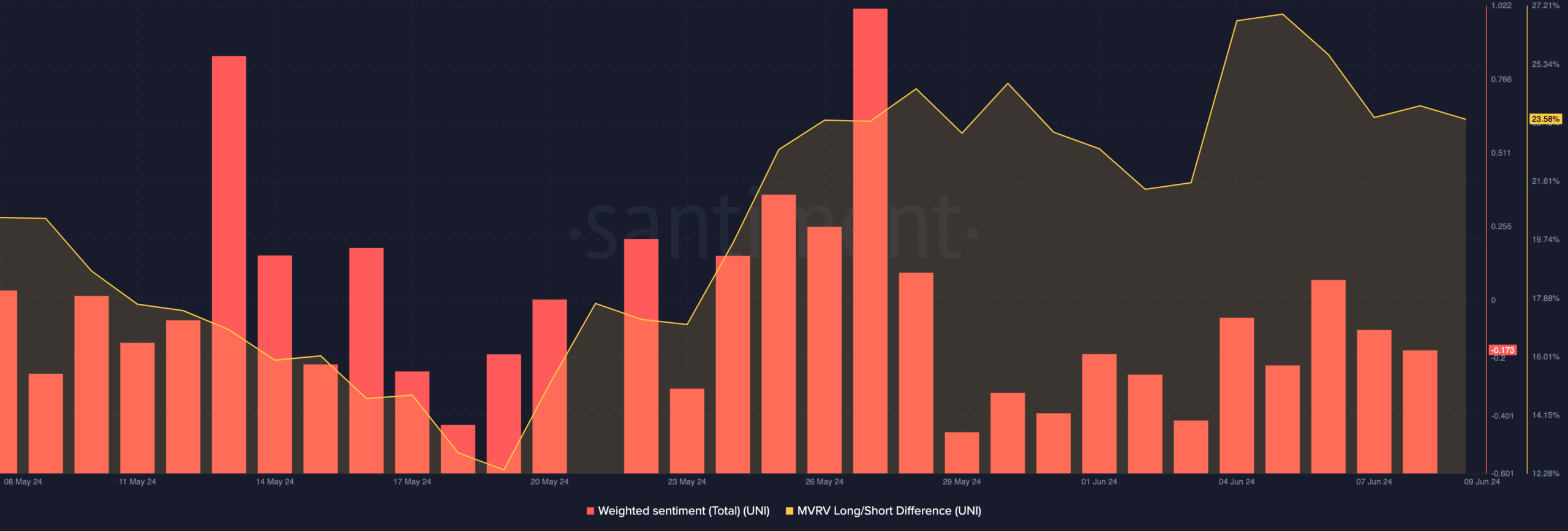

AskFX has used weighted sentiment to check possible targets. This shows what market participants think about a particular project. At press time, the weighted sentiment was -0.173.

A negative value shows that the majority of comments on Uniswap were negative. Demand for the token could decrease and cause a price drop.

The Market Value to Actual Value (MVRV), which was at 27% just a few days ago, has now dropped to 23.58%. If the MVRV Z-score is positive, the token is likely in a bullish phase.

Source: Santiment

Here is the market cap of UNI in ETH.

A negative ratio, on the other hand, indicates a descent into the bear phase. The recent decline does not necessarily mean that UNI has entered a bear phase. It is an indication that the price could fall.

It seems that a pullback from $9.20 is quite possible.