Microstrategy Stock in Focus as Company Eyes Further BTC Purchases – What’s Next?

![]()

Journalist

- MicroStrategy plans to buy more BTC through a recent convertible note offering.

- MSTRs are still a better short-term investment than BTC.

On June 13, MicroStrategy [MSTR] announced its plan to add more Bitcoin [BTC] proceeds from its $500 million private offering of convertible notes. Senior notes are a form of debt strategy that matures in 2032. The update is part of Read More

MicroStrategy plans to use the net proceeds from the sale to purchase additional bitcoins and for corporate purposes in general.

MicroStrategy is using debt to fuel its bitcoin strategy.

The company raised another 122 BTC coins worth $7.8 million in April, bringing the total to $9.8 million. Holdings Based on current market values, 214,400 BTC is worth $14.5 billion.

MSTR’s share price has closely followed BTC despite other catalysts such as its inclusion in the MSCI index or the Russell 1000 index, which will be added on June 28.

However, the stock has proven to be a more profitable short-term investment than BTC, outperforming the king coin on multiple occasions.

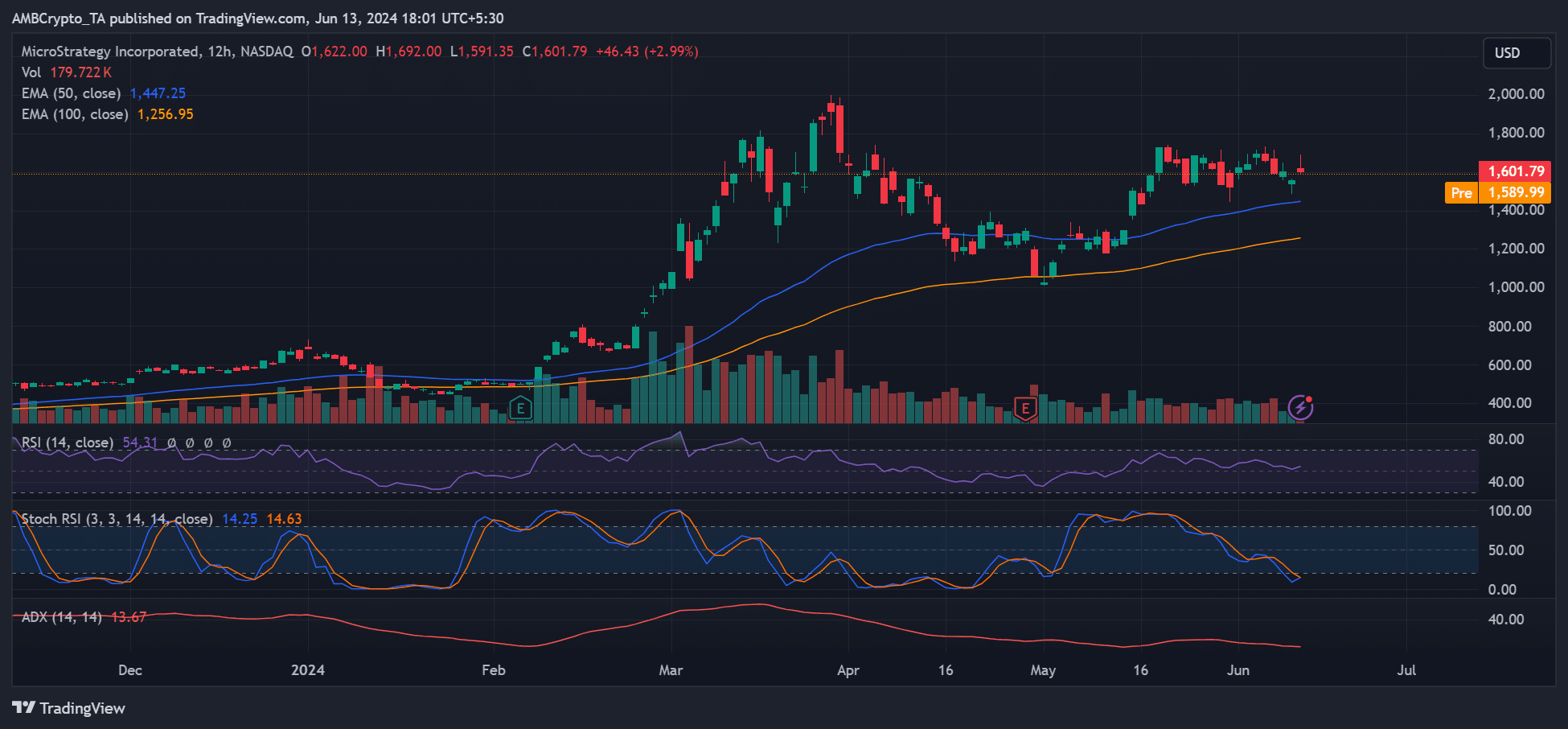

MicroStrategy stock price chart position

MSTR’s market structure was still in a stronger position despite the current market pullback following the Fed’s hawkish interest rate decision.

TradingView: Source for MSTR stock

The price action was also above the 50-day EMA (Exponential Moving Averages) and 100-day EMAs. MSTR’s long-term and short-term price trends have not weakened yet.

The RSI (Relative Strength Index) was also above the mid-range, reinforcing slight but above-average buying pressure. Bulls could be tempted by the Stochastic RSI, which is flirting with the oversold region. This could indicate a possible bullish reversal.

MSTR could soon recover from the 50-EMA and target $1800 or even $2000.

If BTC continues to lose, it could pull the stock to the 100-EMA ($1256). The ADX (Average Directional Index) reading below 20 indicated that there was no trend. Traders should be cautious.

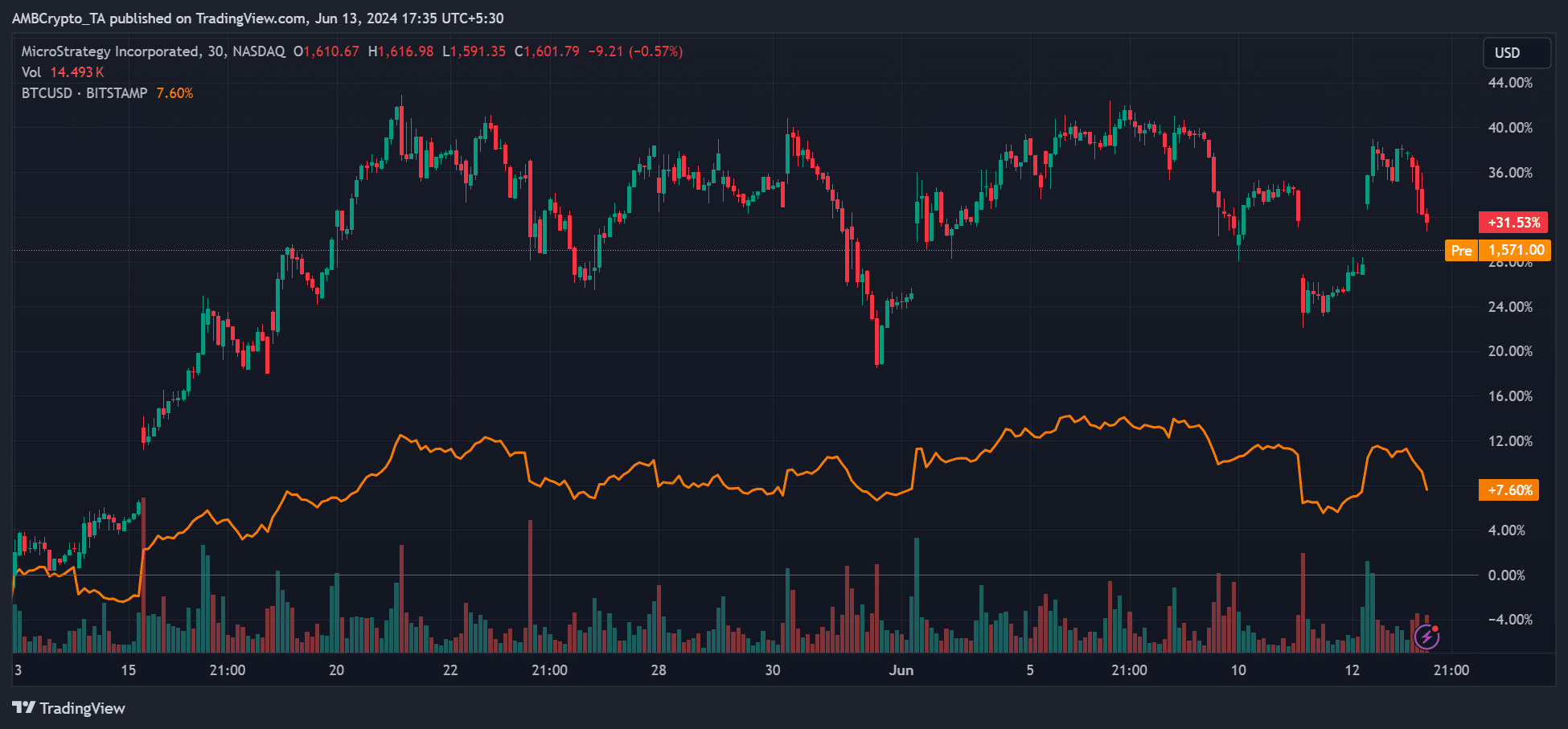

MSTR has still delivered better returns than BTC despite the recent market crash and price consolidation.

MSTR offered an adjusted gain of +30% on a monthly basis at the time of publication, compared to +7% for BTC over the same period. MSTR managed to offer almost four times more than BTC.

Source: MSTR performance vs. BTC