Bitcoin: Why BTC’s Second Bull Phase is Imminent

![]()

Journalist

- Amounts of 10 to 100 BTC are currently being accumulated by addresses.

- Due to its increasing volatility, Bitcoin could reach $80,000 by the end of Q3.

The recent speculation about the end of the bull market for Bitcoin [BTC] has been found to be false. It seems that Bitcoin is preparing for a second leg, with retail investors being active participants in the bull cycles. Historical data from previous cycles show that Bitcoin only reached its peak when many retail investors were in the market.

Retail investors show strength

In March, institutional capital was the driving force behind the rise to $73,750. However, the billions of dollars that drove BTC back then have been declining for some time, leading to price consolidation and correction. Whale and Realized Cap Metric data suggest that there could be a shift in the market dynamics.

Source: CryptoQuant

This capitalization model studies the flow of money from smaller whales to retail investors. It has been observed that bigger players in the market are capitalizing on the decline, leading to an increase in balances for retail investors. Similar situations in the past have historically been the start of a rally after a Bitcoin correction between 20% and 30%.

Crypto Dan, a CryptoQuant author and on-chain expert, shared a similar opinion. In his analysis, he stated that.

The possibility of a significant increase in Bitcoin and additional capital is open for the future.

BTC could reach $80,000 soon

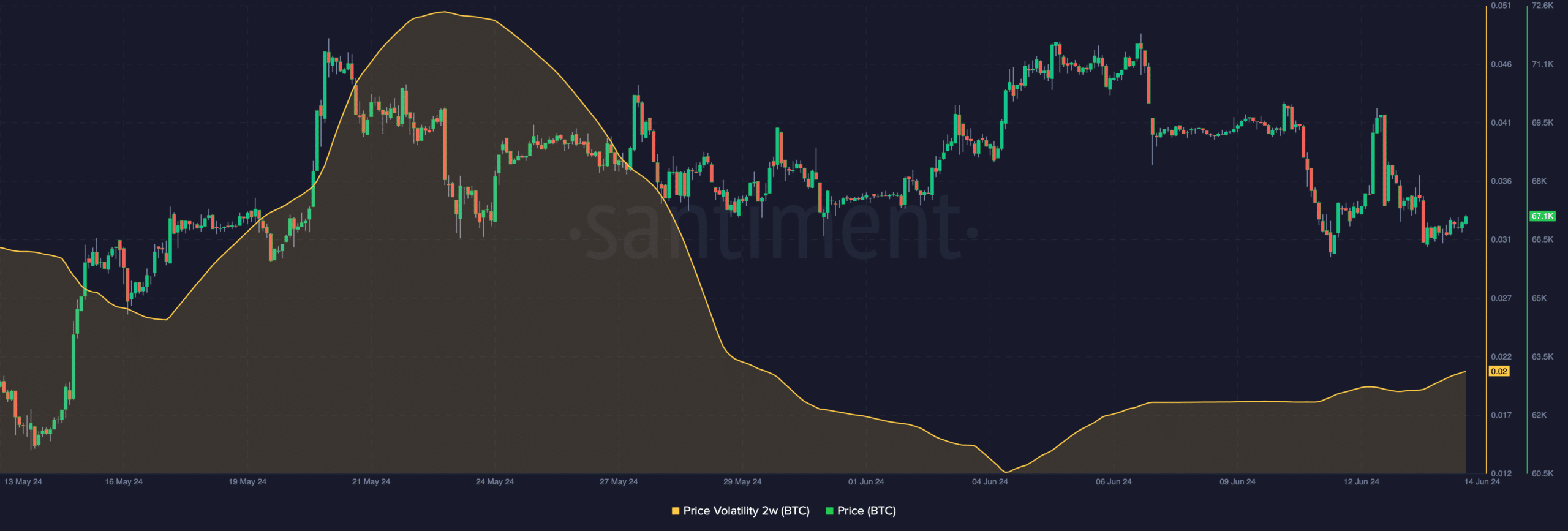

While this doesn’t guarantee that BTC won’t lose value before a new rally begins, analyzing Bitcoin’s volatility further validates the potential return of the rally. Current on-chain data shows that volatility has risen to 0.02 for two weeks. Volatility is a measure of the possibility of an upward or downward movement. Rising volatility can lead to significant price fluctuations, depending on the market’s buying or selling pressure.

Source: Santiment

The price of Bitcoin could rise sharply in the near future, depending on how consistently retail investors accumulate the coin.

Bitcoins: Read the Bitcoins [BTC] Price Predictions 2024-2025

If buying pressure increases, Bitcoin could rise to $80,000 by the start of Q3.

This prediction might not come true if selling pressure continues until then.