Polkadot Is Now Only $6.19, a Reduction of 44%

Contributor

- Polkadot has seen a 44% decline, suggesting a potential buying opportunity.

- Michaël van de Poppe suggests that current levels could be strategic for long-term gains.

Polkadot [DOT]a prominent player in the blockchain ecosystem, has had significant price fluctuations over the past few months. From a high of over $11 in March, the cryptocurrency has seen a significant correction and its price is currently hovering around $6.19.

This represents a 44% decline and positions DOT at a critical point in its market cycle.

Despite the downturn, some industry experts see this as an opportune moment for accumulation, suggesting future appreciation potential.

Strategic Insights for DOT

Prominent crypto analyst Michaël van de Poppe has identified DOT’s current market prices as a strategic entry point. He suggests that current price levels near significant support zones could offer long-term value to savvy investors. This perspective is strengthened by the growing interest in Real World Assets (RWAs) and the continuous expansion of projects within the Polkadot ecosystem, which could fuel DOT’s resurgence in the coming years.

As part of his analysis, Van de Poppe has identified a crucial support area for DOT between $5.67 and $6.11, stressing the importance of this area in maintaining a bullish stance.

Source: Micheal Van de Poppe on X

Should DOT make a higher low within this zone, it could set the stage for a robust recovery.

Conversely, the analyst highlights key resistance levels at $9.30 and $17.00. Overcoming these barriers could confirm a bullish trend reversal and potentially lead to significant gains.

The short-term outlook for DOT remains mixed, with technical indicators suggesting a pessimistic bias.

However, the underlying strength of the Polkadot ecosystem coupled with the enthusiasm for RWAs provides a counter narrative of hope and growth.

Van de Poppe highlights the potential for a breakout, dependent on support levels holding up to market pressure.

Reviewing Investor Sentiment

When assessing Polkadot’s fundamentals, attention seems to be drawn to the open interest trends.

Data

from Coingkass suggests a slight 0.98% decline in open interest to $241.70 million, yet there is an over 80% increase in open interest volume, suggesting increased trading activity. This discrepancy may indicate different investor expectations regarding DOT’s short-term movements.

Source: Coinglass

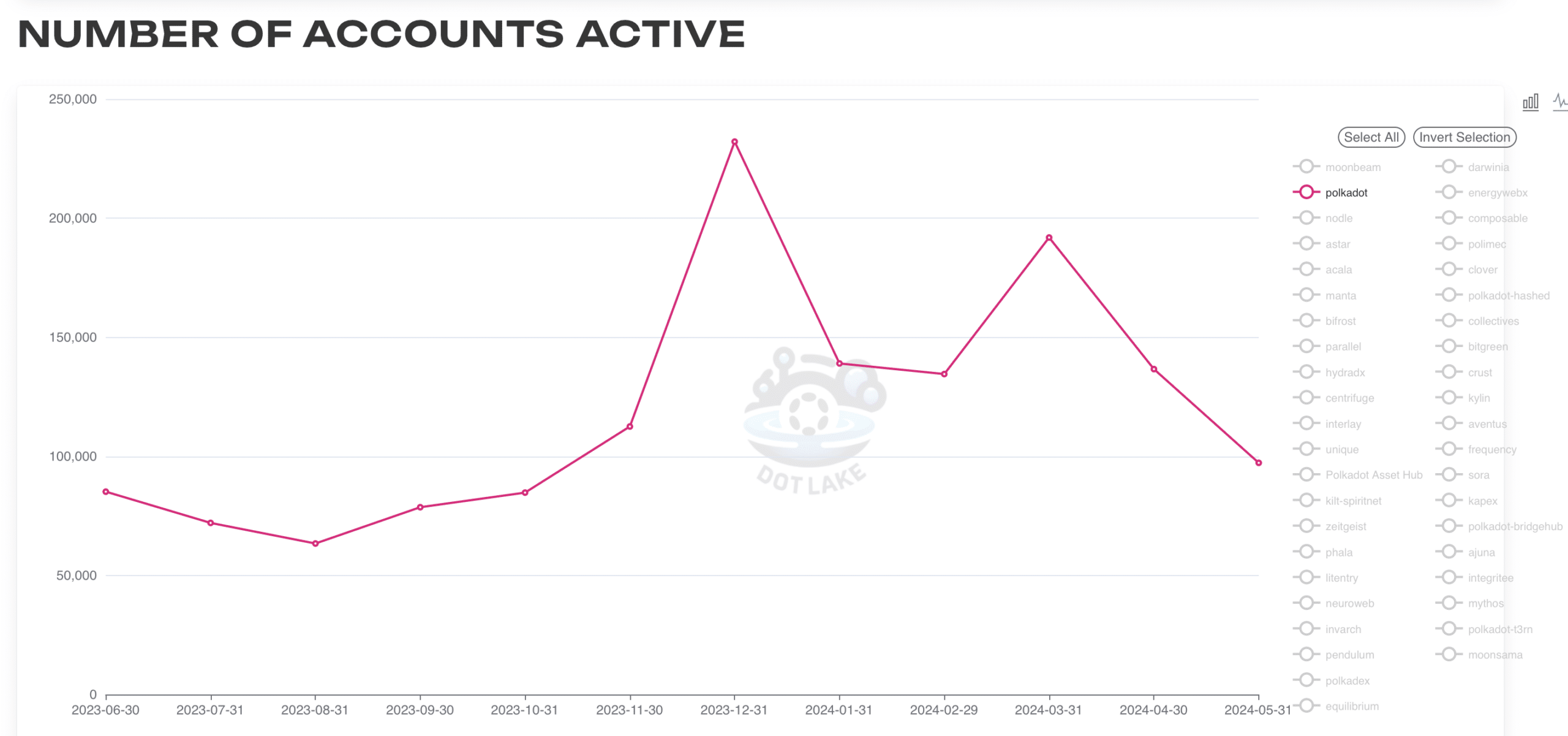

Furthermore, the Polkadot network has different engagement levels. The number of active users

currently stands at around 100,000, down from a peak of 230,000 in 2023. This decline in active users highlights the challenges Polkadot faces in maintaining user engagement and growth. Source: Paritytech

Read Polkadot’s

Price Prediction 2024-25

Despite these challenges, AskFX recently [DOT] highlighted new developments within the Polkadot ecosystem

including the Moonbeam Network – a Web3 smart contract platform – and JAM, a relay chain improvement project. These projects could potentially catalyze a recovery for DOT.