What Are the Odds of Litecoin Falling to $63 in the Near Future? The Odds Breakdown

Financial Analyst

- Litecoin is down 5.64% in 24 hours.

- Various technical indicators showed a possible reversal with increased whale accumulation.

Litecoin [LTC] has seen a considerable price decline over the past seven days. Over the same period, it is down 7.84%, while it is down 5.64% in 24 hours.

At press time, LTC was trading at $72.98, with a 121.34% increase in trading volume to $558 million in the past 24 hours. According to CoinMarketCap, LTC’s market cap is down 5.6% to $4.5 billion at press time.

Source: TradingView

AskFX’s analysis has shown that LTC has struggled to establish an uptrend. Prices have been under massive pressure, with a local low support level of around $70.89 and a resistance level of 80.29.

With the ongoing price consolidation, the price is expected to fall below the support level of $70.89.

Market pressure is pushing prices lower and if such a downtrend continues, the new support level will fall to around $63.46.

However, the 121% increase in trading volume showed that bears were trying to maintain the current prices, resulting in consolidation.

Source: TradingView

The RSI was at 29.52 and the RSI-based MA was at 40.70. When the RSI-based MA falls below its MLA, it shows a strong bearish trend. When the RSI falls below 30, it means that LTC is in the oversold zone.

The oversold zone is usually a sign of a trend reversal where the price can bounce back in the near future. An oversold zone offers buying opportunities as prices recover from oversold conditions.

Litecoin: Possible Upswing?

Source: Santiment

According to Santiment, LTC has seen a significant increase in active addresses. Active addresses increased by 45% between June 7 and June 15, from 3.13 million to 4.54 million.

The increase in active addresses over the past seven days is a good indicator of positive market sentiment. Broadly speaking, increased activity shows increased interest and confidence in LTC.

Source: Santiment

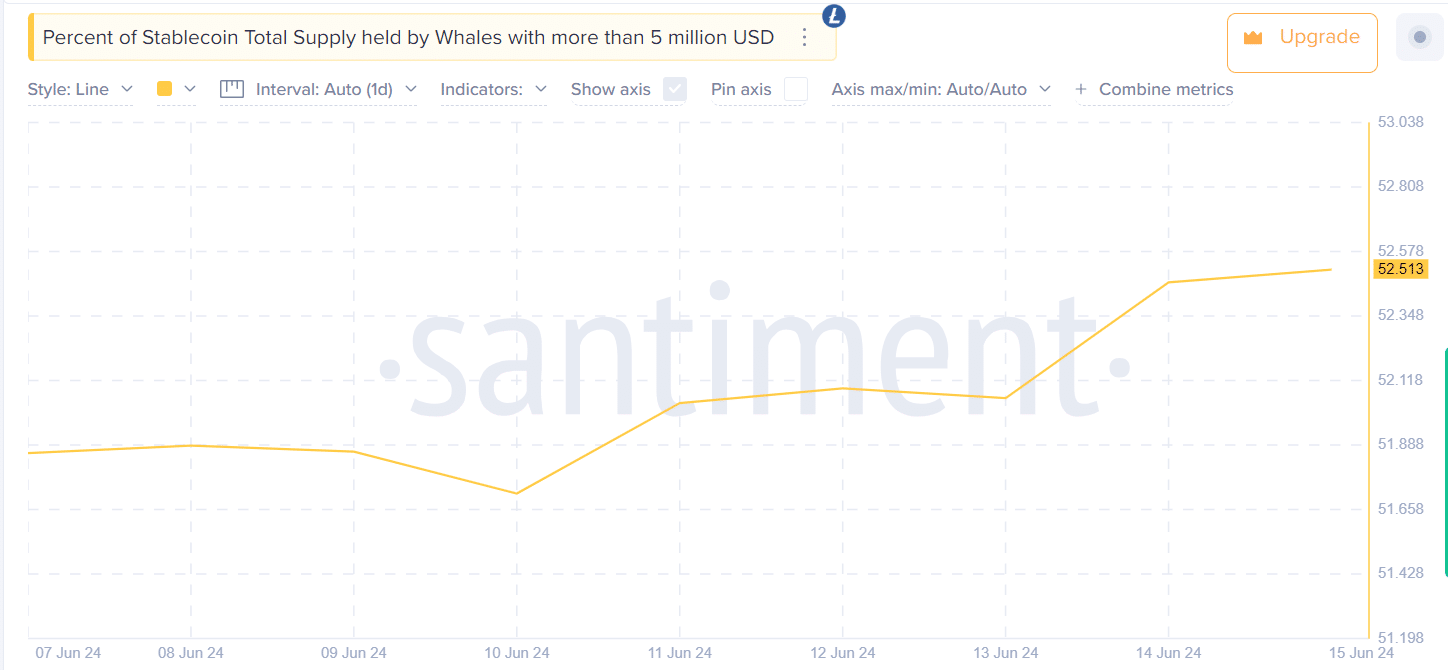

In particular, data on whales holding more than $5 million shows increased interest and confidence in LTC. At press time, 52.513% of the total supply was in the hands of whales.

Since June 13, total whale supply has increased from 52.06 to 52,513 on June 15. During this period, there was increased positive sentiment implied by accumulation and reduced sell-off.

Realistic or not, here is LTC’s market cap in BTC terms

Will the bearish trends continue?

LTC has experienced a volatile market over the past seven days, falling from a recent high of $85.5 to $72.28. If the negative trend continues, LTC will record a new low of $63.58, establishing a new support level.

However, if the positive market sentiment continues, LTC will reverse into an uptrend to $85.96, assuming Bitcoin [BTC] recovers from its current decline.