Celsius, a Crypto Lender, Caused a Stir by Staking $800M in Ether, Leading to a 44-Day Wait for Ethereum Validators

The embattled crypto lender Celsius Network has changed its ETH staking strategy. This creates a backlog of over a month for activating new validators for the Ethereum network.

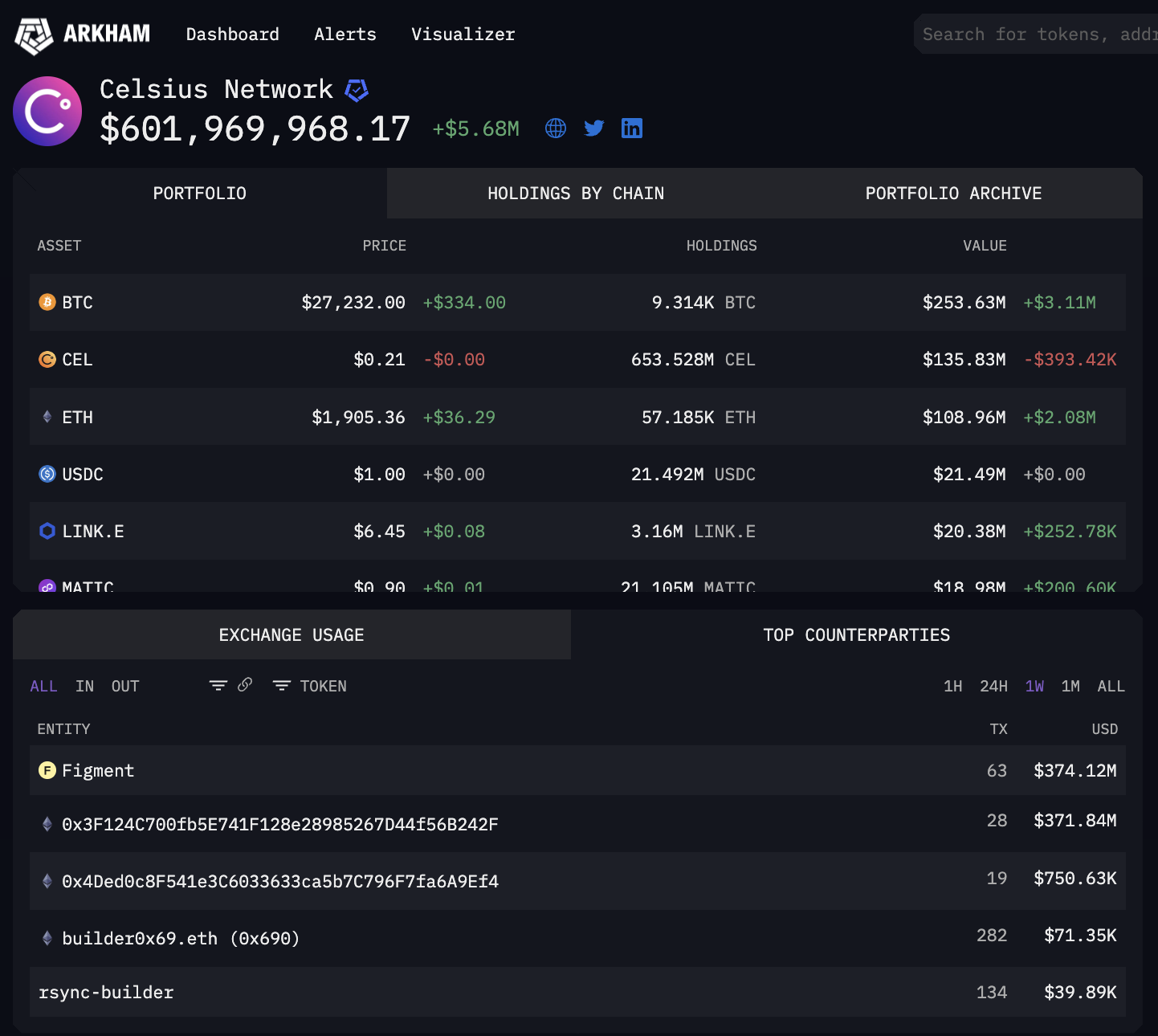

The company has moved ETH into a staking contract over the past two days after cashing in around $813 million in stakes ETH redeemed by Lido Finance, the leader in liquid staking. Data from Arkham Intelligence shows that Celsius has deposited $745 million in ETH since June 1st.

Tom Wan of 21Shares, a crypto investment product manager, noted that the transfers may have added almost a full week to the wait for new validators to be set up on the Ethereum network.

These transactions are part of the lender’s ongoing effort to reallocate the stubbed ETH it has held since Ethereum’s Shanghai update in April allowed withdrawals from staking agreements. The lender had 460,000 ETH – now worth $870 million – staked in Lido Finance and 160,000 tokens – about $300 million at current prices – in its own staking pools.

Transfers took place as the company restructured following its bankruptcy filing in July. The company faced liquidity problems after cryptocurrency prices plummeted and saw numerous withdrawals from users. The US bankruptcy courts auctioned off the lender to Fahrenheit last week. This investment group, backed by Arrington Capital, will acquire the company’s assets, including its institutional loan portfolio, stake cryptocurrency and crypto mining units.

Celsius staking maneuver

AskFX reports that the lender began its staking strategy by staking $75 million of its ETH at Figment.

Celsius has also asked Lido to release its 460,000 ETH stakes once withdrawals are allowed. 428,000 tokens worth $813,000,000 have already been recovered. Blockchain data shows that Celsius split assets between two different crypto addresses, which the company previously used for staking at Figment, as well as to fund its own staking pools. The lender has yet to receive the 32,000 ETH that Lido owes.

According to a Dune Analytics chart by 21Shares, the company transferred a total of 291,000 ETH worth $553,000,000 to the stake contract on Thursday. Wan reported that 192,000 tokens were deposited in the Celsius pool and 99,000 tokens in Figment.

The company started staking all 428,000 ETH on Friday. Arkham data shows that by the time the Figment article was published, the company had invested around $199 million in ETH and deposited around $12 million into the Celsius stake pools.

Arkham reports that after the transfers, the Celsius wallets still held about $109 million worth of ETH.

Ethereum stakers await

Lender can earn rewards from staking digital assets while freezing withdrawals on user deposits remains.

It also lengthens the already long queue for adding new validators to the Ethereum network. Validators in a blockchain proof-of-stake are entities that stake tokens to protect the network and monitor transactions for a reward.

Since the activation of the Shanghai upgrade on April 12th, the demand for missions has increased dramatically. Data from blockchain intelligence firm Nansen shows that deposits exceeded withdrawals by nearly $5.5 billion. That means newcomers have to wait a full month before they can set up validators.

The queue has been further lengthened by Celsius’ recent share deposits. According to Ethereum tracking site Wenmerge, the estimated time to clear the queue is now 44 days and one hour.

Wan, who predicted that the waiting time would be 45 days if Celsius wagered all 428,000 tokens, said the current waiting time would increase by six days, 15 hours and 15 minutes.

Alto, a pseudonymous blockchain detective who was the first to report Celsius transferring to staking wallets, tweeted: “Staking activation only.”