Can Bitcoin Reach a New All-Time High by the End of 2024? The Probability Is 25%

![]()

Contributor

- Bitcoin is expected to rise above $50,000 in October with a 60% probability.

- Peterson thinks 25% of Bitcoin hitting a new all-time high in the same time frame.

Bitcoin [BTC] At the time of publication, it was trading above $57,000. This represents a significant improvement from last week’s sharp decline, which saw it fall to as low as $53,000 – a price level last seen in February.

Bitcoin has hit a low of $54,320 in the last 24 hours. This is a particularly notable bounce considering there are early signs of a sustained downtrend.

Timothy Peterson is a respected Bitcoin economist and analyst. You can also find more information about us on our website. A positive forecast of the cryptocurrency’s development in the fourth quarter of 2024.

Peterson emphasized the importance of Bitcoin’s performance in the coming months and a return to an optimistic mood.

Analysis of Bitcoin’s potential rise

Peterson’s analytics presented a positive outlook to Bitcoin investors and enthusiasts.

He said that if Bitcoin closes July above $50,000, it is likely that the cryptocurrency will maintain or exceed this level into October.

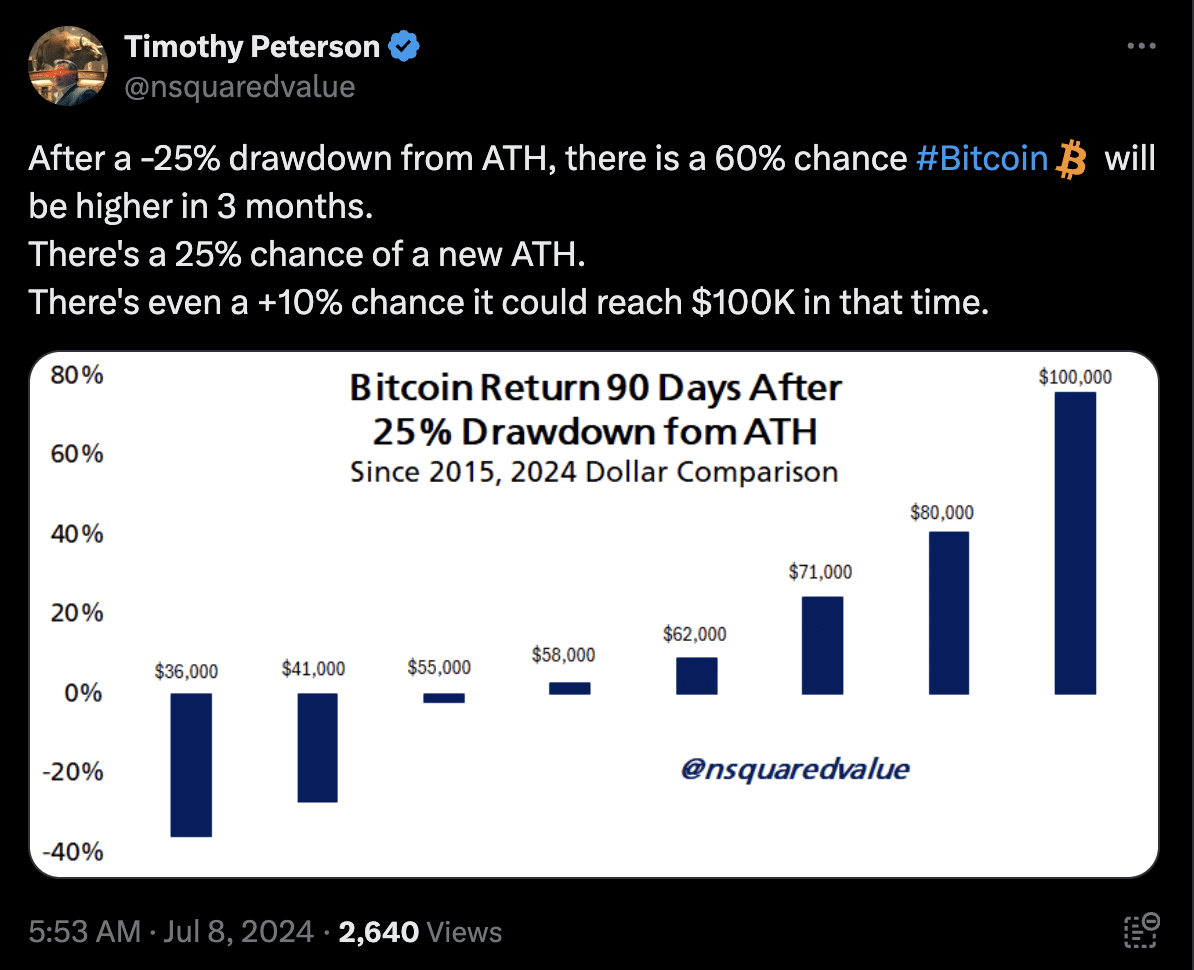

According to his model, after a 25% drop from the all-time high (ATH), Bitcoin’s value has a 60% chance of continuing to rise over the next three months.

Source: Timothy Peterson

Peterson stated that Bitcoin’s ATH could reach a new high within this timeframe.

That Bitcoin could reach $100,000 is less likely, but still a 10% chance. This makes the forecasts and speculations about the future of the asset even more exciting.

Are you prepared for a potential BTC surge?

Bitcoin’s fundamentals offer insight beyond forecasts into its ability to achieve these optimistic targets.

Below are some of the most effective ways to reduce your risk. Market intelligence platform Santiment has found that wallets holding more than 10,000 BTC have benefited from recent market volatility.

Over the past six weeks, large investors have added 12,450 BTC to their BTC holdings.

Source: Santiment

This accumulation, which represents a 1.5% increase in total Bitcoins held, could be a positive signal for the market.

These moves may indicate that large holders, including liquidity providers on exchanges and other potential market participants, expect higher prices or significant market changes.

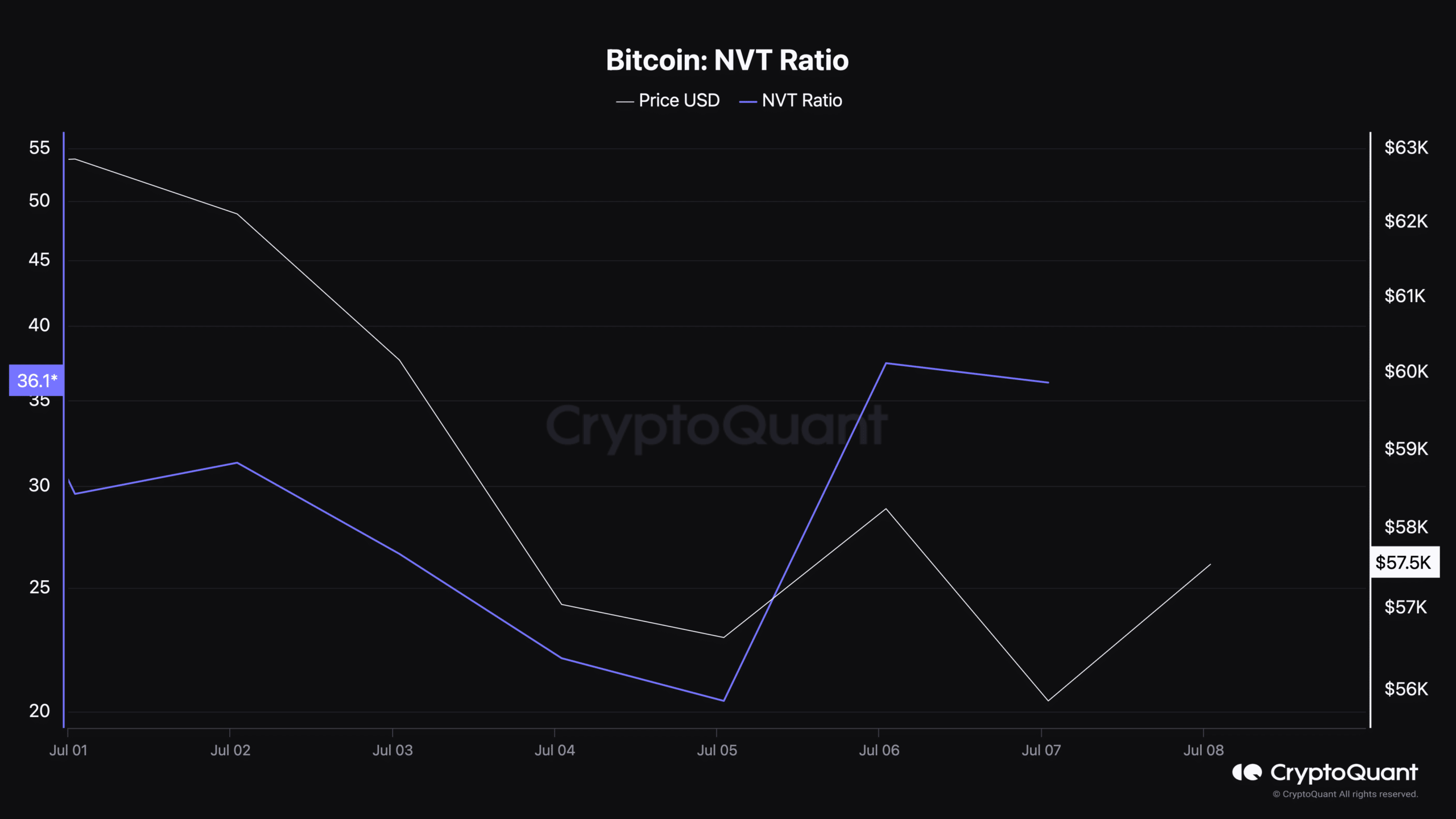

Bitcoin’s network value to transactions (NVT) ratio was also a factor. 36.1 At press timeThe cryptocurrency’s valuation was further refined by.

By comparing the market capitalization with the transaction volume on the blockchain, the NVT ratio helps determine whether a coin is undervalued or overvalued.

Source: CryptoQuant

Bitcoins: Read the [BTC] Bitcoin price prediction for 2024-25

A lower NVT indicates a healthy network and high transactions relative to market capital, which could indicate that the asset is undervalued.

AskFX reported that short-term demand for Bitcoin is insufficient to support a rise above $60,000.