Ethereum’s Pattern is Similar to Bitcoin’s After the ETF: Will ETH Rise 90 Percent?

![]()

Journalist

- ETH price prediction: 90% rise to $6,500 possible after ETF launch.

- US investor demand may not yet fully impact the market for ETH.

Ethereum [ETH] Ethereum saw an 8% drop to just above $3,200, two days after the US spot ETF launch, comparable to Bitcoin’s post ETF launch in January.

If the analysis proves true, ETH could drop to $2,700 within two weeks, then recover and rise by 90%.

Ethereum mirrored Bitcoin’s post ETF launch pattern: an 8% drop ($3,143) two days after approval, -20% ($2,749) two weeks after approval, +90% ($6,547) two months after approval.”

Source: X/Croissant

ETH could reach $6,500 by September, marking a 90% increase in just two months.

Similarly, Bitcoin fell from $48,000 to $40,000 post ETF launch and then rose to $73,000 two months later.

Another well-known analyst, Crypto Kaleo, agrees with this forecast.

Can ETH reach $6,500 and increase by 90% in just two months?

Note that past correlation does not guarantee future outcomes. However, the expected Fed rate cuts in September could benefit ETH and other risk assets, based on analyst predictions.

ETH underperformed BTC in its first week as a spot ETF, evidenced by a greater than 6% weekly adjusted ratio decline in ETHBTC.

TradingView: Source for ETH/BTC

ETH may weaken further if it falls below the mid-range around 0.045, as pointed out by Andrew Kang of Mechanism Capital.

“At this point (below 0.045% ETHBTC), $ETH is no longer as attractive as a hedge.”

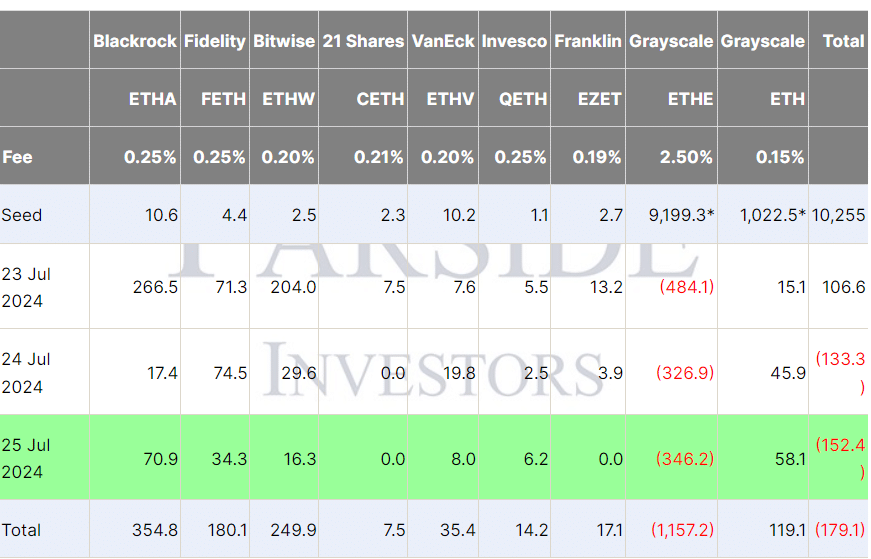

Kang’s concern centers around the US ETFs that track ETH, with notable net outflows from Grayscale’s ETHE.

Source: Fairside Investors

According to Daniel Yan of Kryptanium Capital, ETHBTC’s decline could be slowed at the 0.045 level though it’s premature to predict the continuation of the fall.

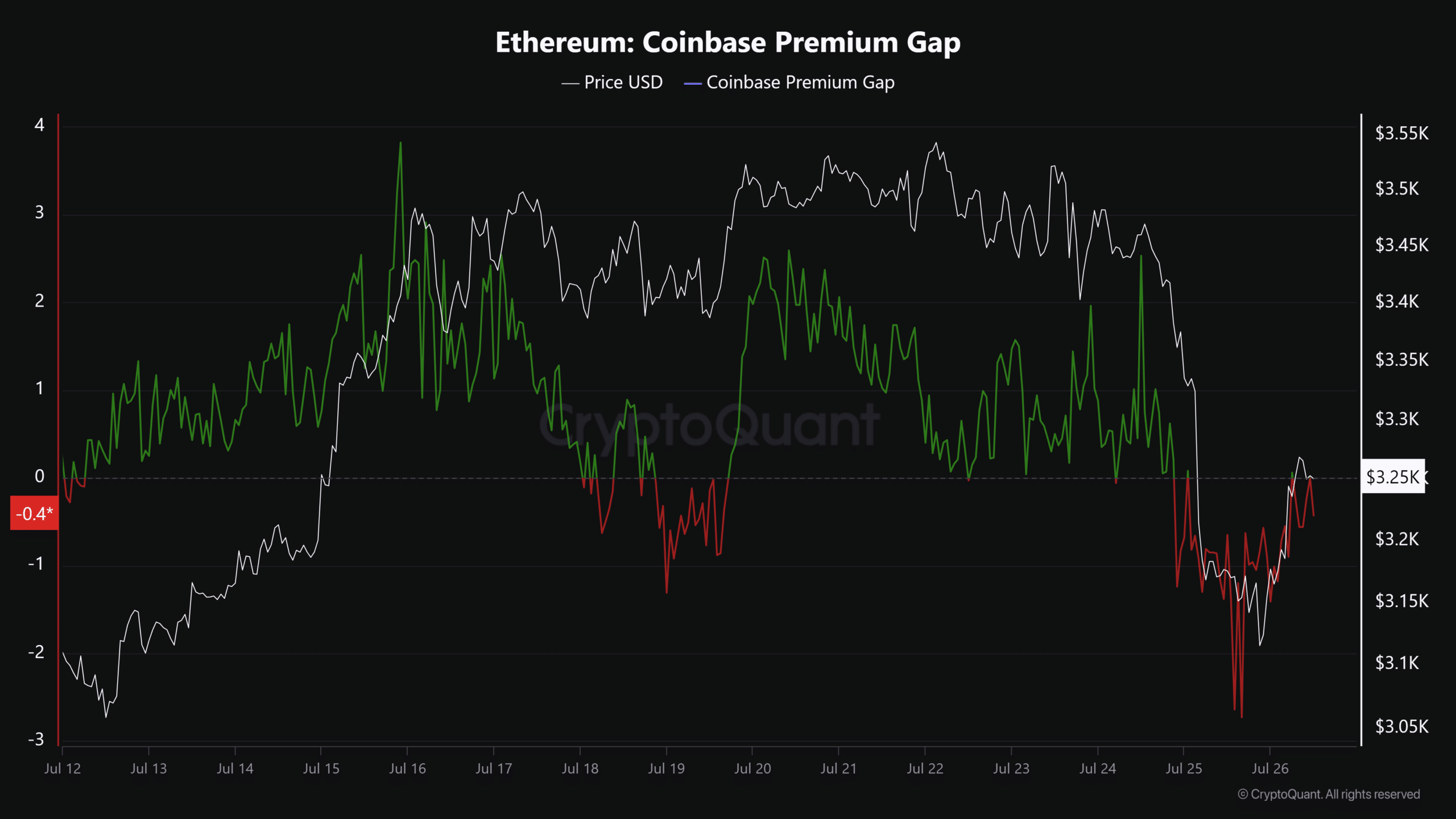

The head of research at CryptoQuant, JA Maartunn, suggests that the ETH price may be impacted by a surge in demand from US investors, indicated by the low Coinbase Premium Gap at the time.

Source: CryptoQuant