Arb’s 9% Decline Allows the Company to Maintain Its Current Price Level

Journalist.

- Arbitrum’s metrics are showing some positive signs, with activity increasing.

- The price of ARB has continued to fall despite these factors. Arbitrum [ARB] has had a very positive run, with the protocol outperforming its competitors on most fronts.

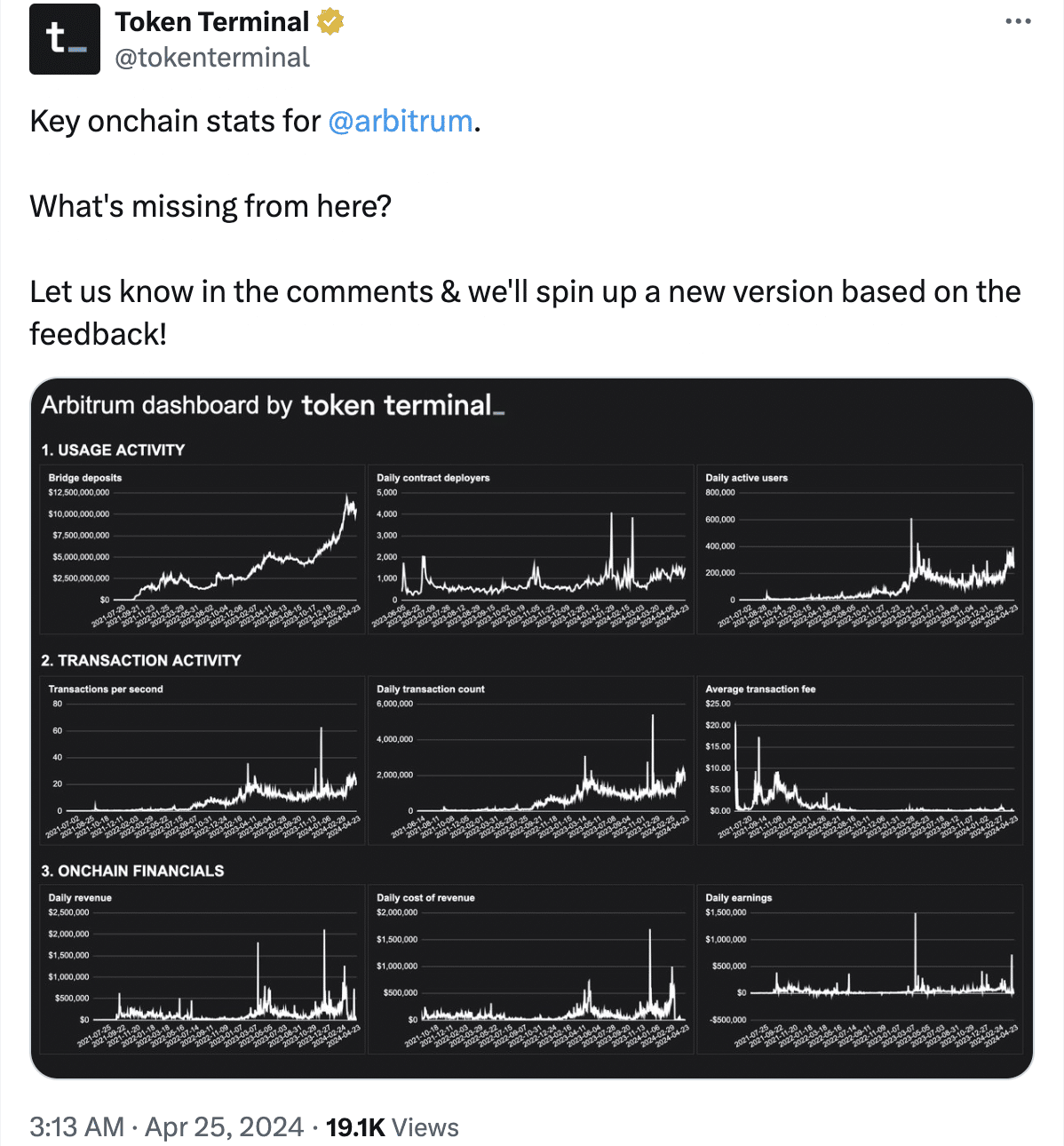

Arbitrum’s network activity has been one of its key strengths. The network has seen a significant increase in activity and transactions in recent weeks.

Challenges in the DeFi Sector

Despite the increased activity, both Total Value Locked and Decentralized Exchange (DEX) volumes on Arbitrum have declined, suggesting that there may be challenges in the DeFi sector.

Declining interest in DeFi could impact user engagement and platform usage in the future.

Token Terminal

In addition, the price of ARB has experienced a sharp decline, falling by 8.91% in 24 hours. This dramatic price drop raises questions about market confidence and investor sentiment towards ARB.

This price increase caused a change in market sentiment, which led to an increase in liquidations. The majority of traders were pessimistic about ARB and the number of short positions rose to 53%.

This change in sentiment reflects a lack of confidence in ARB’s short-term prospects and could increase the token’s selling pressure. It could also affect its price dynamics.

Coinglass

Analysis of the data

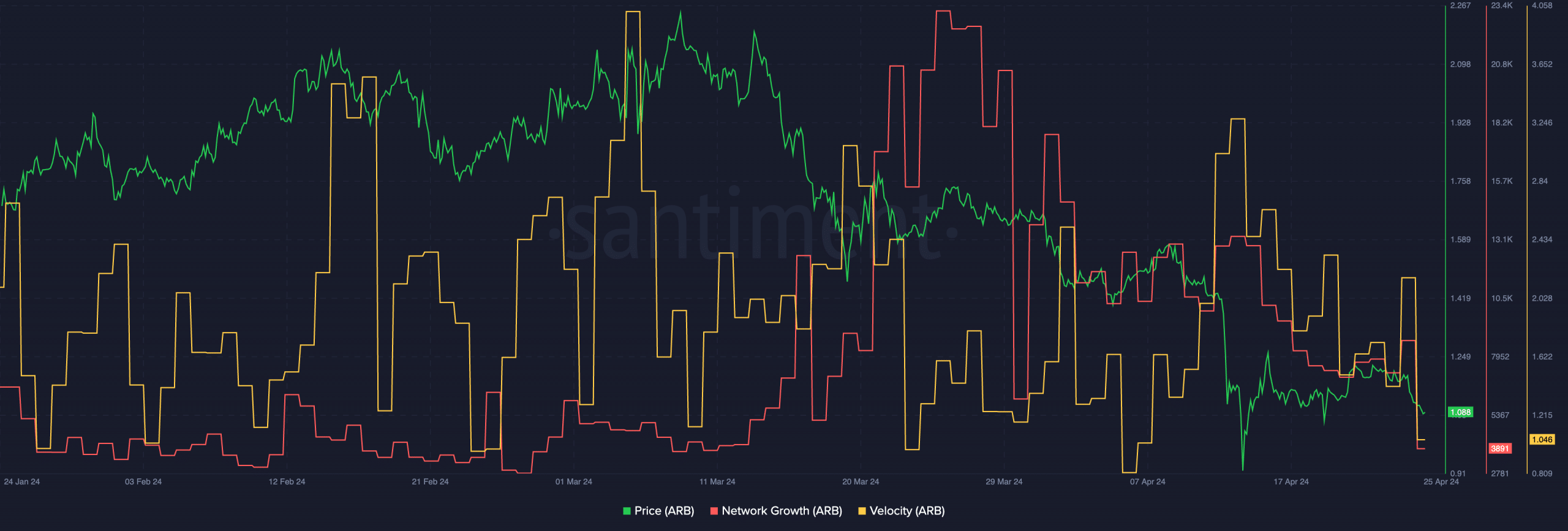

AskFX’s analysis of Santiment data revealed a significant decline in the growth of the ARB network. This decline suggests that new addresses may be less interested in ARB.

The price of ARB can be negatively affected if interest from new addresses wanes. The slowing ARB transaction speed also suggests a decrease in trading activity on the network. This could affect ARB’s overall liquidity and cause further problems in the future. Source: Santiment.

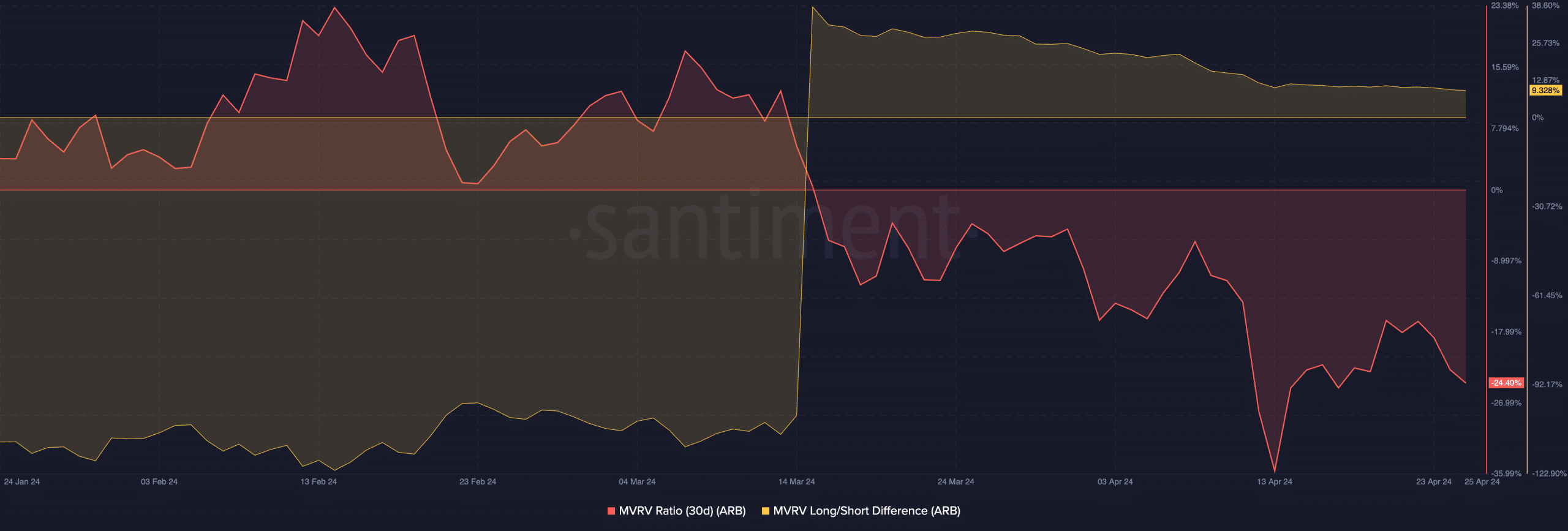

The MVRV for ARB has decreased, reflecting decreasing profitability for holders. This suggested that existing holders were less inclined to sell their positions as they had less incentive to do so. Here is the ARB market cap expressed in BTC terms.

Market Trends

The long/short gap remained high despite the price drop, suggesting that long-term investors are less likely to sell. These factors could help ARB maintain its current price and absorb some of the selling pressure.

Santiment

rnrn