Are Litecoin Investors in a Better Situation than Ethereum Investors?

Journalist

- Litecoin transactions have increased at all levels while Ethereum has fallen behind

- ETH and LTC prices have fallen over the past 24 hours but may soon surpass major milestones

It is rare to find Litecoin [LTC] beyond Ethereum [ETH] at any level. However, on June 6, the number of active addresses on the Litecoin network increased by a staggering 75%.

According to data from IntoTheBlock.com, the difference between Litecoin and Bitcoin was more than 100,000. The total number reached 602,720, the highest since January.

Source: IntoTheBlock

Litecoin Shows Strong Network Growth

Active addresses are the unique wallets that have successfully completed transactions on a particular blockchain. Until a few days ago, the coin’s value was higher than that of Cardano [ADA] On the same front.

It is important to note that the majority of transactions came from low-balance wallets.

Those holding LTC valued between $10,000 and $10 million were not left out. According to IntoTheBlock’s latest post on X

while most of the growth came from transactions under $10, there was a significant increase in all transactions.

It is important to note that the increase in network activity has not led to a rise in LTC. Litecoin’s price was $83.52 at the time of publication, following a 1.8% decline in the past 24 hours. Ethereum was trading at $3,791 and the altcoin also lost a little value.

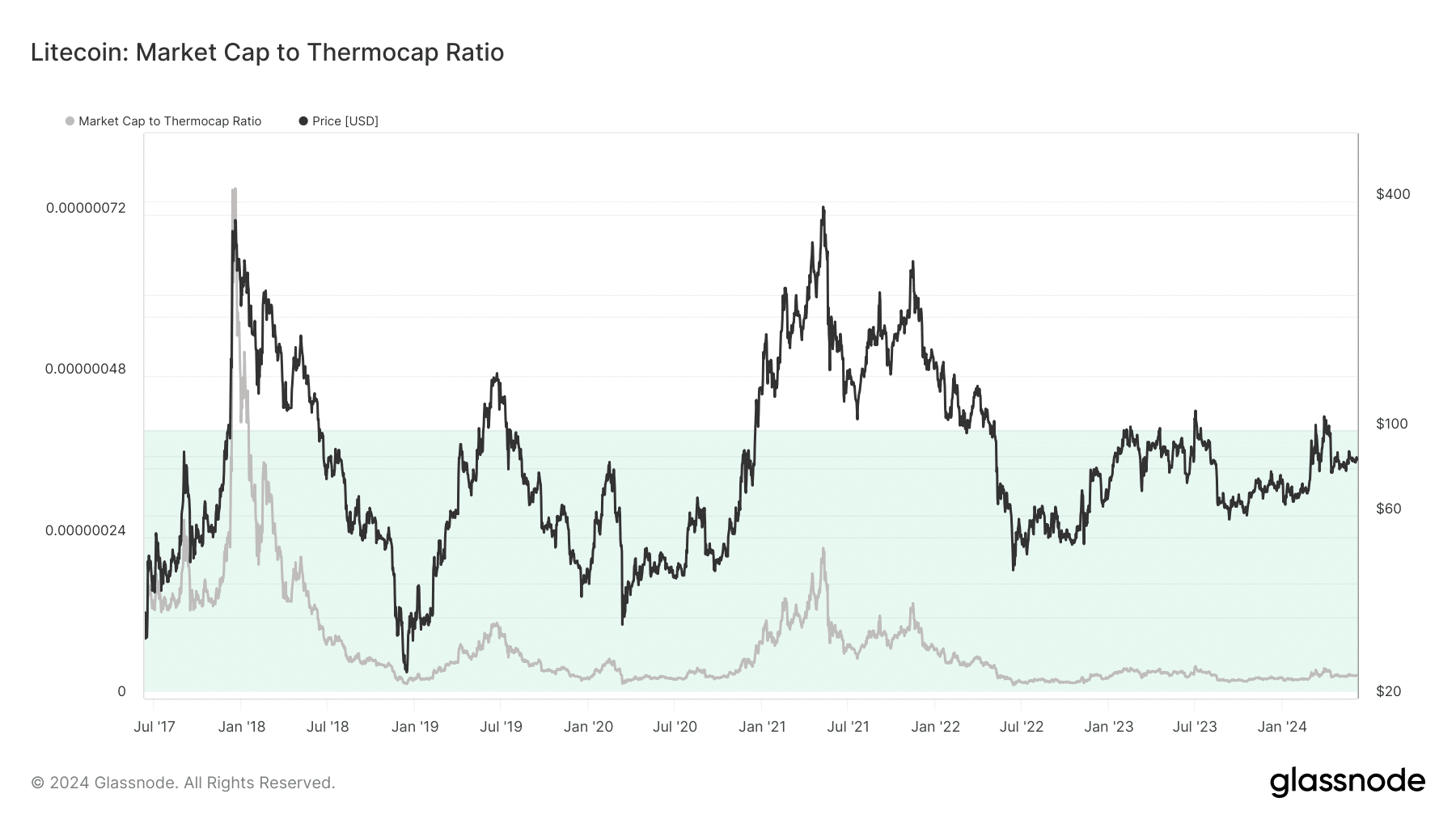

AskFX also looked at Litecoin’s market cap to thermocap ratio. This metric is used to measure the value of a cryptocurrency relative to the total security spend by miners. When the market cap to thermocap ratio increases, it means the coin is trading at a higher price than the miner’s expenses.

In this case, the price is overvalued.

As shown in the chart below, historically, an extremely high value leads to a correction. However, at the time of publication, this ratio was only 0.00000003. This was a low value compared to times when Litecoin was overheating.

Source: Glassnode

Potential for LTC and ETH Prices to Rise

LTC could be trading at a discounted price. If the market returns to a bullish state, the LTC price could rise above $100.

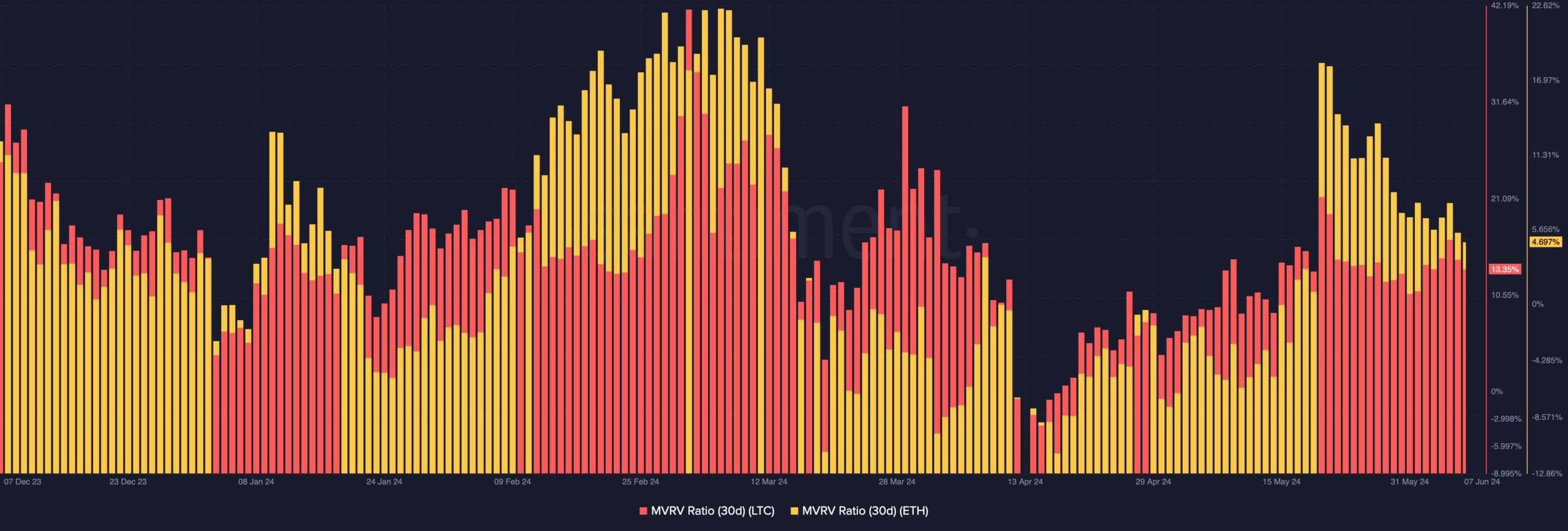

AskFX analyzed the MVRV (market value to realized value) ratio to confirm this thesis. This metric tracks the profitability of coin holders relative to the valuation.

At press time, Litecoin had a 30-day MVRV rate of 13.35%. This means that a typical holder will make a profit if they decide to sell. The gains could be so high that they would trigger a widespread sell-off.

The 30-day MVRV for Ethereum was 4.69%. This suggested that ETH, LTC, and other cryptocurrencies could be in a similar position. However, it also pointed out that Litecoin holders may be better off than their Ethereum counterparts.

Source: Santiment

Here is the LTC market cap in relation to ETH.

In the medium term, it is possible that ETH will surpass the 4k market. LTC could also break its psychological resistance of $100 during the same period.