Bitcoin and Ethereum Lead Crypto Outflows, Exceeding $500 Million

Journalist

- The increase in BTC and ETH outflows was caused by negative sentiment in the market.

- The crypto market is at risk due to the planned dividend of a now-defunct exchange

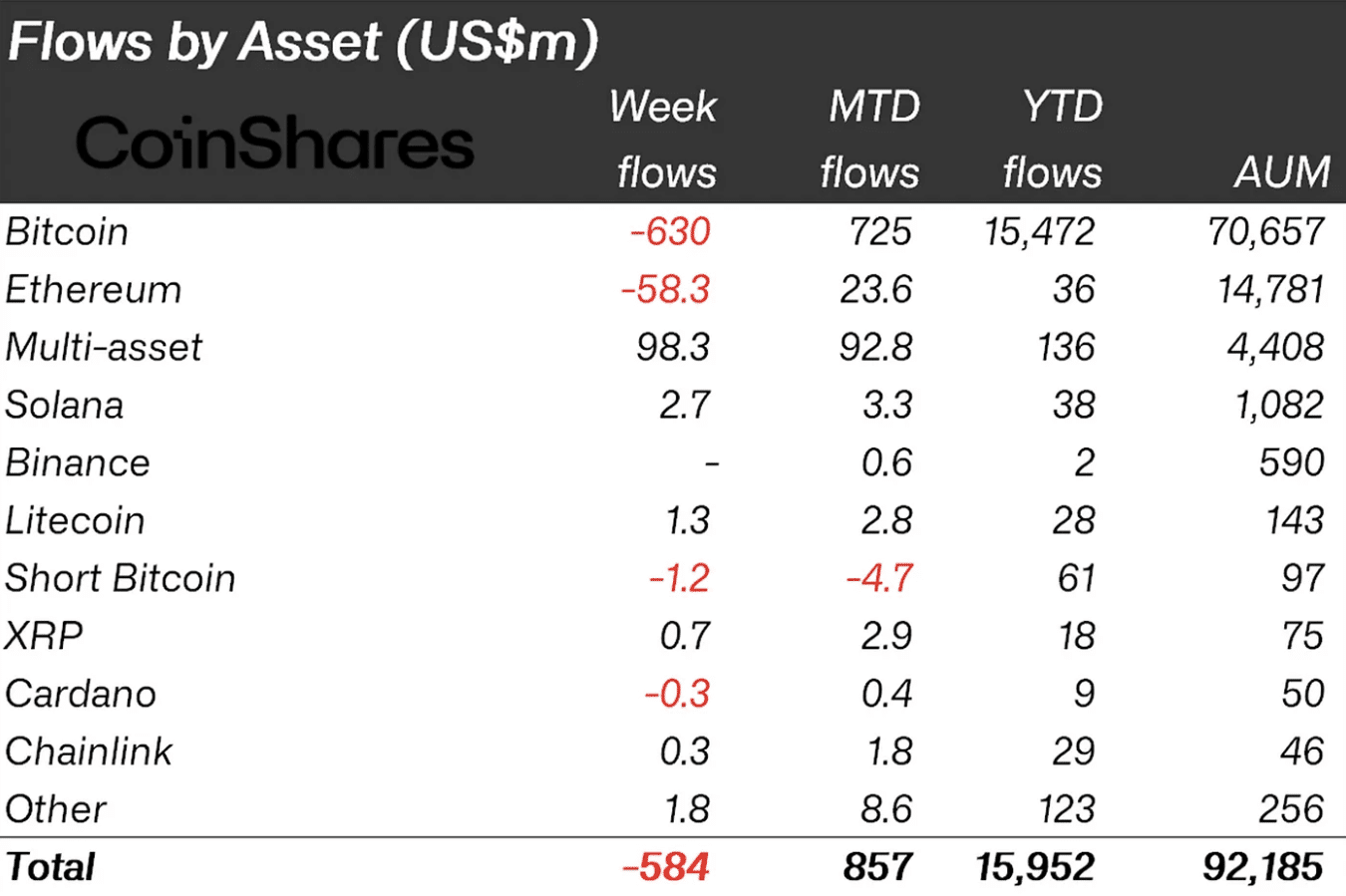

CoinShares’ latest report found that crypto investment products saw massive inflows for the second week in a row. Digital Asset Management reported $584 million in outflows for the last week.

The total amount of Bitcoin outflows for the last two weeks is now $1.2 billion. As expected, the highest capital outflow in Bitcoin [BTC] was $630 million. The report explained the gloomy outlook of investors and the planned interest rate cuts contributed to the capital outflows.

I explained that.

We believe this is a reaction to investor pessimism about possible FED rate cuts this year.

BTC and ETH are second after other altcoins

Trading volume for exchange-traded products (ETPs), excluding outflows, fell to $6.9 billion. This is the lowest volume Bitcoin has seen since the ETF approval on January 10.

Source: CoinShares

Ethereum [ETH] Second on the list was taken by Ethereum spot ETFs with a total outflow of $58.30 million. This was surprising as the market had expected the Ethereum-based spot ETFs to start trading in July.

This was supposed to inspire optimism. However, this did not materialize, the report stated.

“Ethereum was not spared from the negative sentiment, recording outflows of $58 million. A number of altcoins saw inflows following the recent price weakness. The most notable were Solana ($2.7 million), Litecoin ($1.3 million), and Polygon ($1 million).

Bitcoin was trading at $60,028 at press time after briefly falling below $59,000. ETH was trading at $3,349.

Now is the time to be cautious

The first price drop could be related to the revelation that Mt.Gox. In July, Mt. Gox announced it would pay its creditors $9 billion in BTC.

Mt.Gox was the now-defunct Bitcoin exchange that was hacked in 2011. The exchange went bankrupt in 2014. This led to a market crash. There is a good chance that recipients will sell some coins when the distribution begins in July.

If this happens, BTC could drop to $54,000 within a few days as some have predicted. The expected live trading of ETFs could save ETH from another round of correction.

If this happens, ETH could resist further downward movement and be the ticket to the altcoins season that has not yet begun.

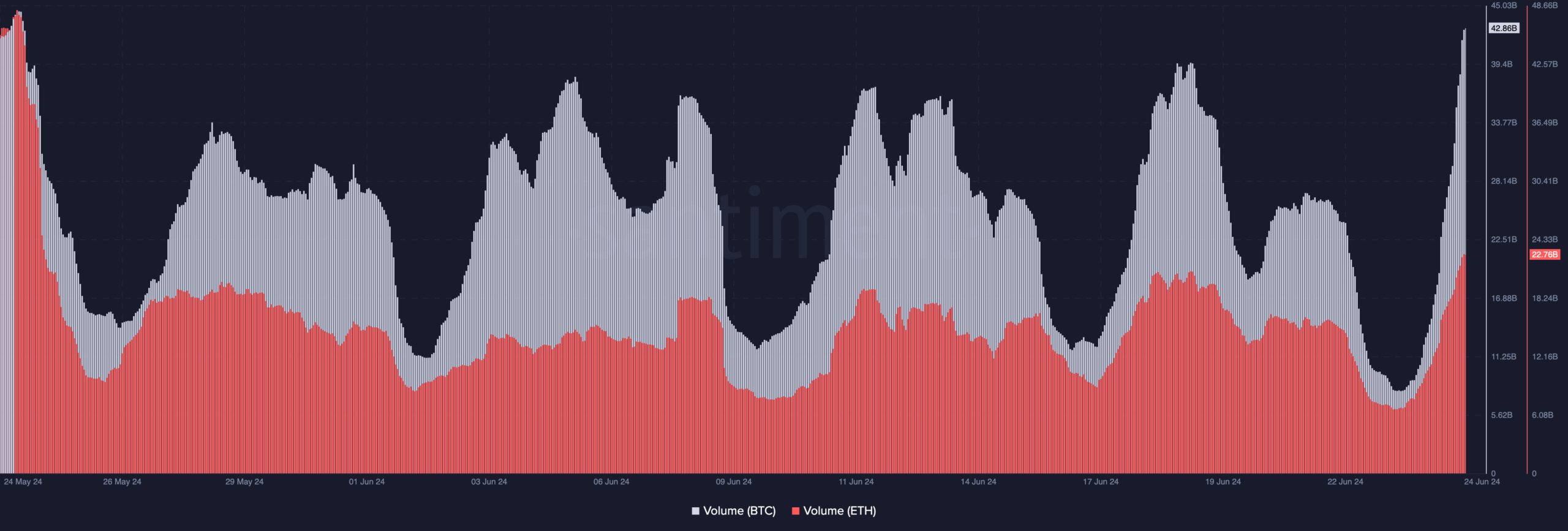

Bitcoin’s monthly volume is also nearing its peak. At the time of publication, the volume was at $42.86 billion. Volume is a measure of buys and sells. It indicates interest in cryptocurrencies.

BTC’s drop means there were more sells than buys. Although ETH’s volume increased, it was not the same as Bitcoin.

Source: Santiment

Here is ETH’s market cap in BTC.

At the time of writing, ETH’s on-chain volume was at $22.76 billion. BTC is currently resisting further decline. If the bulls can defend the coin’s price, it could rise to as high as $63,000.

In the case of ETH, its value could return to $3,500. If the selling pressure increases, prices could reach new lows.