Bitcoin and Solana Lead the Way as Crypto Inflows Continue to Rise After Five Weeks

![]()

Journalist

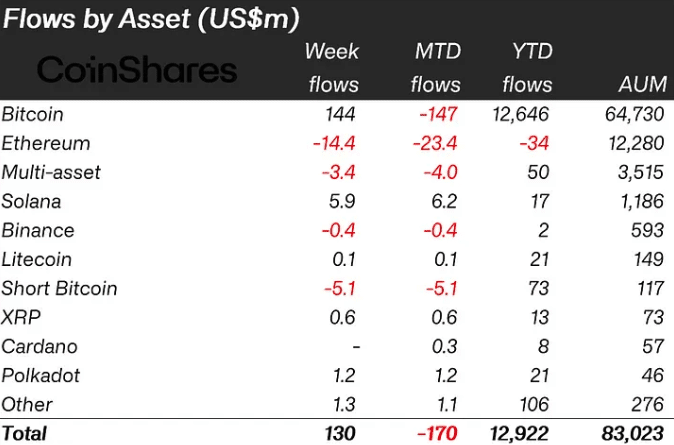

- Bitcoin invested $144 million, while Solana contributed $5.9 million.

- Ethereum’s struggle with regulatory uncertainty led to a sell-off of its products.

According to a report by CoinShares, investment products have finally broken the five-week streak in which they had been seeing outflows. They are now seeing weekly inflows of $144 million.

The digital asset management company publishes a weekly report on investments in crypto products. All five of the past weeks have seen massive outflows despite a strong start to the new year.

Capital increases amid falling volumes

Last week, however, these products managed to attract inflows of $130 million. The report attributed the increase to Hong Kong’s growing interest in cryptocurrency products.

ETFs saw low outflows in the US Bitcoin wasn’t the only one contributing to the positive record.

Solana also played a role in this, according to CoinShares [SOL] as it recorded inflows of $5.9 million. ETP volumes fell despite improvements compared to the average weekly volume for April.

Source: CoinShares

ETPs are exchange-traded products. In April, the average volume was $17 billion. Last week, volume was just $8 billion.

The report noted that the decreased interest was due to a decline in interaction with crypto products.

ETP trading volume on trusted global exchanges has dropped from 31% to 22% this month.

Bitcoin was worth $62,579, up 2.72% in the last 24 hours. Solana changed hands for $148.22, up 7.44% over the same period.

BTC and SOL outperform ETH

This price action could indicate that investing capital in Bitcoin and Solana products is a good choice.

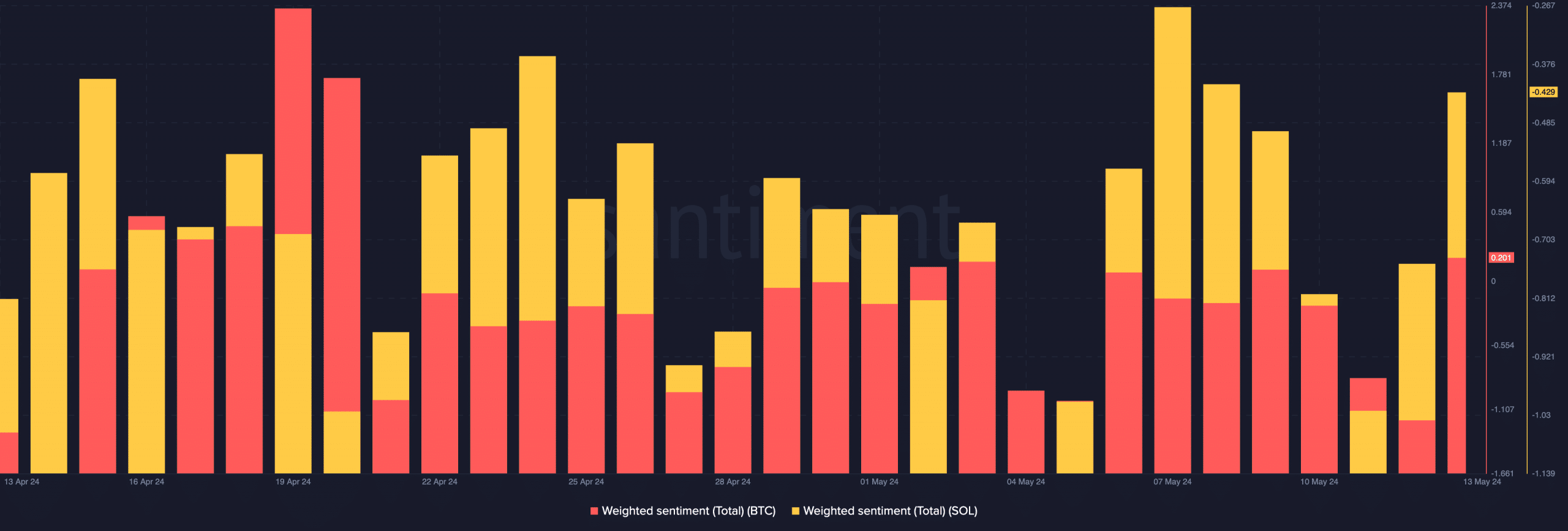

The market seemed to be getting more and more confident about BTC and SOL. The state of their weighted sentiment was a clear indication.

AskFX, using Santiment’s on-chain data, found that Bitcoin’s weighted sentiment was 0.201. This meant that the majority of comments were positive.

SOL was at -0.429. This was an improvement from the previous reading on May 12. This was a confirmation of the decreasing pessimistic bias surrounding Solana.

Source: Santiment

Ethereum [ETH] It was also on the radar. It lost this time because AskFX had reported that the altcoin had received more inflows the week before.

Here is SOL’s market cap in BTC.

According to the latest data, Ethereum-related products recorded outflows of $14.4 million.

CoinShares stated that the main reason for the decline was waning optimism regarding Ethereum ETF approval.

The lack of interaction from US regulators with ETF issuers for a spot Ethereum ETF increased speculation that ETF approval is not imminent, reflected in outflows of $14 million last week.