Bitcoin Buy Calls: What This Means for Your Portfolio

Journalist

- Bitcoin’s popularity has been boosted by a rise in buy calls on social media.

- The coin is still at risk of a short-term correction.

Bitcoin’s [BTC] social activity has increased significantly as cryptocurrency markets await Ethereum’s approval. [ETH] Exchange-Traded Fund [ETF].

Santiment noted in a recent blog post on X.com (formerly Twitter) that social media conversations about the most popular cryptocurrency have been mostly positive, with the market making more buy calls than sell calls.

When traders make a lot of buy calls on an asset on social media, it is a sign that they are enthusiastic about the asset. Some traders view this as an entry point as they perceive prices to be low and ready for a price increase.

BTC holders should think before they leap

This may be a great entry point for some, but ”paper hands” are known to sell when an asset’s social activity increases.

The reason for this is that the increase in BTC’s buy calls by its traders is often due to speculative reasons and not backed by any demand for the coin. Newer investors who need more confidence in the coin’s long-term prospects might be hesitant to hold coins during these periods despite positive social sentiment.

Short-term traders also often see the increase in buy calls as an opportunity to make money. A temporary sell-off can occur even when the general sentiment is optimistic.

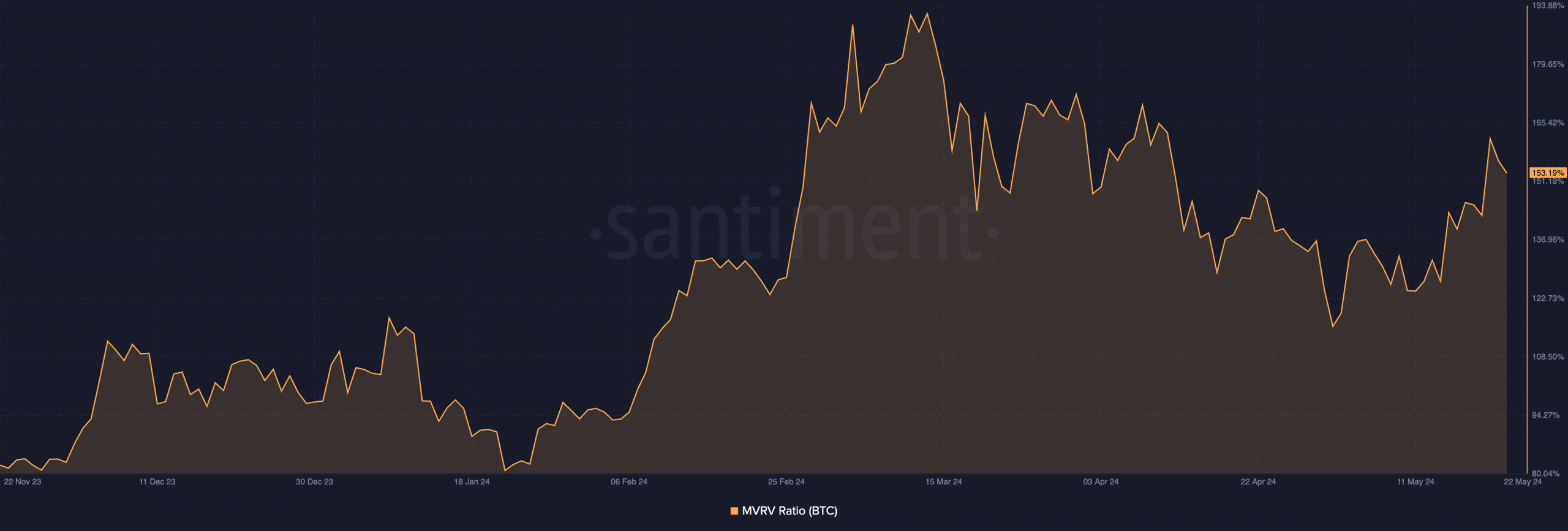

BTC’s MVRV (market value to realized value) ratio was 153.19% at press time. This metric measures the difference between the coin’s current market value and the average cost per token.

Source: Santiment

This is a sign that the coin has been overvalued. Coin holders will be sitting on a profit on average. This could lead to increased selling pressure as investors will be more inclined to do so if they see a high potential return.

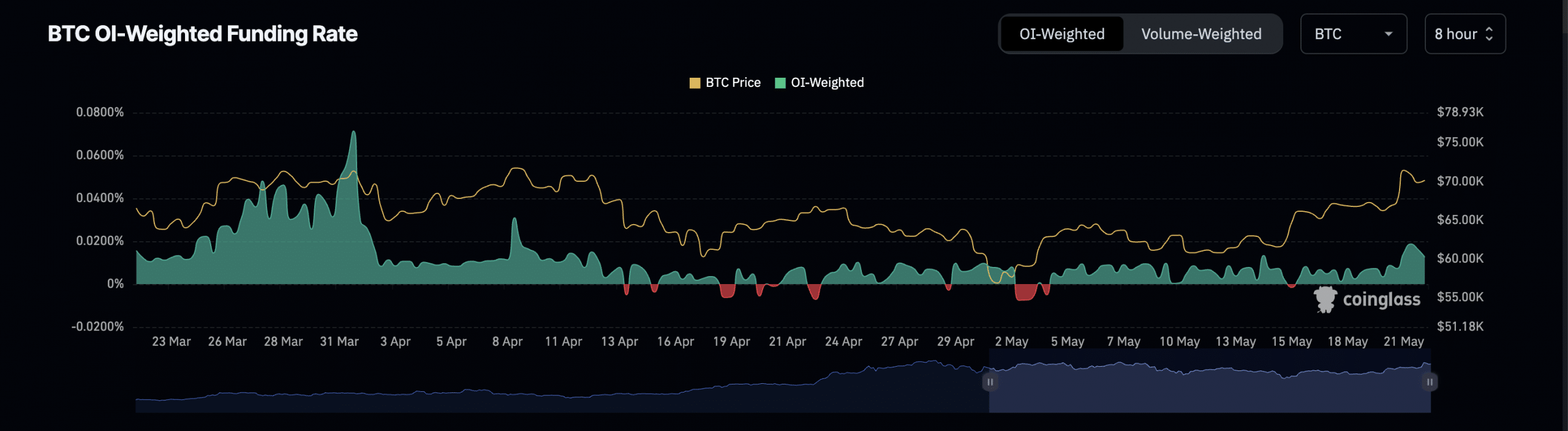

BTC’s rising funding rates increase the likelihood of a short-term price correction. According to Coinglass data, on May 21, the coin funding rate was at its highest level in a full month.

Is your portfolio in the green? BTC Profit Calculator

Source: Coinglass

When an asset’s futures funding rates rise, it is generally a bullish sign and indicates strong demand for long positions.

When they become unsustainable and too high, leveraged positions may be forced to sell. This can lead to price volatility and unexpected price drops.