Bitcoin Dominance Drops to 52% – Is a Market Shake-Up Imminent?

![]()

Journalist

- Bitcoin’s recovery attempt over the past 24 hours has suffered a slight setback.

- BTC is piling up and there are no buyers in sight.

Recently, the [BTC] price of Bitcoin stock has been falling, but efforts have been made to close the gap in the last session.

The king coin has lost its market dominance over the past few days. While the price fell, Over the Counter (OTC) balances continued to rise.

Latest Update on Bitcoin Dominance

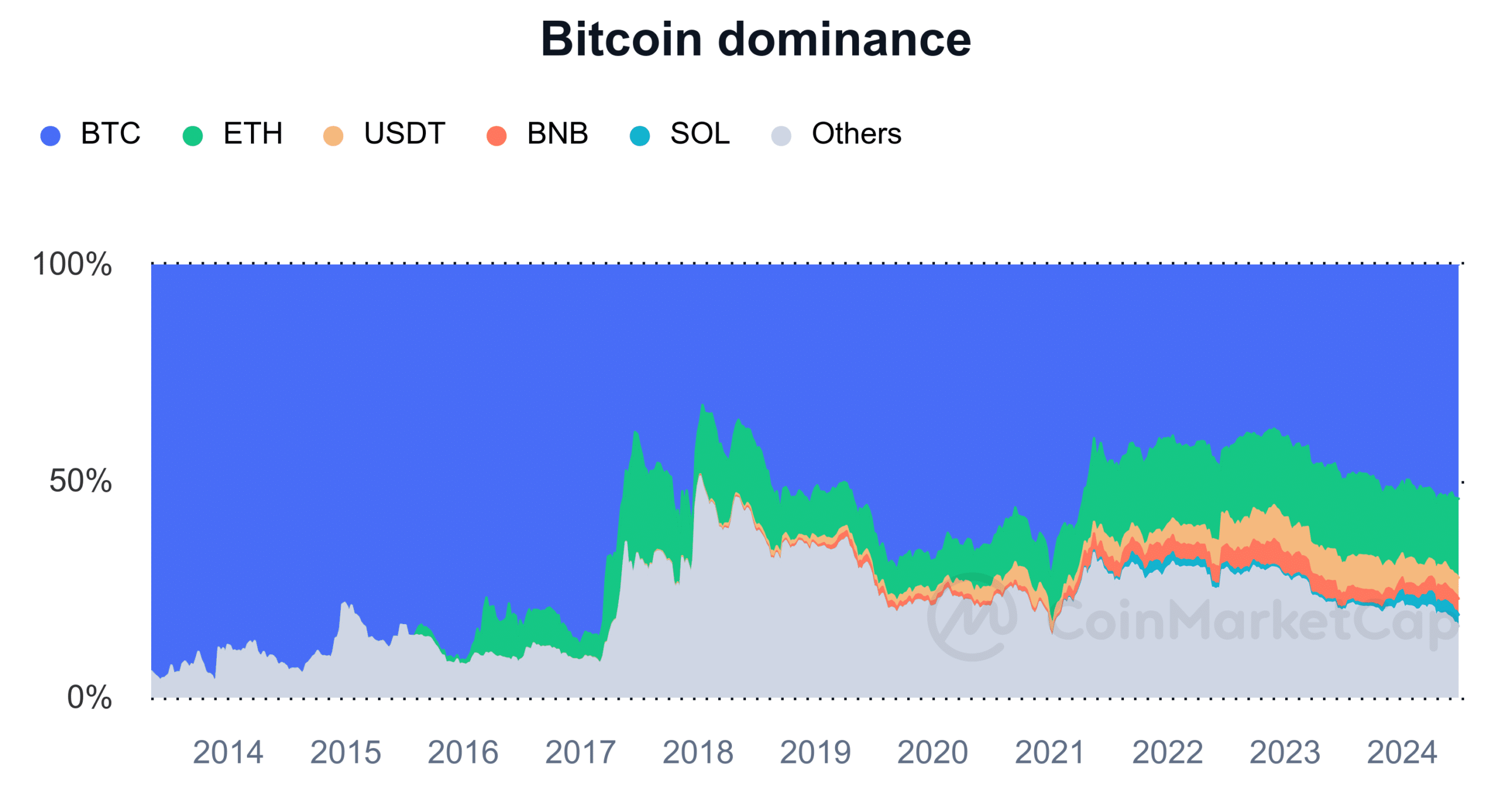

Bitcoin’s dominance in the cryptocurrency market has been decreasing as it struggles to hold on to its value.

AskFX’s analysis has revealed that BTC dominance was above 54% at the end of the trading session on June 24.

By the end of the following day, June 25, the percentage had dropped to about 52.28 percent.

This rapid decline within 24 hours indicates that while Bitcoin lost value, certain altcoins performed relatively better and gained market share.

Source: CoinMarketCap

BTC dominance is still around 53% at the time of writing this article.

This dominance level indicates that Bitcoin still accounted for over half of the total cryptocurrency market capitalization.

Bitcoin Dominance vs Other Assets

The total market capitalization of Bitcoin was approximately $2.27 trillion, while Bitcoin’s market value was over $1.2 trillion.

Ethereum [ETH] The second largest market dominance is almost 18%, which is equal to the total market capitalization.

Analysis has found that BTC’s performance and price can have a significant impact on the distribution of market capitalization between different cryptocurrencies.

Bitcoin Reserves Rising

Recent data from CryptoQuant shows that the amount of Bitcoin in Over the Counter (OTC) or reserves has been increasing.

In the last six weeks, these reserves have grown by more than 103,000 BTC. These BTC are worth over $6 billion at current prices. This accumulation showed a significant increase in OTC reserves.

The steady increase in OTC reserves suggests that there are not enough buyers in the market at present, which is due to the recent drop in Bitcoin’s price.

The price drop may scare away potential buyers and lead to an accumulation of reserves.

Bitcoins: Read the [BTC] Bitcoin Price Prediction for 2024-25

The dynamic between the falling price and the growing OTC reserves highlights the cautious attitude of larger market participants in times of volatility.

Bitcoin’s daily chart showed that it was currently trading at $61,680. The price had fallen by less than 1%.