Bitcoin ETF Holdings Fall: What Does This Mean for BTC?

Journalist

- Bitcoin ETF holdings of various financial institutions declined.

- Bitcoin’s price stagnated and volumes skyrocketed.

Bitcoin’s recent price correction [BTC] turned the market sentiment negative. But it wasn’t just crypto traders who were affected, Wall Street’s interest in the king coin also waned.

Bitcoin ETFs see growth

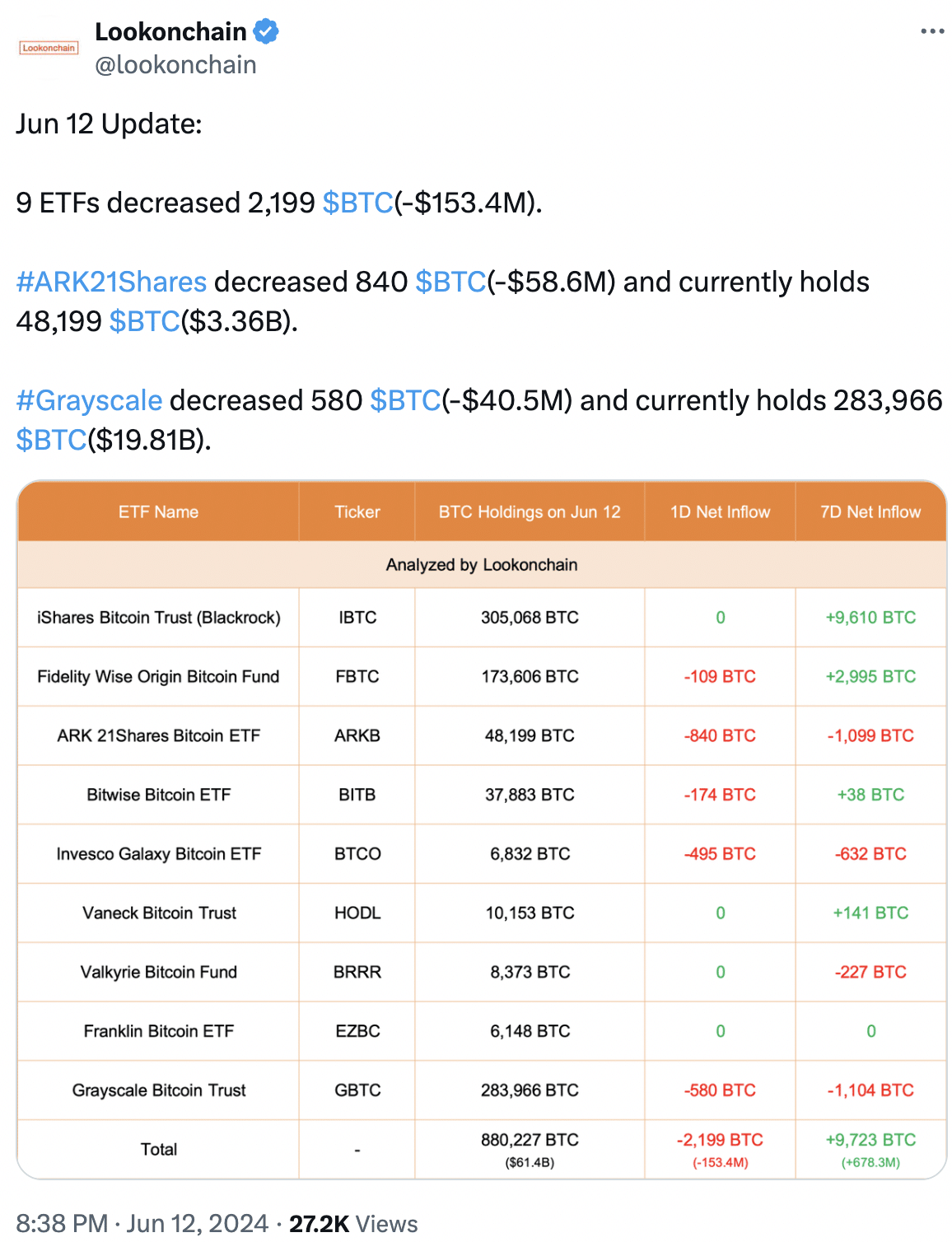

Nine Bitcoin exchange-traded fund ETFs saw a collective decline in holdings of 2,199 Bitcoin, equivalent to about $153.4 million.

This decline can be attributed to two major players – ARK21Shares and Grayscale. ARK21Shares saw a decline of 840 BTC, equivalent to about -$58.6 million.

As of June 12, they held 48,199 BTC, worth about $3.36 billion. Grayscale also saw its holdings drop by 580 BTC, about $40.5 million. As of June 12, Grayscale held 283,966 BTC, worth $19.81 billion.

If major players lose confidence and sell their holdings, it could be a sign of a lack of trust in BTC’s long-term potential, which could lead to a negative sentiment effect across the market.

This could lead to a broader sell-off as less risk-averse investors panic and follow suit.

Source: X

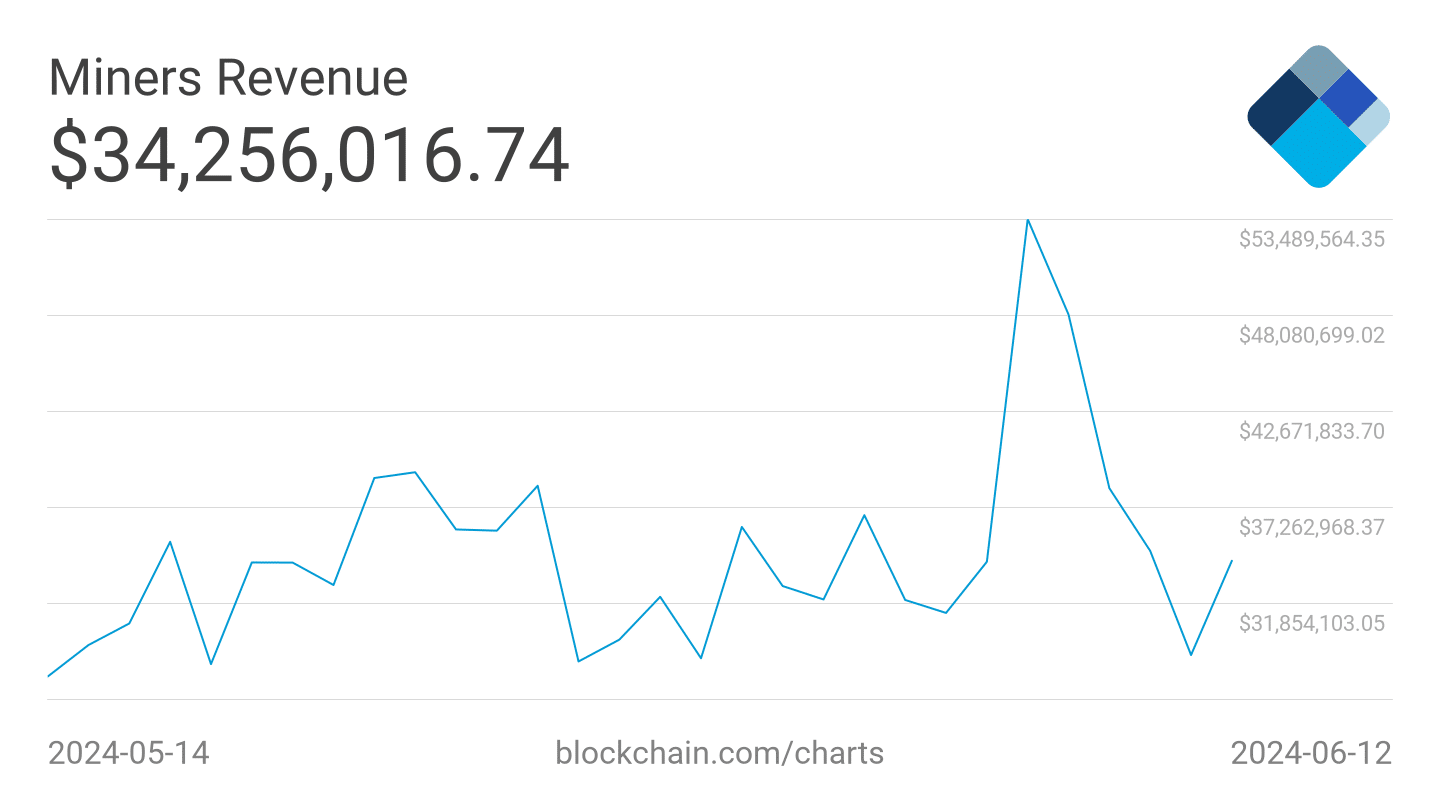

Data from this week showed a two-month high in transfers from mining pools to exchanges, coinciding with BTC approaching its local top of $70,000.

This suggested that miners were taking advantage of the price surge, possibly via over-the-counter (OTC) desks.

This trend was likely driven by the recent Bitcoin halving, which reduced miners’ rewards and prompted them to sell some of their holdings to maintain profitability.

On June 10, 1,200 BTC were sold, the highest daily volume in two months, indicating a possible increase in selling pressure from miners.

In addition, miners’ revenues declined. As miners’ revenues continue to decline, the incentive for these miners to sell their holdings to remain profitable increases.

This decline in miners’ profitability may further increase the selling pressure on BTC.

Source: Blockchain.com

Read Bitcoin (BTC) Price Prediction 2024-2025

How is BTC doing?

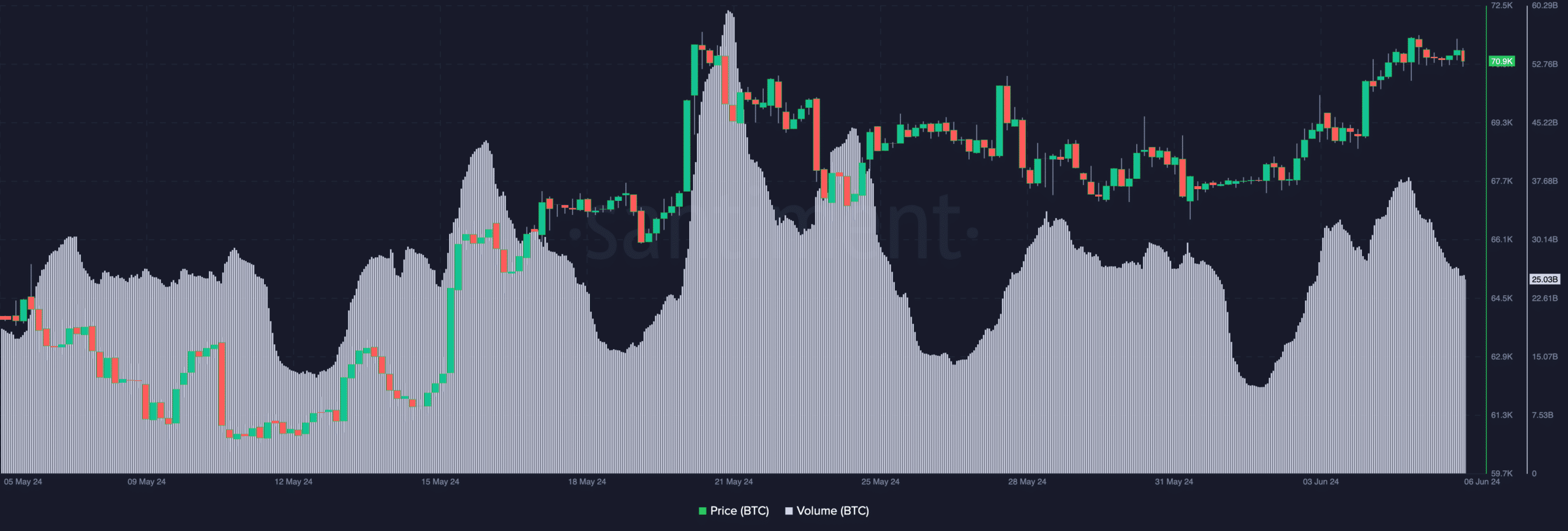

At press time, BTC was trading for $67,268.41. In the last 24 hours, BTC price has fallen by 0.35%. Despite the price drop, BTC trading volume increased by 25.26%.

The rising trading volume for BTC could be an indicator of renewed interest in the coin. If the volume continues to grow, a positive change could also be reflected in the price.

Source: Santiment