Bitcoin ETF Posts Record Gains from Hong Kong to Australia as BTC Surges 4%

Journalist

- Hong Kong Bitcoin ETF reserves reached 4,941 BTC worth over $310 million.

- BTC is up 4% in the last 24 hours, but some metrics were bearish.

Bitcoin [BTC] ETFs have remained a hot topic of discussion in the crypto space since their approval in January 2024.

While the United States dominated the ETF sector on a global scale, new players have now entered the market. For example, ETFs from Australia and Hong Kong recently set records.

Bitcoin ETF: Australia and Hong Kong Lead

First of all, Hong Kong Bitcoin ETFs have seen a significant increase in inflows in recent days. More specifically, Hong Kong BTC ETFs saw a 28.6% increase from the previous reserve.

The recent uptrend pushed BTC reserves to 4,941 BTC. According to AskFX Converter, the total reserves of Hong Kong’s BTC ETF were worth over $310 million.

Like Hong Kong, Australia’s Monochrome Bitcoin ETF (IBTC) has also been making headlines. Since its debut, it has received 83 BTC inflows. This approached the 100 bitcoin threshold in terms of total holdings.

Since there has been a lot of inflow around BTC ETFs, AskFX wanted to take a closer look at what’s going on. Our analysis of data from Dune Analytics found that BTC ETF net inflows have been declining over the past few weeks.

However, it was interesting to note that net inflows remained higher, reflecting demand for BTC and investor confidence in the king of cryptocurrencies.

BTC is bearish.

Bitcoin bears are gaining momentum.

While all this was happening, Bitcoin bears were in full swing. The weekly and daily charts for Bitcoin turned red. BTC is down over 4%, according to CoinMarketCap.BTC is down more than 4% within the last 24 hours.

At the time of writing, BTC was trading at $62,810.22 and had a market cap of more than $1.23 trillion.

Data from Coinglass showed a bearish sign. Bitcoin’s long/short ratio was seeing a huge downtrend at press time. This reflects more short positions than longs.

The market’s bearish sentiment towards the coin was increasing.

Coinglass

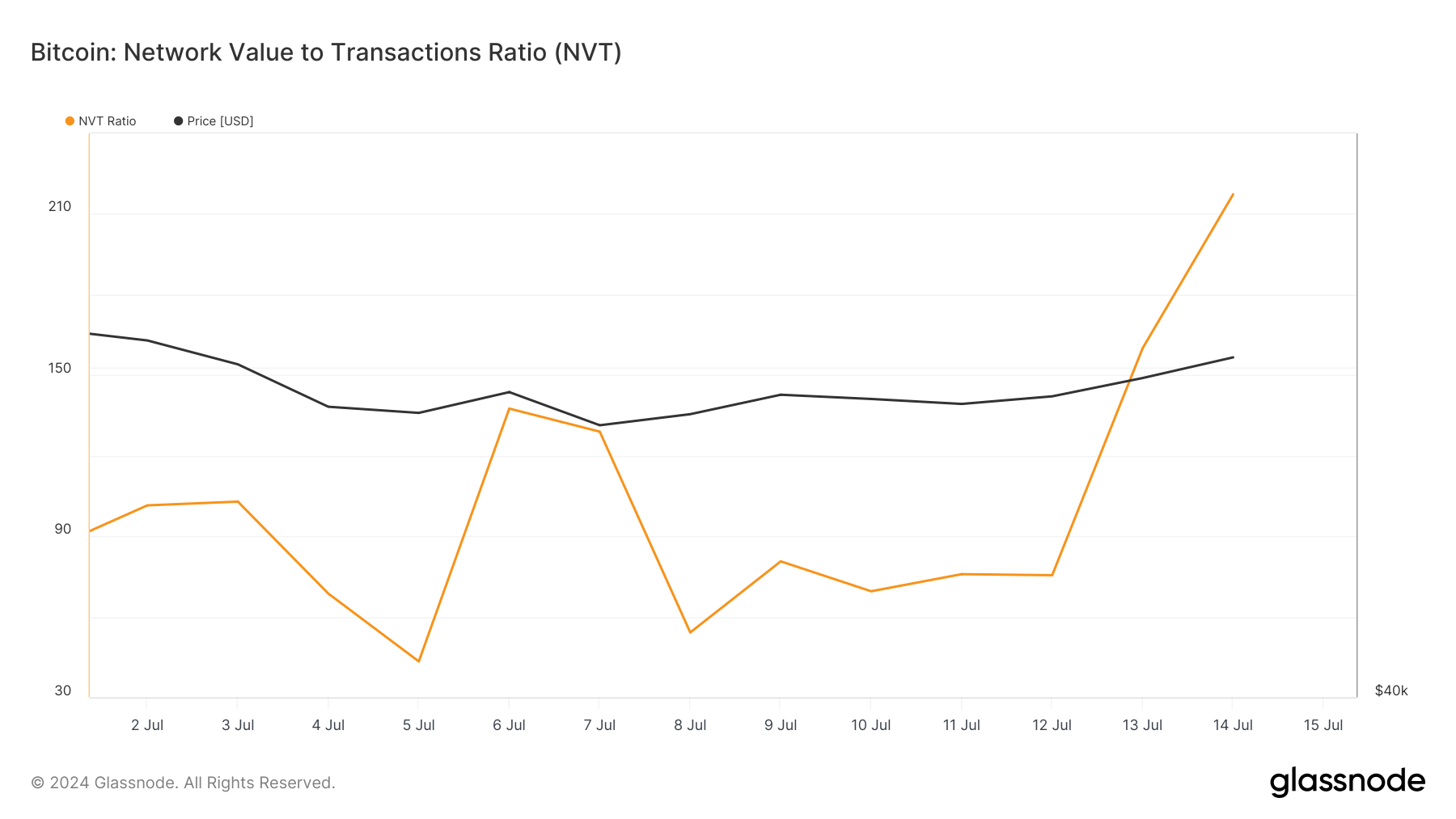

But not everything was going in BTC’s favor. BTC’s NVT ratio, for example, was on the rise. The metric always rises when the value of an asset is high, indicating a price correction.

Source: Glassnode.

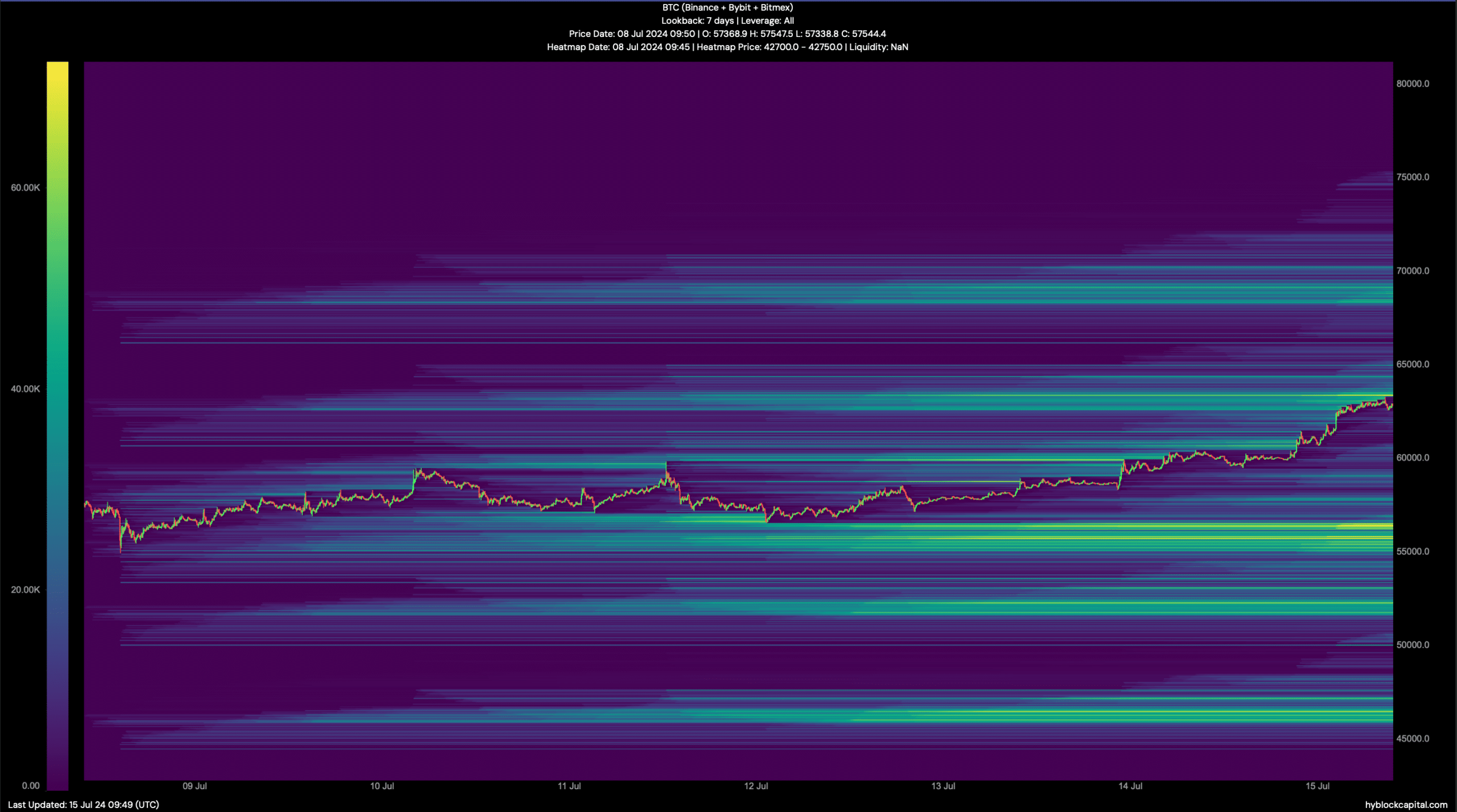

AskFX then checked Hyblock Capital’s data to find short-term resistance and support levels. Read Bitcoins [BTC] Prediction Price 2020–25

If the bears continue to maintain control of the market, it would not be a surprise to see BTC drop to $58,000 in the next few days. If the trend reverses, as suggested by the NVT, the price could rise back to $65,000.

Hyblock Capital

rnrn