Bitcoin Network Assessment: Its Future Given the Challenges for Miners and NFTs

Financial Analyst

- Interest in Bitcoin NFTs has dropped significantly in the past few days.

- Miners’ revenues have dropped and hashrate has dropped.

Bitcoin price [BTC] has seen a massive price increase in the past few days, crossing the $65,000 mark. However, no comparable growth has been seen in the Bitcoin network.

A look at the NFT space

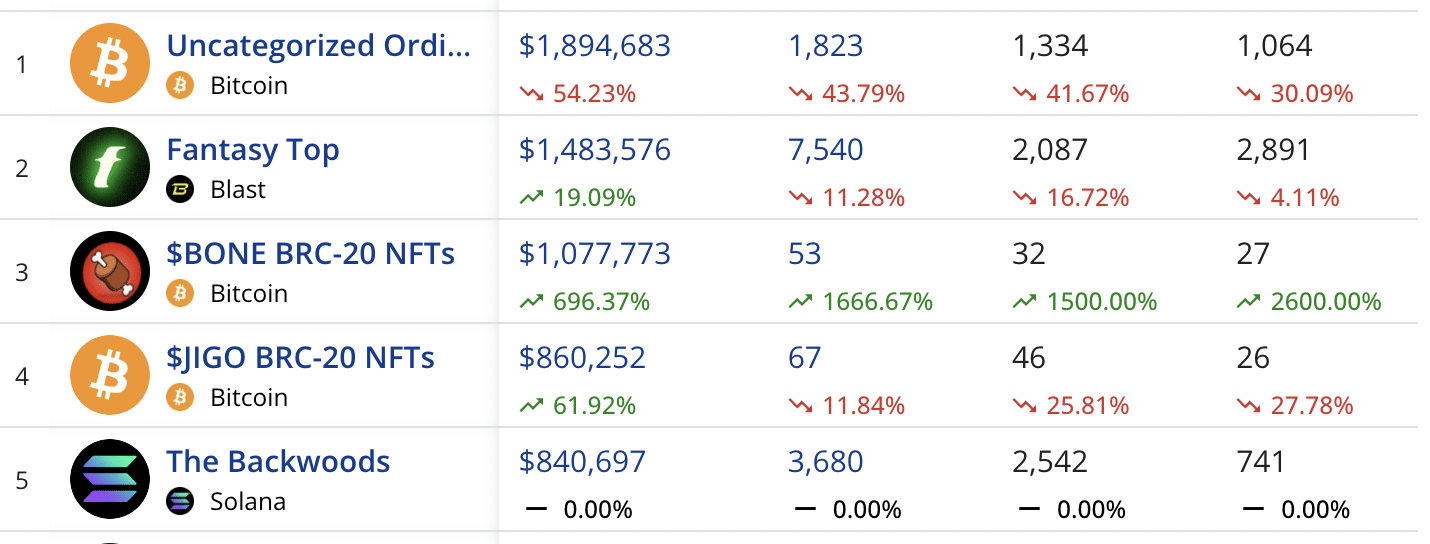

According to recent data from CryptoSlam, interest in the NFT sector has been slowly declining. Notably, the sales volume for Bitcoin NFTs dropped by 17% in the past 24 hours.

Popular Bitcoin NFT collections such as BONE and JIGO have seen a massive drop in both minimum value and volume in the past few days.

Source: Crypto Slam

This waning interest in NFTs can damage the growth potential of the Bitcoin network and also affect overall activity.

The number of daily active addresses also dropped significantly, showing that interest in the Bitcoin ecosystem was waning at press time.

Source: Santiment

How are miners doing?

A drop in activity on the Bitcoin network can also affect miners’ revenue. When activity on the Bitcoin network drops, fewer transactions take place. This leads to lower transaction fees.

Since miners receive transaction fees for inserting transactions into blocks, a drop in activity leads to lower total transaction fees that miners collect.

In recent days, revenue generated by miners dropped from $107 million to $30 million at press time.

Source: Blockchain.com

The hashrate for BTC has also been dropping in recent days, which can cause difficulties for miners.

While it seems beneficial that solving blocks becomes easier with a lower hashrate, the network’s automatic difficulty adjustment reduces the block reward each miner receives when there is less competition.

This puts pressure on transaction fees as a source of revenue for miners.

However, the reason for the potential drop in hashrate, namely a drop in network activity, often also means that there are fewer transactions and lower transaction fees.

Read the [BTC] Bitcoin price prediction 2024-25

This poses a major problem for miners as they will receive a smaller share of fixed block rewards and have fewer opportunities to earn from transaction fees.

Source: Blockchain.com