Bitcoin Volatility Could Increase in the Coming Days – Why

Journalist

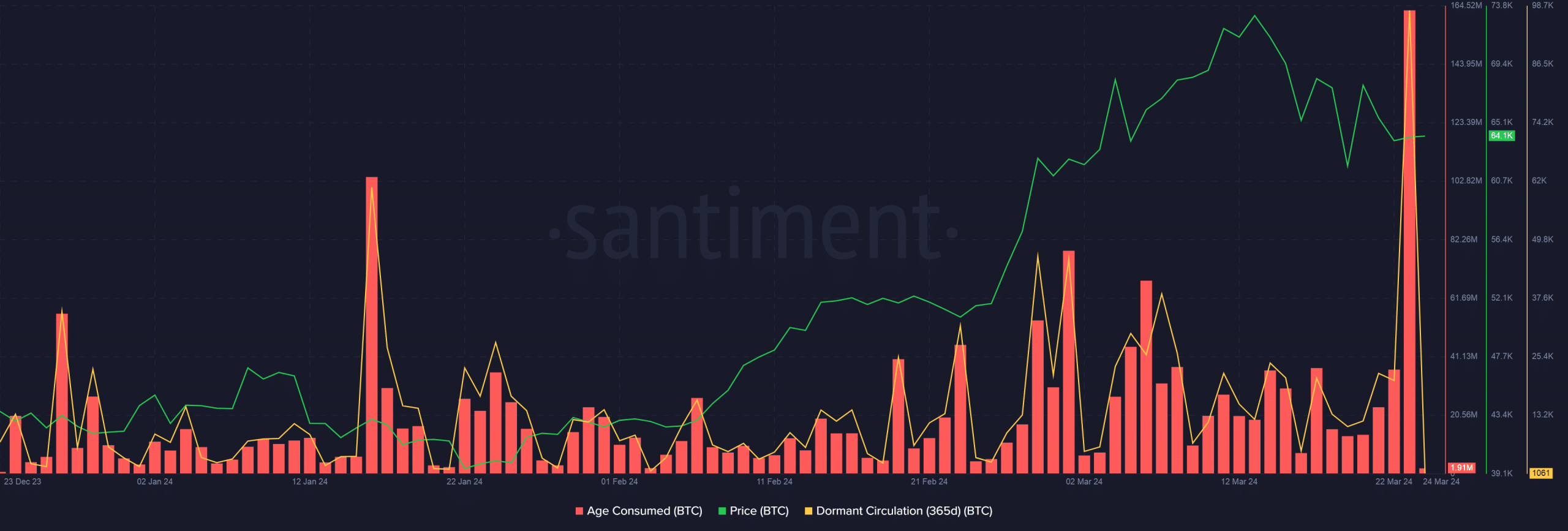

- This was the biggest spike in dormant BTC stock movement in over two years.

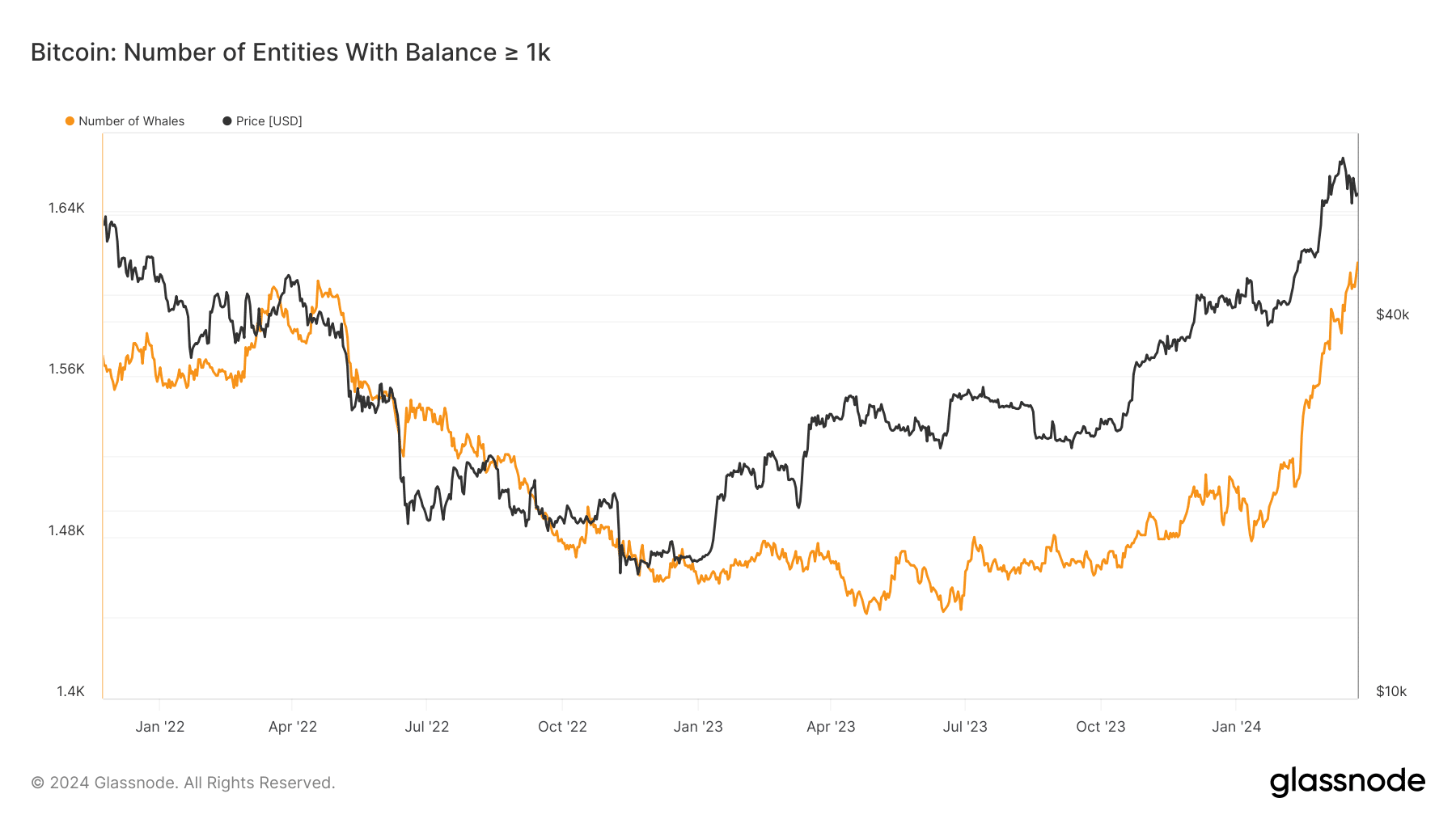

- Whales continue to add Bitcoin exposure to their portfolios.

Bitcoin [BTC] The range of $64,000 to $67,000 remained stable over the past week. However, $68,000 was a strong resistance.

According to CoinMarketCap, the King coin was trading for $64.14k at the time of publication. That’s 12% lower than the previous month’s all-time high (ATH).

Bitcoin Volatility

There could be an increase in volatility in the coming days. AskFX analyzed Santiment data and found that many BTCs that were previously inactive began moving addresses on March 23rd.

This was actually the largest increase in dormant BTC holdings in over two years.

Source: Santiment

In 2023, dormant supply reached new highs across all major age groups. This signals a cautious market strategy and HODLing.

The price of Bitcoin rose to new heights in 2024. These long-term investors started making profits and releasing more Bitcoins for trading. Volatility and price increases are usually preceded by a decline in dormant stocks.

Market Structure

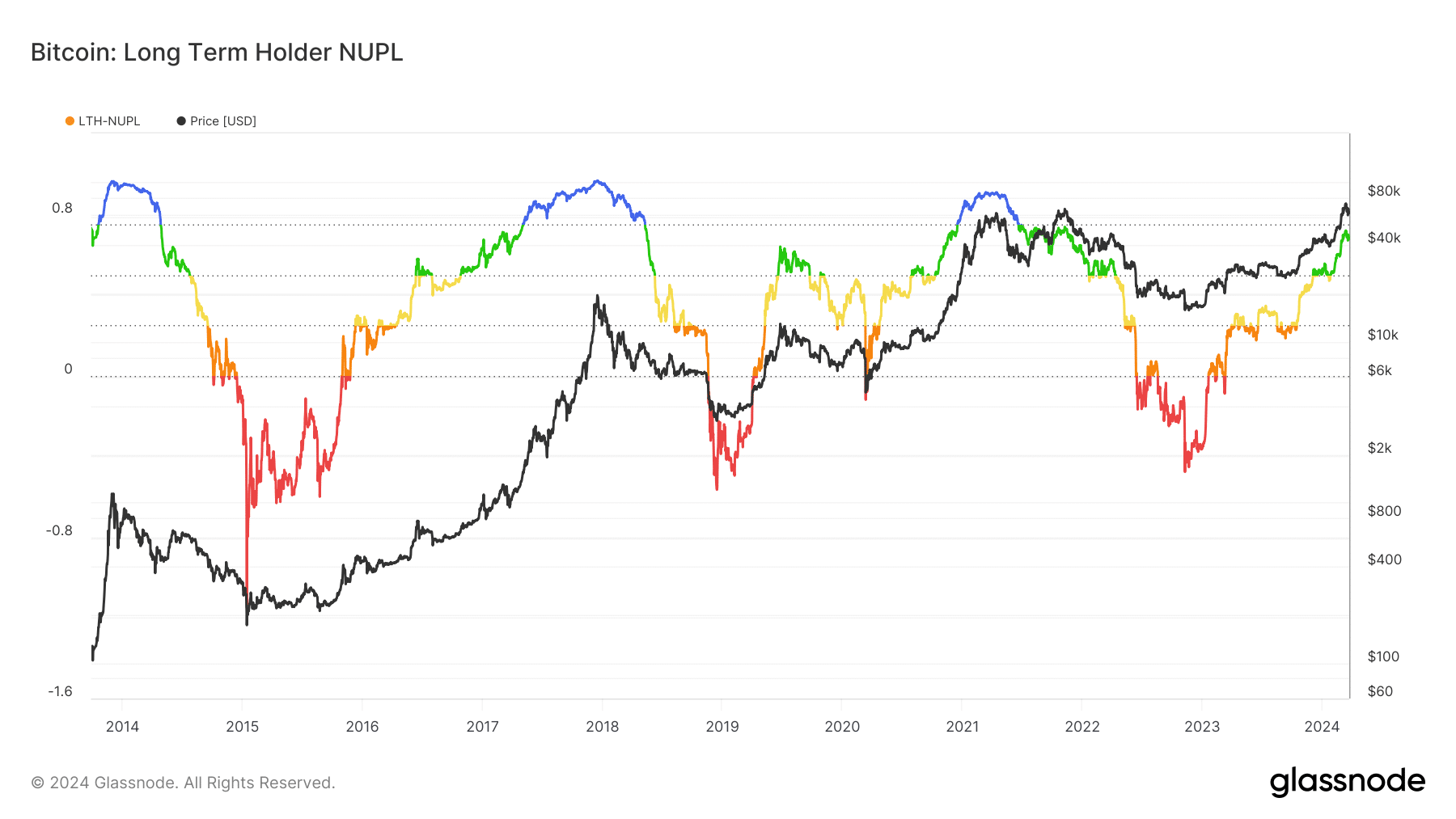

AskFX’s analysis of Glassnode’s “Net Unrealized Loss/Profit” metric found that most long-term holders make a profit.

As shown below, this market phase has historically been a catalyst for further price increases. Market highs usually associated with euphoria or greed were still a long way off.

Source: Glassnode

Whale Activity

Whales took advantage of market suppression to increase their Bitcoin exposure.

On March 23, the number of individual units with at least a thousand coins increased to 1,616. This is the highest level since February 2021.

Bitcoins: Read Bitcoin price prediction [BTC] for 2024-25.

The accumulation of Bitcoins has not stopped despite the sharp price drop from its peak, indicating a belief that the value of the cryptocurrency will increase in the long term.

Source: Glassnode

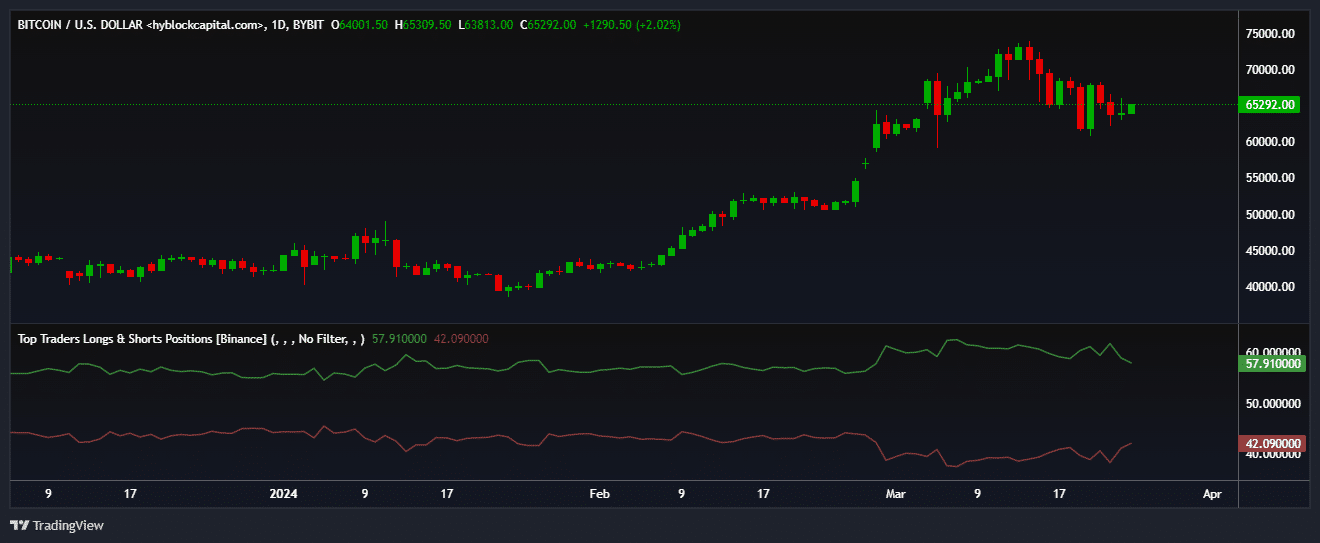

Whales also showed their optimism in the derivatives market. Hyblock Capital reported that 58% of all whale positions were long Bitcoin on Binance at the time of publication.

Source: Hyblock Capital