Blackrock’s ETF Plans See Ether Rising to 7-Month High, Dwarfing Bitcoin; Altcoins Are Crashing

-

ETH rose 10% to nearly $2,100 after a Nasdaq filing confirmed BlackRock’s intention to launch an ETH-based ETH filing.

-

BTC recently traded at $36,600. That’s an increase of 3% in one day.

-

As ETH and BTC gained strength, the rotation from altcoins to cryptocurrencies stopped.

ETH rose from $1,900 to $2,000 in the early hours of the morning in the US. A filing showed that a corporate entity called “iShares Ethereum Trust” was registered in Delaware – the home state of many US companies. In June, BlackRock’s iShares Bitcoin Trust experienced a similar situation - the Delaware corporation’s registration came just before the ETF application.

On Thursday history repeated itself. A Nasdaq filing hours after the Delaware filing confirmed BlackRock’s plans for an Ether-focused ETF.

According to BlackRock ETH News, the price of Bitcoin rose from around $35,000 to just under $38,000 in just a few minutes. However, BTC experienced a sharp decline and fell to $36,300.

ETH is up 10% in the last 24 hours while BTC is up 3%.

Altcoins like XRP DOGE UNI XLM and XLM crash

While ETH, BTC and most altcoins showed strength throughout the day, they pulled back and pared their gains from previous days as capital rotation towards smaller tokens appeared to have stopped.

Ripple’s XRP and Dogecoin, Uniswap and Stellar’s XLM all fell 6% to 7%. However, Toncoin fell 10% after rising 20% the previous week.

Leading ETH liquid stake platform Lido (LDO) and RocketPool (RPL) governance tokens rose 18% and 23%, respectively.

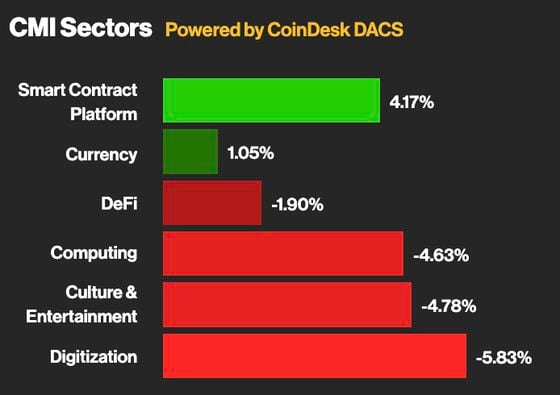

Across the sectors of the AskFX Market Index, the differences in performance between the two largest crypto assets and other market participants were evident. The only sectors that recorded gains were the BTC-led currency sector and the ETH-heavy smart contract platform.

Altcoins’ weakness may have been compounded by a risk-off session in traditional markets after Federal Reserve Chair Jerome Powell said the central bank would not hesitate to raise interest rates if necessary. This dampened expectations of more moderate policies.

The S&P 500 index and the Nasdaq fell almost 1%, ending the winning streak of US stocks.

Why BlackRock’s ETH ETF filing is important

Market analysts believe that a spot BTC ETF, if approved by the SEC, could attract sophisticated investors who have previously been unable or unwilling to do so felt comfortable buying crypto. There are currently several Bitcoin and Ether futures ETFs available, but these are inferior due to their rollover costs.

Diogo Monica is President of Anchorage Digital, a nationally chartered digital asset bank.

In an email, he explained that “a spot ETF ETF” would have a similar effect to a BTC equivalent. It would provide a regulated shell to allow institutions and consumers to access the ETH ecosystem.