Bnb for $1000? Watch for These Patterns:

Market Analyst

- The optimistic sentiment surrounding BNB increased as the price fell.

- Market indicators and metrics pointed to a potential trend reversal.

The crypto market experienced a crash in the past few hours as the values of most cryptocurrencies, including Binance Coin [BNB]fell.

However, the trend could be short-lived as BNB price consolidated within a pattern and a breakout could lead to a massive bullish rally.

BNB Chart Turns Red

As top cryptocurrencies like Bitcoin [BTC] and Ethereum [ETH] experienced corrections, BNB also followed the trend as its price fell by more than 1.7% in the last 24 hours.

According to CoinMarketCapthe coin was trading at $583.63 at the time of writing, with a market cap of over $86.1 billion.

But that was not all, as despite the price drop, BNB consolidated within a bullish pennant pattern.

World Of Charts, a well-known crypto analyst, recently posted a tweet highlighting this pattern. According to the tweet, investors could witness a massive bull rally if the coin tests this pattern and successfully breaks out.

In fact, the rally could pave BNB’s way towards $1,000 in the coming weeks.

What to Expect in the Short Term?

Since the road to $1,000 seemed long and ambitious, AskFX checked BNB’s metrics to find out what to expect from the coin in the short term.

According to our analysis of data from Santiment, the coin’s social volume increased while its price fell. The negative price movement also led to a drop in BNB’s weighted sentiment, which means that bearish sentiment was increasing.

Santiment

Despite the coin’s falling price, its trading volume dropped by 14%. A drop in trading volume is a sign that a price trend may not last long. BNB’s funding rate also turned red.

With prices moving in a different direction than the funding rate, a trend reversal is likely to be expected soon.

Santiment

Next, we checked BNB’s daily charts to see what the indicators suggest. According to our analysis, the Money Flow Index (MFI) for the coin has been trading sideways for the past few days.

The Relative Strength Index followed a similar pattern, suggesting that investors may be experiencing a few days of slower movement. According to Bollinger Bands, the coin was trading in a lower volatility zone, which meant there were few chances for an unprecedented price drop.

Source: TradingView

Is your portfolio green? Check out the BNB Profit Calculator

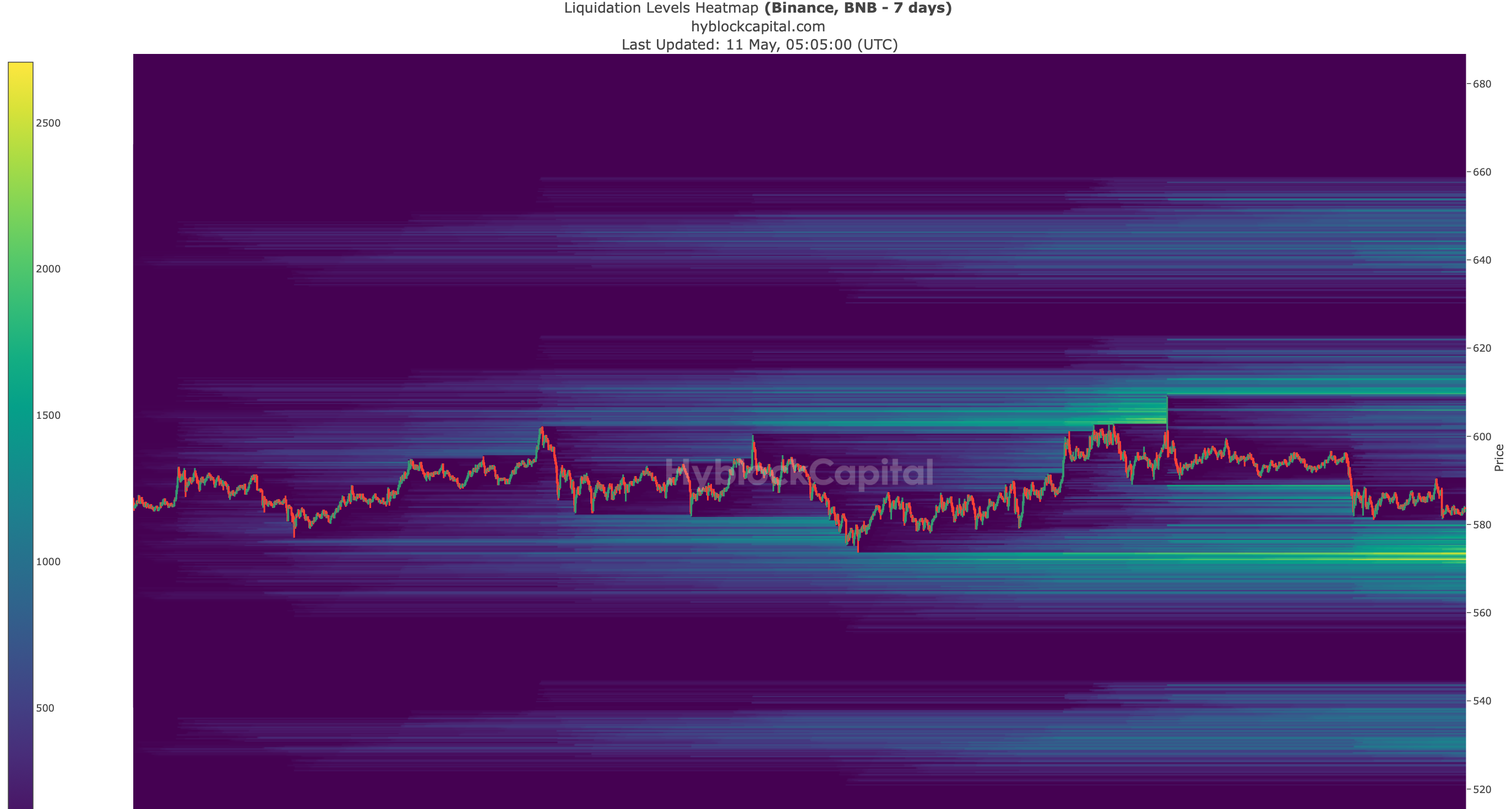

An examination of the coin’s liquidation heatmap revealed that the liquidation rate would spike sharply around the $573 mark.

BNB’s value could fall to this level before rising again if the bears refuse to let go.

Hyblock Capital