British Tourism Goes Cashless: Alipay+ and DNA Payments Lead the Way

By: Pedro Ferreira

- In the era of mobile payments in the UK, tourists are switching to cash to save time.

UK The tourism industry is on the verge of a revolution. The tourism industry is on the verge of a revolutionary transformation. Collaboration between DNA Payments and Alipay+ – a global leader in mobile payments This platform will change the way tourists spend their money. This breakthrough Visitors will be able to easily use their mobile devices to make transactions, eliminating the need for physical currency and improving the overall travel experience. A major shift is taking place in retail. The future of commerce in the UK and the world is being reshaped.

DNA Payments, one of the major players in the UK point-of-sale terminal market, recently announced the acquisition of Alipay+ and has significantly expanded its offering through the integration.

This integration is a good example. Over 50,000 UK merchants will be able to accept direct payments from an international pool of tourists, mainly from Asia. This opens up new opportunities for Asian tourists. They are used to using mobile payment systems such as Alipay or WeChat Pay from home. The first step is to allow foreigners to spend their money in UK businesses. The initial rollout is focused on the hospitality sector. Businesses such as Boisdale Restaurant Group and Lochside House Hotel allow their customers to carry firearms. Alipay, GrabPay and Kakao Pay are just some of the 14 platforms offering e-wallets. They can pay their bills by scanning a QR code.

Carefree travel, no stress

Tourists are bound to reap the benefits of tourism. The days of worry are over. Avoid carrying around large wallets full of cash or worrying about exchange rates. Alipay+ allows tourists to travel light by relying solely on their smartphone as a financial lifeline. Transactions are fast, secure and effortless. The waiting times associated with traditional methods are eliminated. Payment methods are more convenient, which in turn makes shopping and paying for goods or services easier. Travel experiences allow tourists to focus on creating unforgettable experiences. Spend more time with loved ones and worry less about bills.

Unlocking opportunities for UK merchants

You can also read more about it here The impact of tourism goes beyond tourists’ convenience. The impact on UK merchants is significant. Merchants in the hospitality sector in particular, which are heavily dependent on international trade, offer great opportunities to visitors. By focusing on Asian tourists’ mobile payment preferences, businesses can capitalise on Asian tourists’ penchant for mobile payments. A large and lucrative customer base is one factor that drives stronger customer loyalty. Tourists are more likely than other people to visit establishments that cater to their needs. Payment methods. Mobile payments also provide valuable data. Businesses can tailor their services based on customer preferences and spending habits. Make your offers and promotions more efficient.

Shaping the future of retail transactions

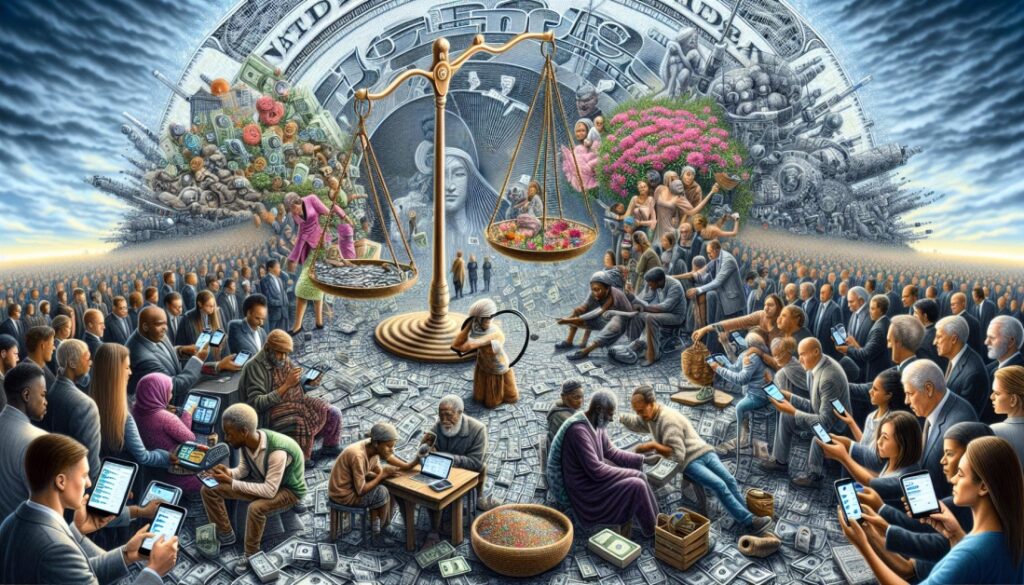

You can also learn more about: This partnership has a ripple effect that will shape the future of retail transactions around the world. Cash and traditional cards still dominate. The immediacy of mobile payments is replacing the slow erosion. This change presents both challenges and opportunities for businesses around the world. This change presents both challenges and opportunities for businesses around the world. The challenge is to adapt to the changing landscape and ensure they have what they need. Infrastructure and partnerships to accept mobile payments from a diverse range of customers. This change is an opportunity. Benefits of a frictionless, data-driven payments ecosystem

- 763 Articles

- Followers: 16