Cardano Jumps to $0.6? Investor Guide to ADA

![]()

Journalist

- ADA’s consecutive rise comes to an end.

- Cardano could see a price rally.

Cardano [ADA] holders experienced a glimmer of hope as ADA ended the week on a positive note. Positive price movements were a welcome change after the recent significant declines in ADA.

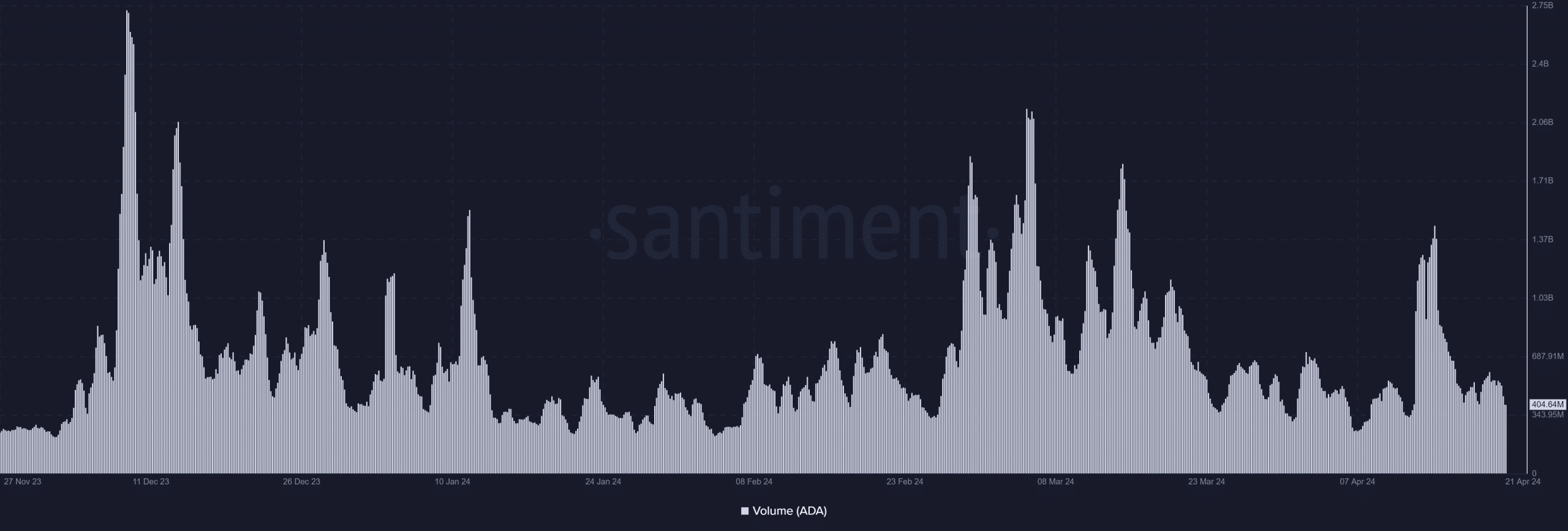

The volume chart painted a different picture that casts doubt on the durability of the current trend.

Changes made to this section

Cardano ends the week with a bang.

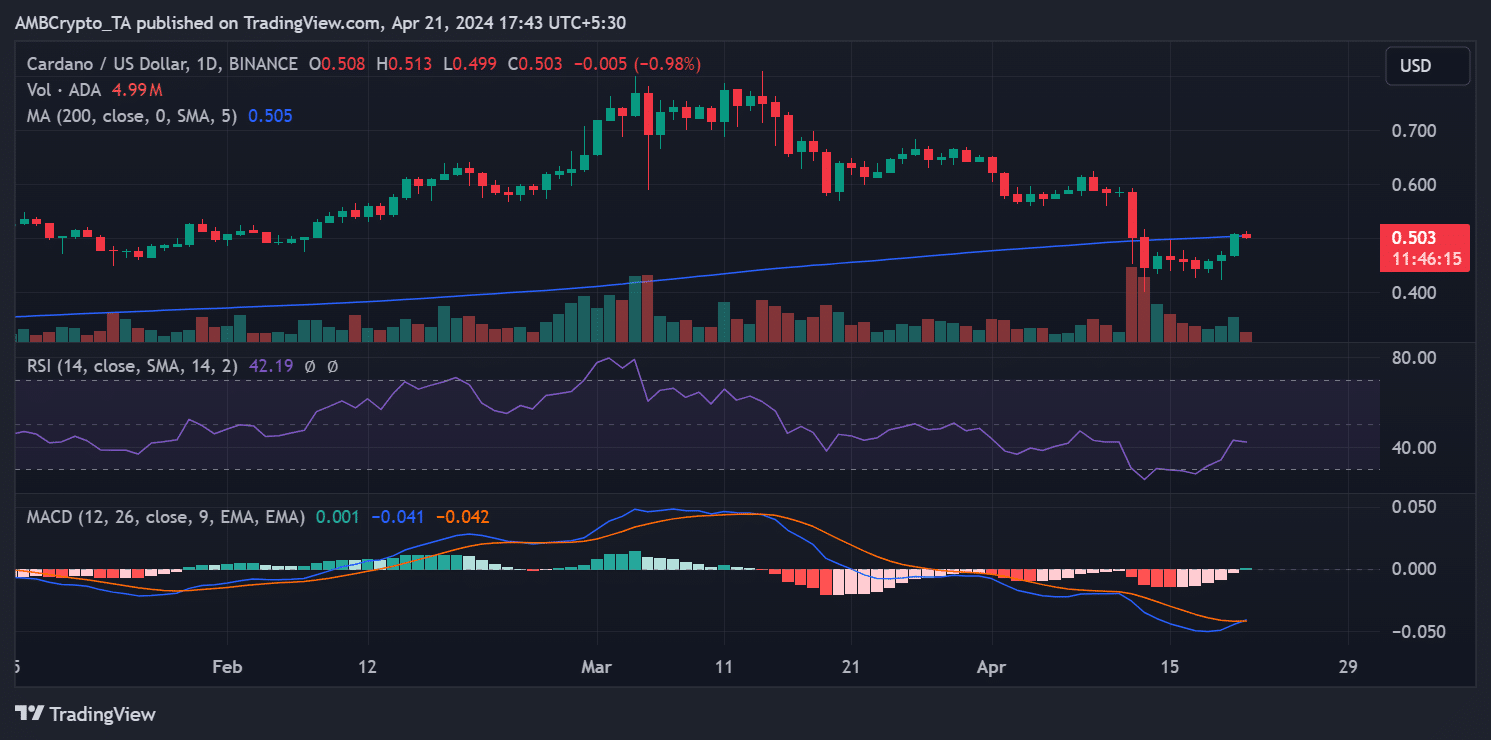

Cardano’s daily price chart showed that the week ended with a strong performance. ADA recorded an increase of approximately 8.3% on April 20. The day closed at around $0.5.

This bounce marked the end of the uptrend that had started on April 18. It also offered some respite after the steep declines of the previous week.

TradingView

ADA was trading at around $0.5 at the time of writing, with a small increase of 1.5%. Despite the uptrends that have occurred, ADA remains in a downtrend.

The Relative Strength Index is below the neutral line. This indicates a lack of positive momentum for the price trend.

This section has been edited to reflect updated information

Analysis of Cardano volume revealed that there was a discrepancy between traders’ activity and price movements. The volume did not show the same excitement despite the positive price trend. It also failed to cross the $500 million threshold.

Volume has dropped by more than half since the beginning of this week. Volume at the time of writing was around $402 million.

Source: Santiment

This discrepancy indicates a lack of convergence between volume and price, which could indicate a possible lack of sustainability of the price uptrend.

Stagnant volume indicates a lack of trader participation, which is crucial to sustaining price increases. The current price trend could be sustained with increased volume.

Is your portfolio in the black? Cardano Profit Calculator

Interest in ADA is increasing

Cardano open interest on Coinglass has been declining over the past few days. Although it was slightly higher at the time of writing, it has not yet reached its previous levels.

Open interest was approximately $207.8 million at the time of writing, a significant drop from the $400 million observed around April 10. This downward trend in open interest indicates a decline in cash flowing into ADA.