Cardano Remains Bullish Despite Derivatives Market Shift – Will ADA Surge?

Journalist

- Cardano remains in the top ten by market cap.

- At the time of writing, the price increase is less than 1%.

Cardano [ADA] recently fell out of the top ten cryptocurrencies by market cap. Its derivatives market remains strong, with recent increases in open interest and trading volume.

Cardano metrics remain positive

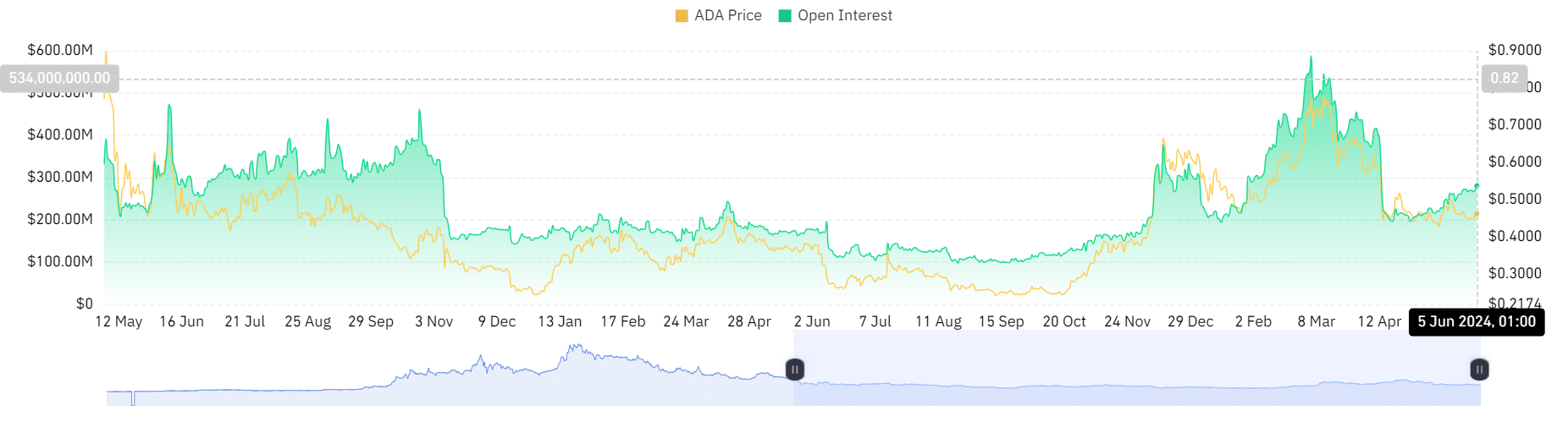

A Coinglass analysis of Cardano derivatives metrics showed slight increases. The volume chart showed a slight increase to $280.7 million at the time of writing.

Trading volume on June 4 was approximately $270 million, an increase of more than $10 million from the previous 24 hours.

Source: Coinglass

The increase in open interest was also reflected in volume, suggesting that investors were putting more money into ADA. This is usually interpreted as a bullish sign and indicates that investors expect a price increase.

The funding rate was approximately 0.0106% at the time of writing, indicating a positive trend. While this positive funding rate is not the highest, it does indicate that there are currently more buyers than sellers.

This reflects a general sense of optimism about a price increase in the future.

Cardano remains 10th by market cap

Data from CoinMarketCap showed that Cardano was in 10th place at the time of writing with a capitalization of $16.5 billion.

It was behind Toncoin, which is now in ninth place with a capitalization of more than $17 billion.

ADA fell to tenth place in the market cap ranking as TON experienced a price increase that ADA could not keep up with.

The chart shows that TON is up more than 12% in the last seven days, while ADA is only up less than 1%.

ADA Sees Positive Movement

Cardano has shown positive price movement in the past few days, as seen from an analysis of its daily time frame. Cardano’s price rose by 2.46 percent on June 3, trading at $0.45. At the time of writing, Cardano was trading at around $0.46, up less than 1%.

The price is still below the short-term average moving line (yellow), which represents its immediate resistance.

TradingView

Is your portfolio green? Cardano Profit Calculator

The analysis also shows that if Cardano is able to break the immediate support (yellow lines), the next resistance level will be the long-term average (blue lines) at around $0.50.

Cardano’s market cap is likely to increase if it crosses this level, allowing the company to regain its previous position in the market cap rankings.