Cashless Societies and Income Inequality: Examining the Social Impact of Payments

By: Pedro Ferreira

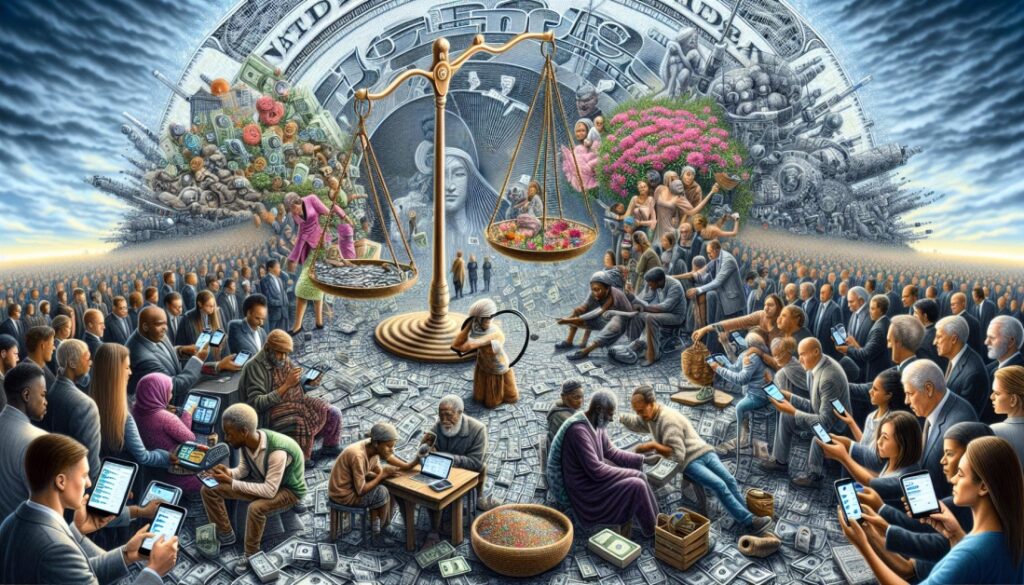

The relationship between the two is changing as we move towards a cashless society. Payment methods and income inequality are an urgent issue that requires attention. Exploration. This article examines the social impact of cashless payments: benefits and consequences for different income groups.

The effects of transitioning to cashless societies

The benefits of using cashless payments are discussed in detail. As societies around the world move away from traditional cash transactions, digital payment methods are becoming widespread. This change is often driven primarily by the convenience, efficiency and technological advances that come with cashless payments. It is important to consider the broader societal impact of cashless payments, especially with regard to income distribution.

Potential issues with financial inclusion

Cashless payments can improve financial inclusion and introduce new banking services for people without bank accounts. However, challenges related to affordability and accessibility of digital devices and the internet can create a digital divide that excludes certain income groups from participating in the cashless revolution.

Studying the impact of the cashless society on the banked and unbanked population is therefore of utmost importance. Digital payments promise inclusion, but inequalities persist. The gap in financial literacy and access could widen, thereby exacerbating existing income inequality. These challenges need to be addressed to ensure that the benefits of cashless transactions are shared fairly.

Economic disparities in technology skills

The technology behind cashless payments is also crucial for success. Differences in income often correlate with differences in technology skills. This gap can be closed through education and accessible interfaces. It is important to ensure that all income levels can benefit from the advantages of digital transactions without exclusion.

Surveillance, privacy, and security concerns

Cashless societies raise concerns about the use of digital transactions, data protection, and surveillance. Lower-income groups are likely to be disproportionately affected by surveillance, as their financial transactions become more visible. Analyzing the social impact of increased surveillance is crucial to minimize potential privacy violations.

Government Initiatives and Policy Considerations

Government initiatives and policies are crucial in shaping the impact of cashless societies on income inequality. Measures that focus on accessibility, education, and affordability can help reduce inequalities. Finding a balance between driving digital adoption and protecting the interests of vulnerable populations requires thoughtful policy.

Comprehensive analysis: understanding industry-wide impacts

The impact of the transition to a cashless society is far-reaching, influencing the financial sector and beyond. This shift could alter the economic structure in the context of income inequality, influence government policy, and redefine consumer behavior. A more comprehensive analysis encourages us to think about how financial institutions and governments interact, and how companies can adapt to the changing social landscape and navigate the complexities of payment methods and their development.

External perspectives: integration of different viewpoints

The inclusion of perspectives from external sources broadens our understanding of the social impact of cashless payments and income inequality. Experts in various fields such as sociology, economics, and public policy can provide insights into social impacts, highlighting the different ways in which society can be influenced. This broader perspective allows for a deeper examination of the complex interplay between income differences and non-cash transactions.

Future Predictions: Speculating about developing trends

By looking into the past, we can speculate about future events. The trend towards cashless payments and income inequality allows us to predict how these dynamics could develop.

. We could see advances in innovative solutions in financial technology to bridge the digital divide. Understanding financial inclusion and changes in wealth distribution patterns, and ensuring that stakeholders proactively shape these potential developments through policies and strategies is crucial.

Conclusion: Striking a balance between progress and justice

The path to a cashless society is diverse and offers both challenges and opportunities. The convenience and efficiency of electronic transactions offer promising prospects for financial inclusion, but it is important to address potential challenges that could exacerbate inequalities.

Cashless societies offer the possibility of greater financial inclusion by providing access to banking services to people previously excluded from formal financial systems. Digital transactions are streamlined, which can increase efficiency, reduce costs, and promote economic growth.

The challenges of this change should not be underestimated. The digital divide may arise from affordability and accessibility concerns that prevent certain income groups from fully participating in the cashless revolution. To ensure that cashless transactions benefit everyone, it is important to work together to close these gaps through targeted measures and initiatives.

In navigating this complex landscape, it is crucial to find the right balance between progress and ensuring justice. Policymakers, financial institutions, and industry stakeholders must work together to create inclusive frameworks that take into account the needs and circumstances of different income groups. Additionally, efforts should be made to prioritize digital literacy and infrastructure development to equip individuals with the necessary tools to fully participate in the cashless ecosystem.

Ultimately, we should measure progress towards cashless societies not only by their technological advances but also by their impact on social justice. By proactively addressing income inequality, we can ensure that the benefits of cashless societies are distributed equally, creating a financial environment that promotes both progress and equality.

rnrn