Crypto Funds Record Largest Weekly Inflows in More Than a Year: Coinshares

Crypto exchange-traded products recorded $326 million in inflows in the week ended October 27, according to a report from CoinShares.

1152 Total views

30 Total shares

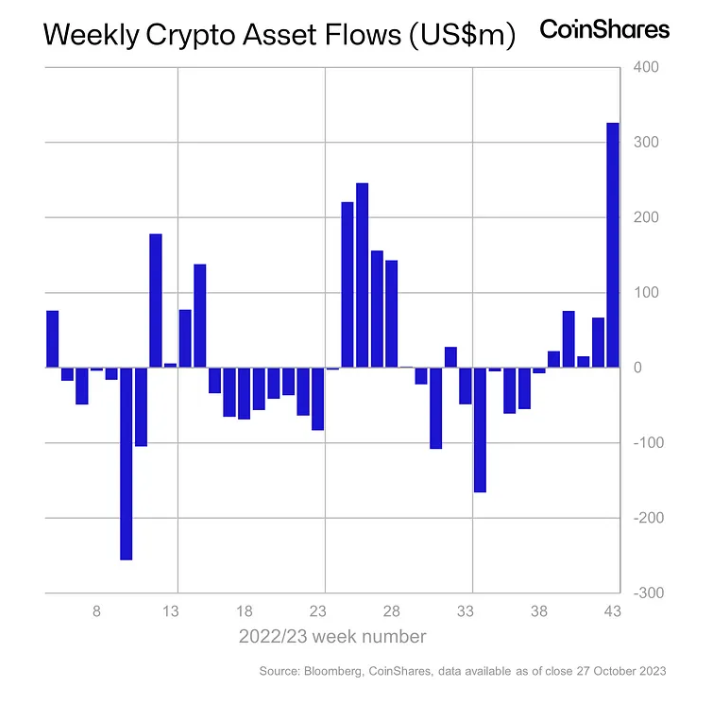

Cryptocurrency exchange-traded products (ETPs) recorded their largest weekly inflows in more than a year, according to an Oct. 30 report from asset management platform CoinShares. Inflows totaled $326 million in the week ended October 27, dwarfing the previous week’s $66 million.

In digital asset investment products, we recorded inflows of $326 million, the largest single week of inflows since July 2022!

In our opinion, these numbers are due to increasing investor optimism that the US Securities and Exchange Commission (SEC) is ready to approve a spot-based Bitcoin ETF in the US.

– #Bitcoin –… pic.twitter.com/AbgsgjcaOz

– CoinShares (@CoinSharesCo) October 30, 2023

ETPs are investment funds whose bonds or shares are designed to track the price of a specific asset. In the case of crypto ETPs, they usually track the price of large cap cryptocurrencies like Bitcoin

BTC

$34,516

or Ether

ETH

$1,810

. Some investors prefer to participate in crypto prices through funds rather than holding these assets themselves, as shares of these funds can be held in a traditional brokerage account.

An ETP “inflow” occurs when the price of the fund rises faster than its underlying, resulting in the fund purchasing the asset. This is generally considered bullish for the underlying asset. In contrast, an “outflow” occurs when the fund needs to sell the asset because the prices of its bonds or shares decline relative to its target, which is usually considered pessimistic.

According to CoinShares’ report, weekly inflows for the week ending October 27th were $326 million. This was the highest value since July 2022, 15 months ago. It was also the fifth consecutive week of ETP inflows.

Related: Gary Gensler’s Bitcoin ETF position is ‘inconsistent’… says Gary Gensler

According to CoinShares, a possible explanation for this The sudden increase in inflows could be because “investors are optimistic that the US Securities and Exchange Commission is close to approving a spot-based Bitcoin ETF in the US “, which could be expected to see inflows into US-based funds following approval.

Despite the sharp increase in inflows, this week represented only the 21st largest increase on record, CoinShares said. The largest weekly inflows last week flowed into Bitcoin ETPs, accounting for 90% of the total volume. Solana’s SOL

SOL

$35

also benefited from the bullish sentiment permeating the market, recording $24 million in inflows. However, Ether funds moved in the opposite direction and suffered $6 million worth of outflows.

Although several applications have been filed over the years, the SEC has yet to approve a spot Bitcoin ETP. Van Eck amended his application on October 19, presumably to address the agency’s concerns. Hashdex also met with the SEC on October 25 to seek approval for its spot Bitcoin ETP.