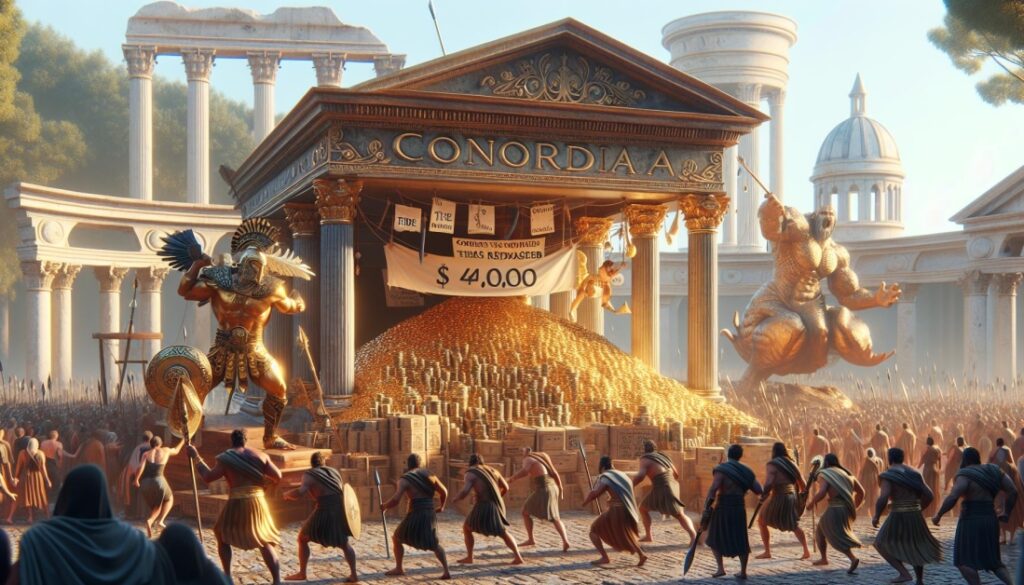

DeFi Credit Protocol Concordia Raises $4 Million in Round Led by Tribe and Kraken Ventures

Concordia is a multi-chain protocol that manages risk and collateral for digital assets. It was funded with $4 million through a seed funding round led by Tribe Capital, Kraken Ventures and Cypher Capital, as well as Season Capital and Cypher Capital.

Decentralized finance has become increasingly fragmented since the “DeFi summer” of 2020. This makes it more difficult for users of decentralized financial systems to access liquidity or transfer assets between blockchains. Cross-chain bridges are a solution to this problem, but they also raise a number of security concerns. The streamlined process, reduced risks, and compliance could attract more traditional and decentralized (TradFi) finance.

Concordia wants to make it easier to manage and access cross-chain collateral and liquidity. The protocol provides users with a simplified way to manage collateral for margin trading. Margin trading is a way of borrowing money to buy and sell assets at a potential profit. With Concordia, users can manage collateral through a single account and move assets between blockchains without using wrapped tokens or bridges. For example, the Application Programming Interface Architecture (API) has a modular structure. Institutional investors can choose which features they want to use. Concordia’s liquidity pools are available to developers who wish to take advantage of them.

Thomas Ruble said in a press release that Concordia is on track to integrate DeFi and TradFi. Everyone wants to move assets quickly with frictionless blockchains. Main Street and Wall Street share the same World Wide Web. They have the same interest in a global financial system.