Digital Dollar Project Completes CBDC Pilot for Retail Transfers with Western Union

This project simulates transfers to BDO Unibank customers in the Philippines with improved processing times, costs and transparency.

The Digital Dollar Project (DDP) announced that it has completed a study on remittances to the Philippines using a simulated central bank digital currency. Western Union and BDO Unibank were partners in the project.

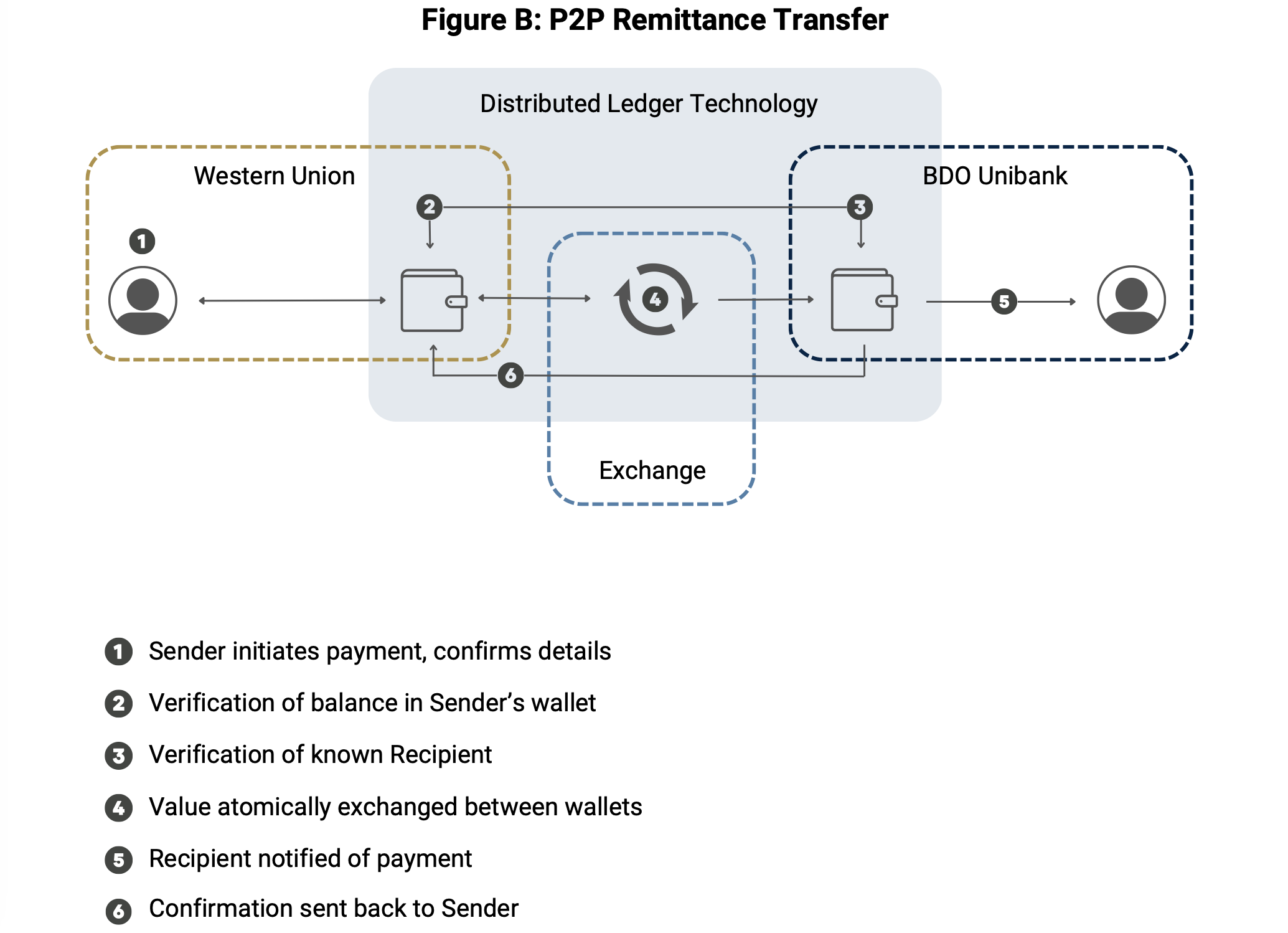

A version of the DDP champion model was used in the project. It was a simulation where a central bank issued CBDCs to an intermediary bank, which then gave Western Union access to them for transfers to BDO Unibank customers in the Philippines. WU exchanged one dollar CBDC for one Philippine peso CBDC via a decentralized exchange (DEX) at a rate set by a third-party oracle. WU received a payment confirmation and transferred the money to the customer’s bank account.

The transaction was carried out using central bank money instead of commercial bank money. This contradicts current practice. The DEX played an important role in the study. The authors stated that the creation of such an exchange would have advantages in terms of increased competition and transparency. The authors noted that the majority of remittances to the Philippines occur when trade in Manila is closed, making this stage problematic.

The study did not address privacy issues, but the report found that distributed ledgers help protect privacy by allowing granular control over the amount of data shared with consumers. When using distributed ledgers, both the transmission of messages and the transmission of value occurred simultaneously and within seconds. Current technology takes more time to transfer value than it takes to transfer messages, which introduces counterparty and credit risks. The authors concluded:

“The pilot demonstrated that CBDCs do not crowd out the service offerings provided by Western Union and BDO Unibank, but instead offer an opportunity for modernization and efficiencies for private sector companies and their customers.”

The average transfer is between $200 and $300 per transaction. According to the study cited in this report, they were worth $626 billion in 2022. In 2021, remittances from the United States totaled $74 billion. Seven percent of US households sent remittances abroad.

PUBLICATION: Findings of our latest whitepaper delve into the benefits and considerations of utilizing a potential U.S. #CBDC in cross-border payments. Pilot study with @WesternUnion, BDO Unibank, and @Accenture shows a CBDC could expedite payments in <10s https://t.co/vR2Z8wRNaR pic.twitter.com/X7HRCcshnc

— The Digital Dollar Project (@Digital_Dollar_) August 3, 2023

Wire transfers from the US to the Philippines typically cost 4.4% for a total transaction of $200, with bank transfers costing an average of 7.98%. The simulation would reduce costs, increase transparency and save time at the same time.

In September, the DDP technical sandbox was launched by Christopher Giancarlo. He is co-founder of former Commodity Futures Trading Commission Chairman Christopher Giancarlo. Accenture also supported the project.