Dogecoin Falls Below Key Support: Why Buyers Should Be Alert

![]()

Journalist

- There was no volume or momentum change in Dogecoin that would indicate a price reversal.

- Liquidation chart showed that range formation was possible on a short-term basis.

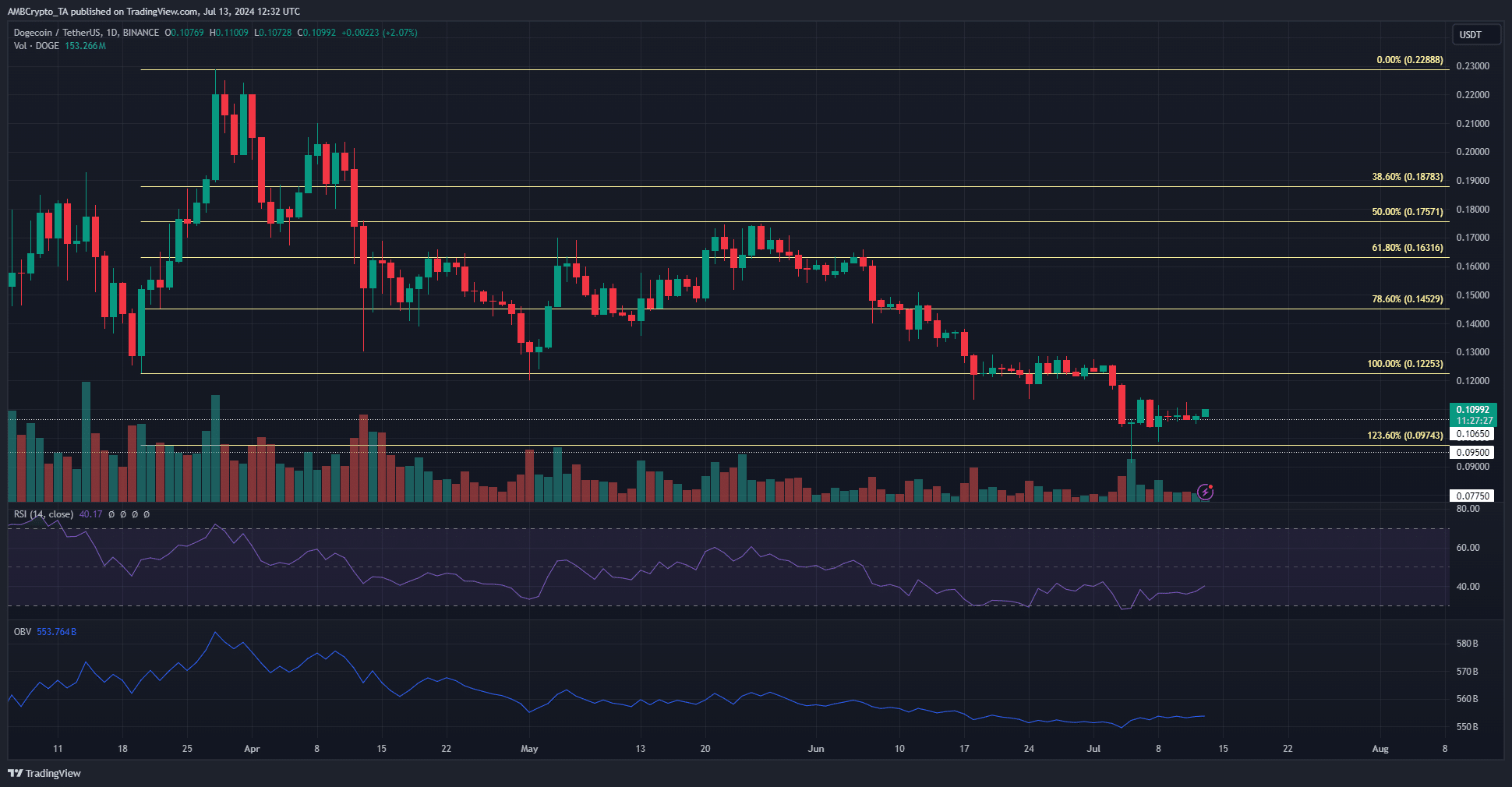

Dogecoin [DOGE] Bulls have been struggling to defend the support zone between $0.123 and $0.028 since March. Lukewarm demand indicates that demand may not be enough to cause a quick reversal.

TradingView: Source for DOGE/USDT

After the recent decline, OBV shows no discernible movement, indicating that bearish momentum is still dominant and bulls are powerless to reverse the trend.

Open interest falls to pre-rally lows

DOGE gained 176% within a single month following the massive price surge in late February/early March. Open interest started at $480 million and reached $478 million on July 13.

The significant decline in OI over the past four months is an indication of dwindling confidence among futures traders. When and if the meme coin breaks key resistance levels, speculators could flood the market again.

Both OBV (open interest) and OBV are still in the doldrums. This means that buying pressure in the spot and futures market is at an all-time low. On-chain metrics suggest that this is unlikely to change anytime soon.

Dogecoin network metrics reflect token distribution

The 30-day MVRV was negative last month, suggesting that short-term investors were making losses. The average coin age has also been declining since late May. However, it increased for 10 days in June.

It was therefore not a smart idea to buy DOGE despite its undervaluation. The falling coin age suggests that the coin is being distributed rather than accumulated. Since the price drop last week, the consumption indicator has not changed.

Dogecoin Wallet: [DOGE] Price prediction for 2024–25

AskFX has noted that the liquidation heatmap for a 7-day period shows a possible short-term range between $0.104 and $0.1128.

After $0.113, $0.13 and $0.05135 are the next levels to watch.