Ethena Has Gained 45% in Just Two Weeks, but the Bulls Still Face an Uphill Battle

![]()

Financial Analyst

- Ethena has shown a bearish trend on the higher timeframe.

- The momentum shift has not been offset by buying pressure.

Ethena has suffered losses in the first seven days of July. [ENA] The coin’s price rose 44.9% between the low of $0.343 on the 5th and the high of $0.497 on the 18th.

Bulls got off to a good start, but that was not enough to reverse the downtrend on the higher timeframe.

ENA would face resistance on its way up if the psychological level of $0.5 is held. Can buyers convert this level into support?

Ethena: The future looks bullish

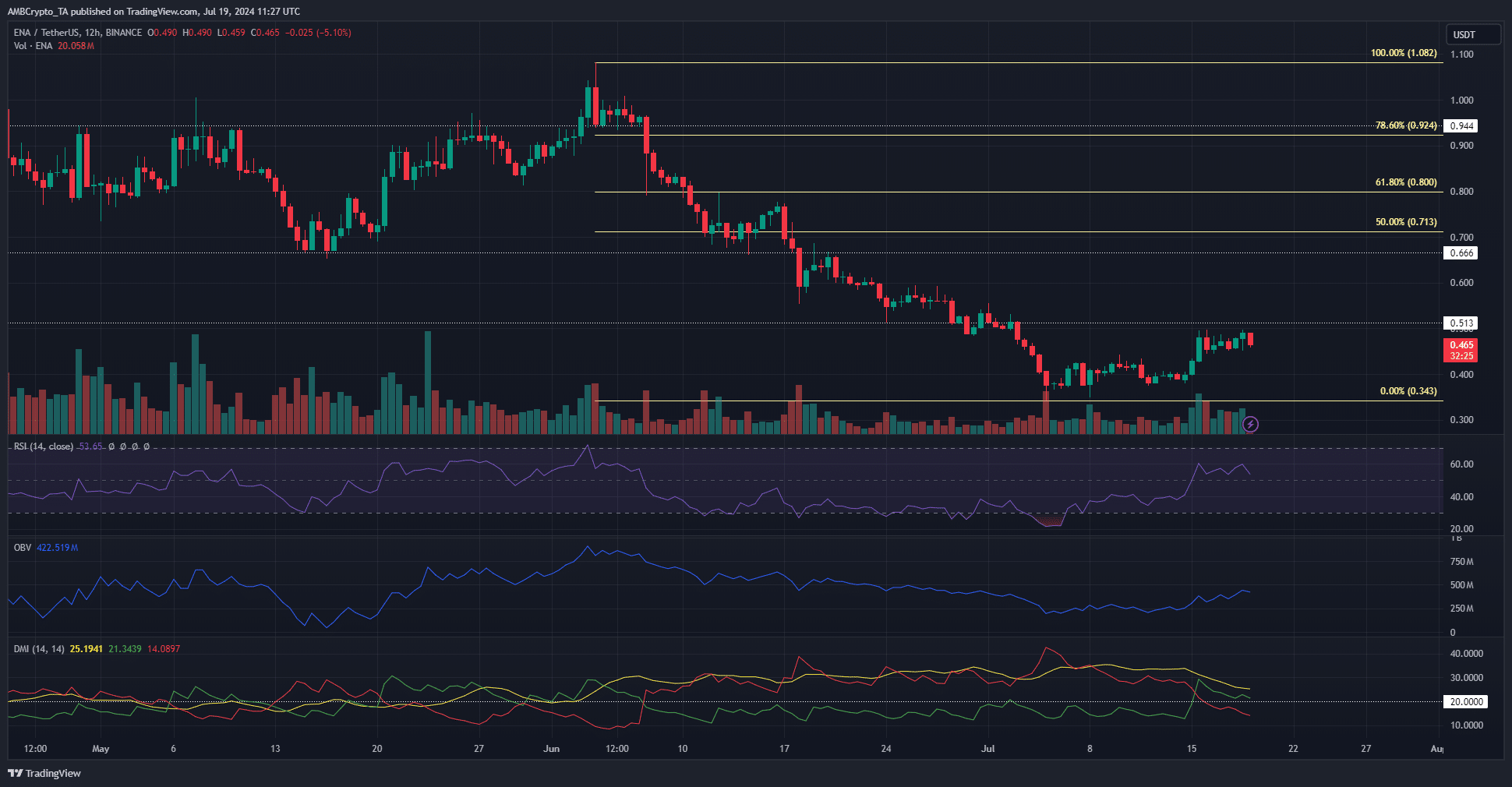

TradingView: ENA/USDT

On July 15, the 12-hour RSI chart rose above the neutral 50. This was a sign of a trend change.

The Directional Movement Index (DMI) also showed that the +DI crossed above the -DI, indicating a possible trend change.

A clear uptrend is not yet evident. The recent lower high of $0.443 was undercut. Ethena has been forming higher lows in the past few days, so this was a shift in the market structure.

To change investor sentiment, it is necessary to move beyond the $0.5 supply zone. The OBV has started to rise, another sign of increased buying pressure.

After the liquidity test, traders should be prepared to receive rejection from $0.55.

The price recovery was preceded by a surge in network growth.

The 30-day MVRV was -1.88%. This showed that short-term investors suffered a small loss. After the recent price increase, it is not surprising that the short-term MVRV has recovered.

The sharp downward trend in the average coin age was the surprise. It signaled the beginning of a new distribution phase.

Is your portfolio in the green? Check out the ENA profit calculator.

The falling average dollar age invested indicated an increase in network activity and a return of coins to circulation, which was bullish.

Ethena’s metrics were negative. The data does not indicate a significant breakout of the $0.5-$0.55 resistance.

Disclaimer: This information is not intended as a source of financial, trading, investment or any other advice. It represents the sole opinion of the author.