Ethereum ETF Beats “20% of BTC” Estimate on Day One – What’s Next?

Journalist

- ETH ETF’s first day performance was higher than analysts’ expectations of 15-15% for BTC ETFs.

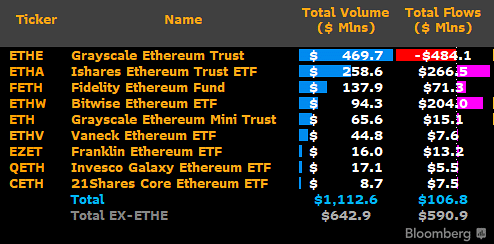

- Grayscale’s outflows were nearly half a billion dollars, while BlackRock’s ETHA led the way.

US Spot Ethereum [ETH] ETFs made a spectacular debut with trading volumes exceeding $1 billion. Grayscale ETHE and BlackRock’s ETH ETFs recorded trading volumes exceeding $100 million on the first day.

Vaneck, Franklin and Invesco Galaxy were the only ETFs alongside 21Shares with daily trading volumes exceeding $10 million.

Bloomberg is a great tool for analyzing flows. Below are some of the most effective ways to increase your ROI: The products saw net inflows of $107 million, of which $266.5 million came from BlackRock ETHA and 204 from Bitwise ETHW.

Source: Bloomberg

However, Grayscale ETHE was the only product with a total outflow of $484.1 million, while the mini version saw an inflow of $15.1 million.

ETH ETF’s first day performance beats analyst estimates

Grayscale saw over $100 million in outflows, but the above trading volume was still more than $1 billion.

Bloomberg analyst Eric Balchunas earlier Below is a list of projected data BlockRock’s estimates of a 20% BTC ETF would be exceeded if BlockRock’s volume exceeded $200 million.

If we use the BlackRock ETF to represent $ETHA, the volume after one hour is about $50 million. If it can reach $200 million before EOD, it will exceed our estimate of “20% BTC” (since $IBIT brought in $1 billion on the first day).

By the end of Tuesday’s trading session, ETHA had a volume of $258 million. This is about 26% more than BlackRock’s IBIT volume on the first day, beating estimates.

Zaheer Ebtikar Split Capital, a crypto hedge fund, also commented on the stellar performance stating that the first day’s results exceeded analysts’ estimates.

Our site’s final numbers show a total volume of about $1.3 billion across all ETH ETFs. “About 28% BTC on debut and significantly higher than most estimates of 15-20%.”

On the first day, some products, such as the Vaneck Ethereum ETF (ETHV), outperformed its BTC ETF. Mathew Sigel said he was shocked by the results.ранимThe Feast.

“And I’m proud to say that $45 million in ETHV was traded on the first day, surpassing our $26 million HODL volume!”

However, Grayscale’s ETHE has outflow fears After a $484.1 million outflow on the first day, this one seems justified. This was a far larger outflow than GBTC, which lost $95.1 million on its debut day in January.

ETH price also rose only marginally on the ETF’s debut day, rising 1.25% to $3,540, but was still below $3,500 at press time.

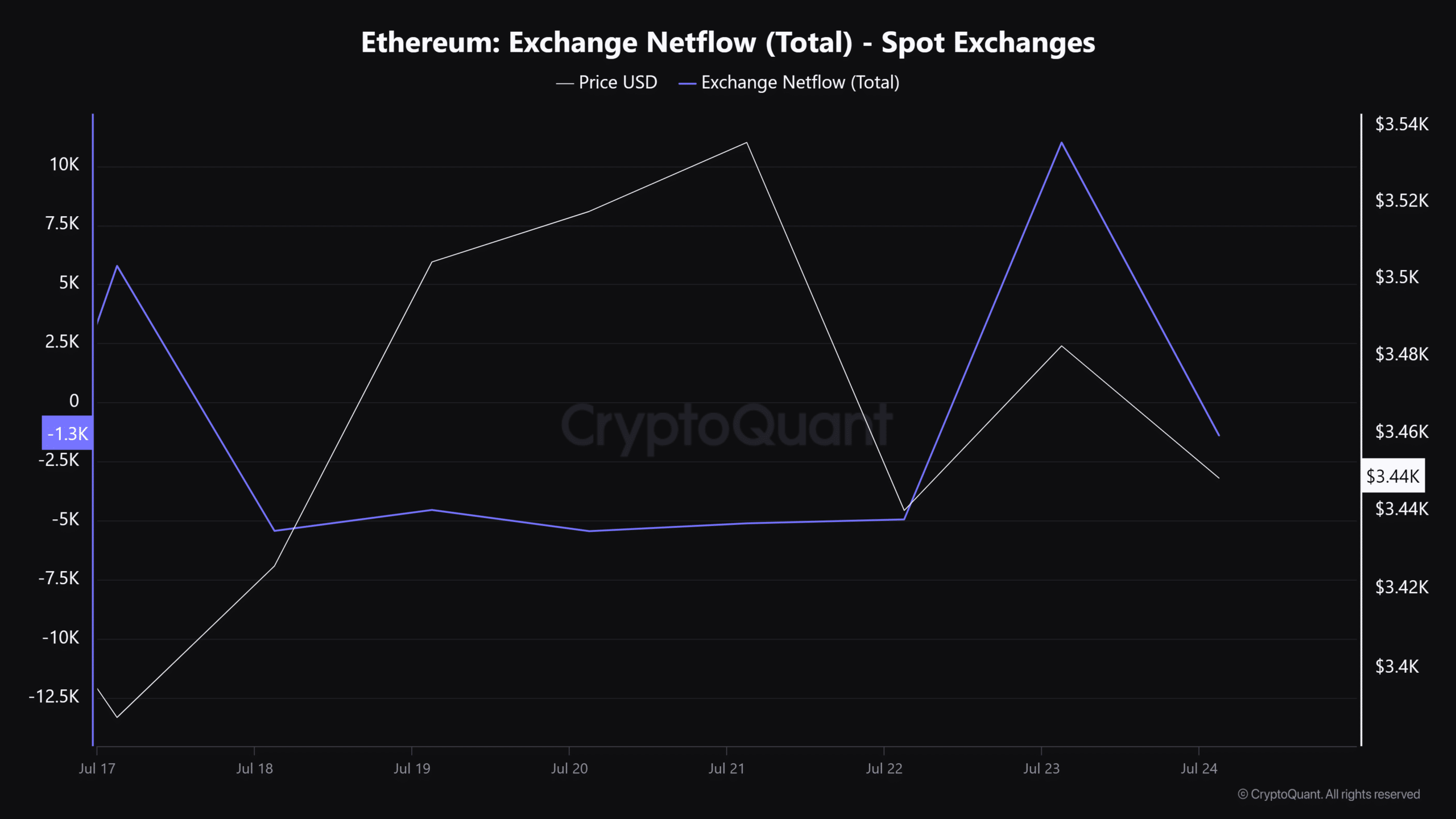

Exchange netflow shows that there was no selling pressure on ETH spot markets following the ETF’s debut.

The fact that more ETH was sent to personal wallets compared to exchanges shows the increased accumulation.

Source: CryptoQuant