Ethereum: Top Reasons Why ETH Will Reach $5,000 by 2024

Journalist

- ETH may face slight resistance, but a rise to $5,000 seemed almost certain.

- The bullish forecast was reinforced by increasing confidence in altcoins.

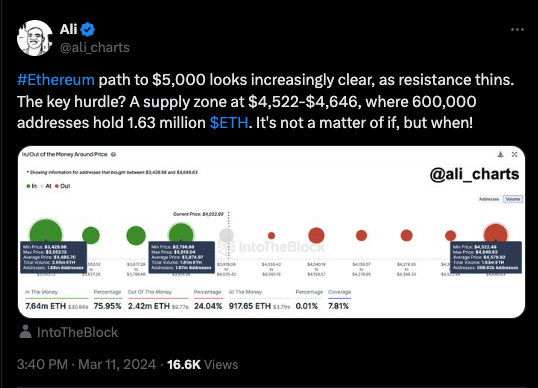

Ethereum price is rising. Ali Martinez, an analyst, believes Bitcoin could soon reach $5,000. Altcoins first need to break the supply wall of $4,522 to $4,646.

A supply zone is the accumulation of orders. In this case, the goal is to create a wall that prevents the price from falling. Using IntoTheBlock data, Martinez found that 600,000 addresses purchased 1.63 million ETH in this range.

Source: to reach the break-even point. This could slow Ethereum’s uptrend, but a rise to $5,000 was almost certain.

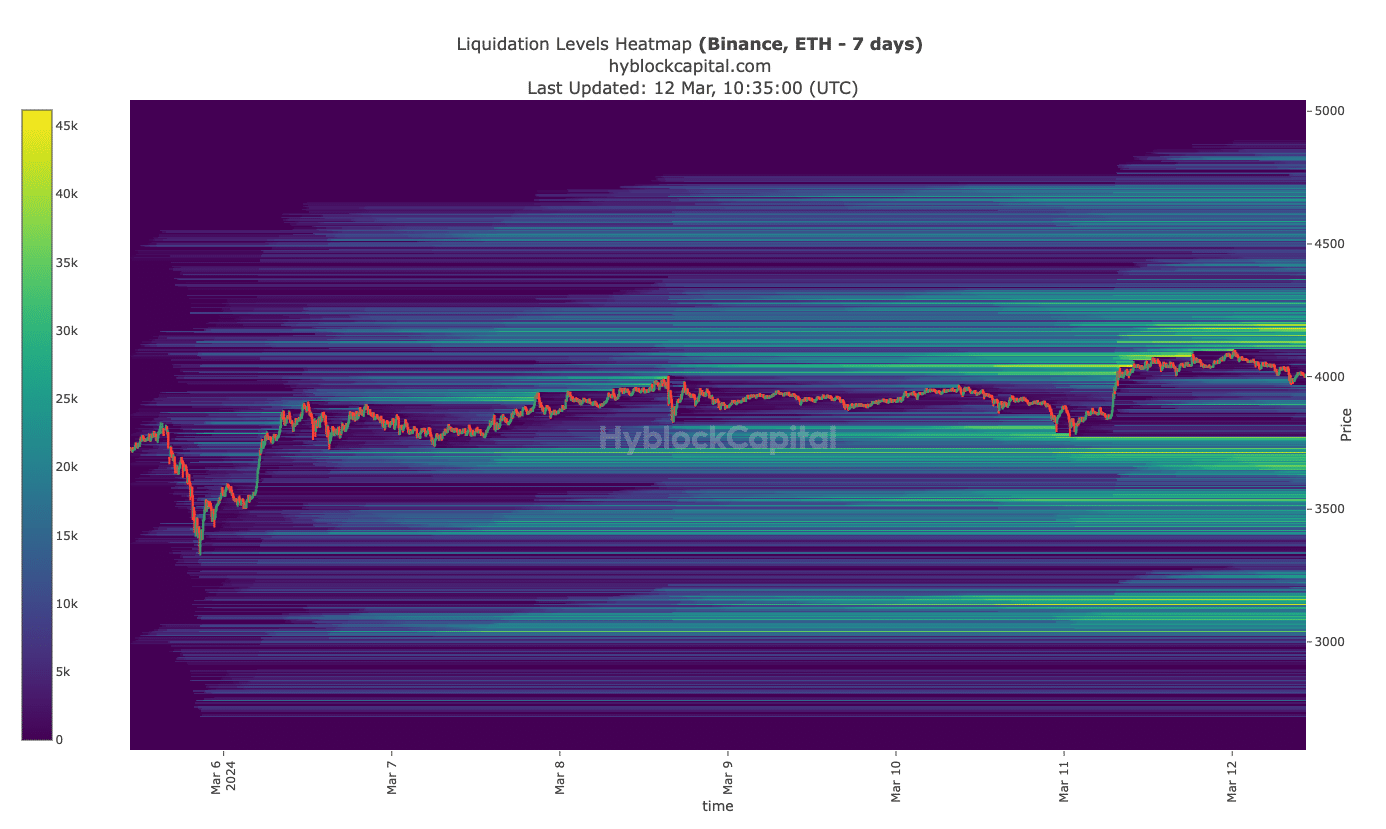

AskFX came to this conclusion by analyzing the Liquidation Hotmap. The Liquidation Heatmap is a simple tool that predicts where large-scale liquidations might occur.

Liquidation occurs when a trader closes his position due to price changes. Liquidation can also occur if there is not enough margin to cover the financing fees.

According to our analysis of HyblockCapital data, a large-scale liquidation could occur if ETH reaches $4,205. A successful close above the $4,205 price point could result in higher value.

ETH’s liquidation heatmap shows a possible rise to $5,000

Source: HyblockCapital

ETH’s rally is fueled by bearish aggression

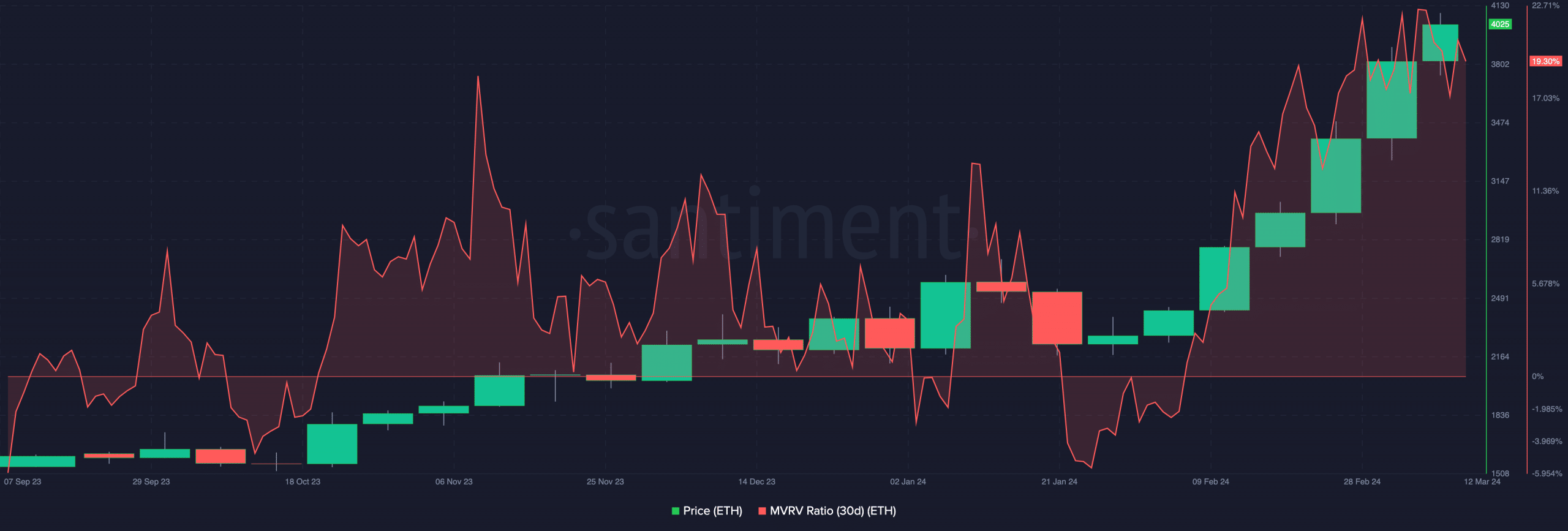

AskFX also assessed the funding rate to determine the likelihood of a rally. The funding rate is the difference between the price of a perpetual contract and the spot price for a cryptocurrency.

According to Santiment data, Ethereum’s aggregate funding rate was 0.068%. The positive funding rate implied that ETH was trading at a premium price well above the index value.

The rising value of ETH and the high value of this metric suggest that bears are aggressive. Unfortunately, they are not rewarded for their aggressiveness. The current price of ETH is therefore potentially bullish.

We also looked at the addresses that were active. At the time of publication, there were 537,000 active addresses on the Ethereum network. This is a significant increase from March 10th.

The increase in active addresses indicates growing interest in ETH. It could also be a bullish sign for traders as it indicates that the network is healthier.

Ethereum Rising Price and Funding Rate

Source: Santiment

Price Predictions for 2024-2025

Conclusion: A combination of the metrics evaluated correlated with a price increase. ETH could see some decline as it targets a higher all-time price. [ETH] However, indicators suggest that any possible decline may not last very long.