Find Out if Litecoin Will Repeat History and Hit $110 Again

Journalist

- The price of LTC has increased by more than 3% in the last seven days.

- Most indicators looked optimistic, but some metrics suggested otherwise.

Litecoin [LTC] investors had a pleasant week as the price of the coin skyrocketed. The weekly rally allowed LTC to reach a critical level that could soon lead to another bull run if all goes well.

Therefore, AskFX took a deeper look at the current state of LTC to understand what to expect from it.

Litecoin aims for $110

According to CoinMarketCapLitecoin is up more than 3% in the last seven days. But the growth rate declined in the last 24 hours as its price moved marginally.

At press time, LTC was trading at $85.44, with a market cap of over $6.3 billion. The drop in volatility was not bearish as LTC was actually consolidating near a key resistance level.

Crypto Rand, a well-known crypto analyst, recently posted a tweet suggesting that LTC’s price was close to breaking through resistance.

The last time LTC’s price crossed this mark, the coin was able to reach $110 in early April 2024. If history repeats itself, investors could witness LTC hitting new highs with $110 as the first target.

Therefore, AskFX checked LTC’s metrics to see if a bull rally is imminent.

Our analysis of Santiment’s data revealed that whale activity around the coin was high as the number of whale transactions increased last week.

Santiment

LTC’s MVRV ratio, which has been rising over the past few days, was another bullish metric. At press time, the metric stood at 8.49%.

But not everything was good for Litecoin. The coin’s NVT ratio, for example, shot up dramatically, suggesting that LTC was overvalued.

In addition, Glassnode data showed that LTC’s reserve risk has increased. The uninitiated might think that high reserve risk indicates a situation where confidence is low and prices are high.

The price is likely to correct, as the rise in this metric is usually accompanied by a rise in reserve risk.

Glassnode source

Expectations?

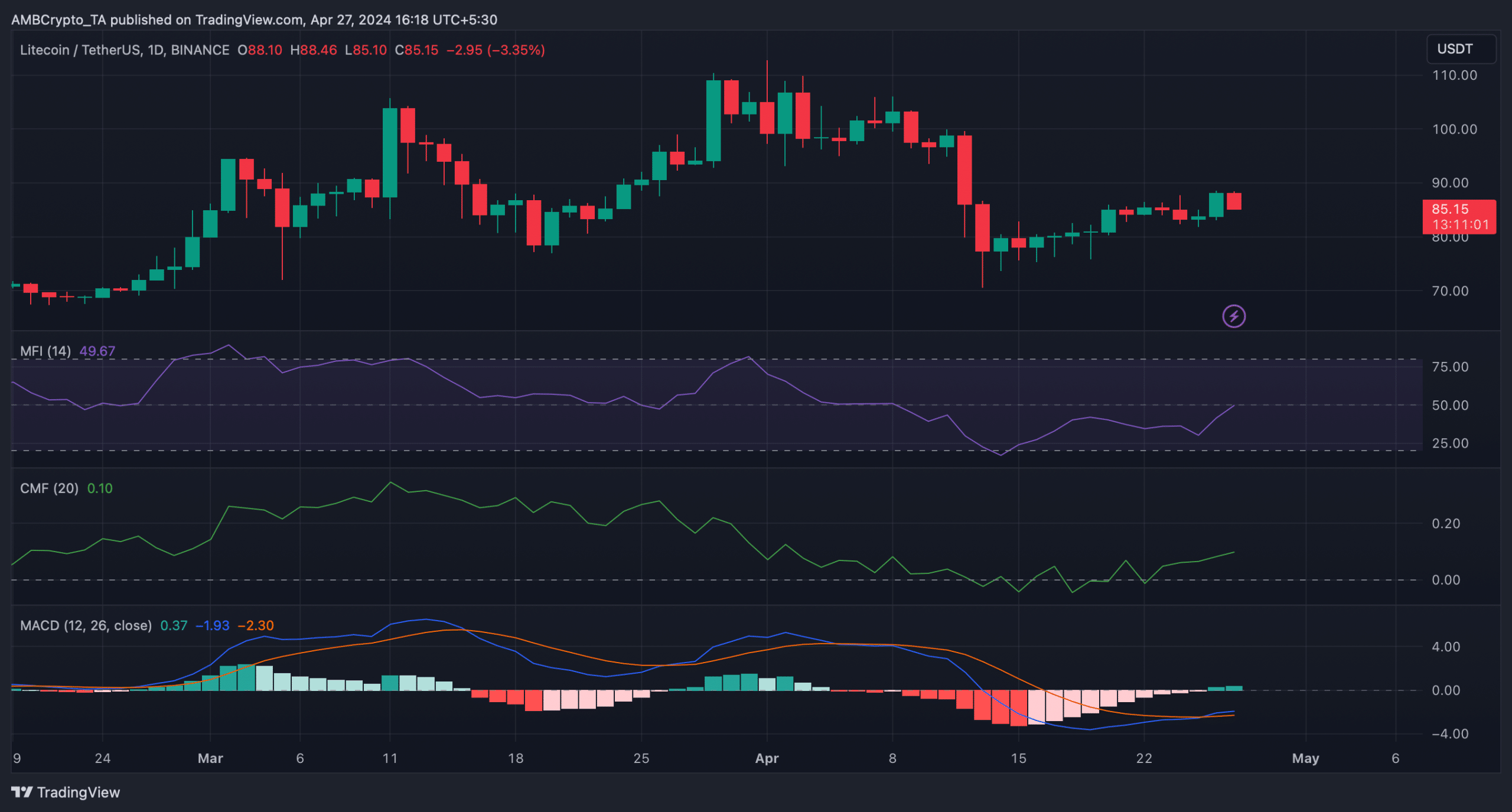

Fortunately, most market indicators seemed optimistic, unlike some metrics. The MACD showed a bullish crossover. Both the Money Flow Index and the Chaikin Money Flow saw strong increases.

These indicators suggested that Litecoin could soon experience a bull run that could allow it to reclaim $100 in the coming week.

TradingView

Read Litecoin’s [LTC] Forecast 2024-25.

While the focus remained on LTC’s volatility, it was intriguing to note that the blockchain’s mining sector suffered a slight setback.

Coinwarz data shows that the LTC hashrate has dropped significantly over the past seven days. At the time of writing, the blockchain hashrate was 1.01 PH/s.