Fomo Drives Bitcoin’s New Monthly High

![]()

Journalist

- The net change in position for long-term investors has shifted to positive.

- BTC’s previous resistance has been replaced by support.

Bitcoin [BTC] The market is booming, investor confidence is growing, and the exchange is showing an optimistic forecast.

Long-term holders have also returned to the market, signaling a return to form for the king coin.

Bitcoin Market Analysis

Santiment data shows that Bitcoin traders have regained their confidence, as shown by the social volume and especially buying activity metrics.

The volume of social buying activity has increased significantly, indicating higher buyer interest.

The buying sentiment score reached 117 on July 15. This was higher than the social selling volume, which stood at 92.

This discrepancy between buying and selling volume suggests that market sentiment is currently leaning towards buying. More participants are choosing to buy BTC than selling.

This trend is indicative of the current fear of missing out (FOMO) that has gripped the market. Traders and investors are rushing to take advantage of the perceived uptrend in Bitcoin value.

This dynamic can lead to sustained price increases and even accelerate if demand exceeds supply.

Bitcoin welcomes long-term investors back

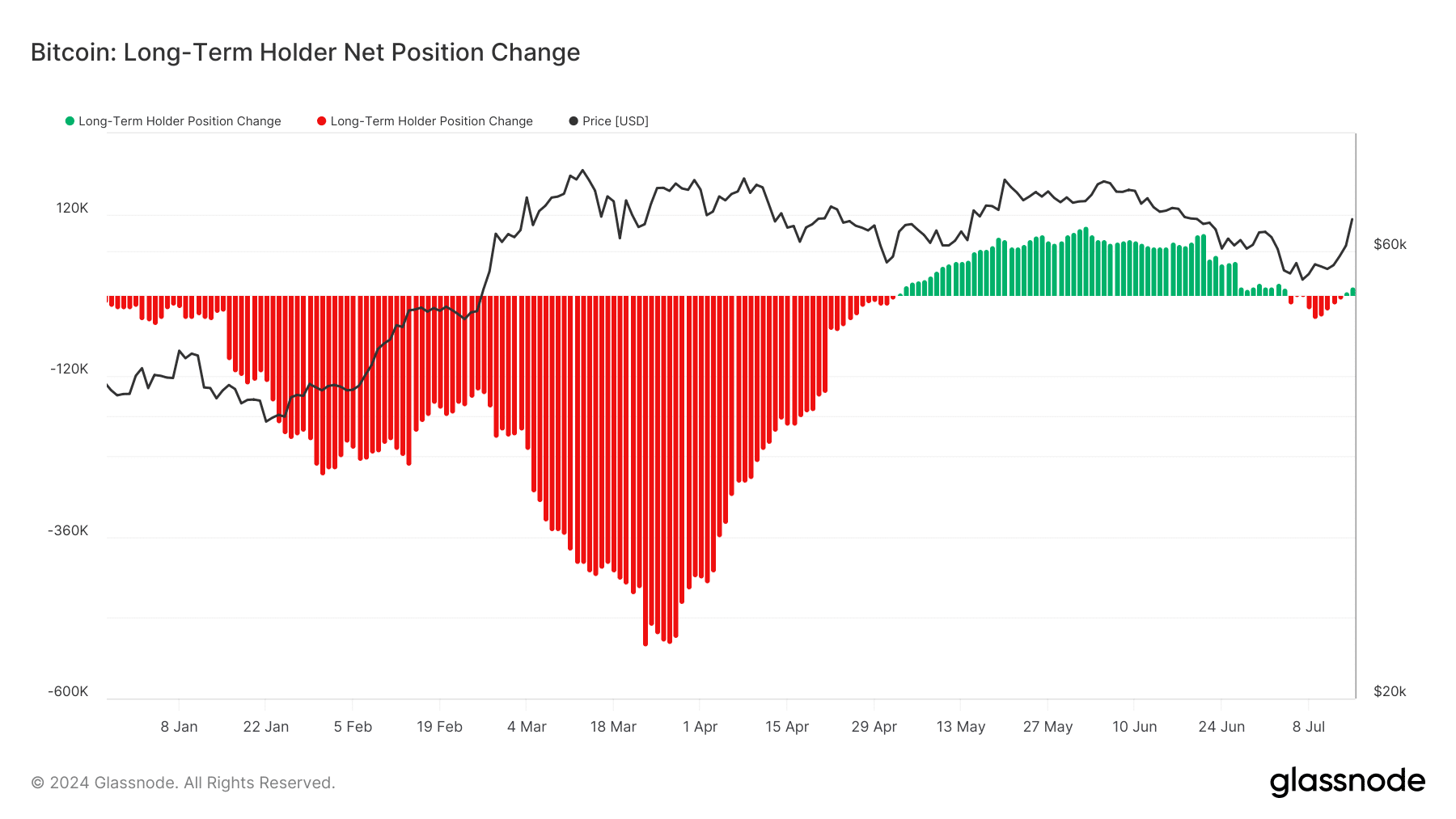

Glassnode’s recent data on the net position change metric of long-term Bitcoin holders provides insightful evidence of the cryptocurrency’s current uptrend.

This metric was previously negative, meaning that long-term investors were selling more than buying.

This net selling trend continued for most of the month, contributing to a negative sentiment among investors.

Source: Glassnode

The recent changes in this dynamic have been noticeable. The trend is now reversed and the metric is showing a positive value.

According to the latest analysis, there was a net change of almost $13,000. This positive change suggests that Bitcoin is being bought back by long-term investors.

The trend shows their renewed confidence that it has the potential to continue to appreciate. This accumulation phase by experienced investors is typically a strong bullish sign.

BTC breaks $60,000

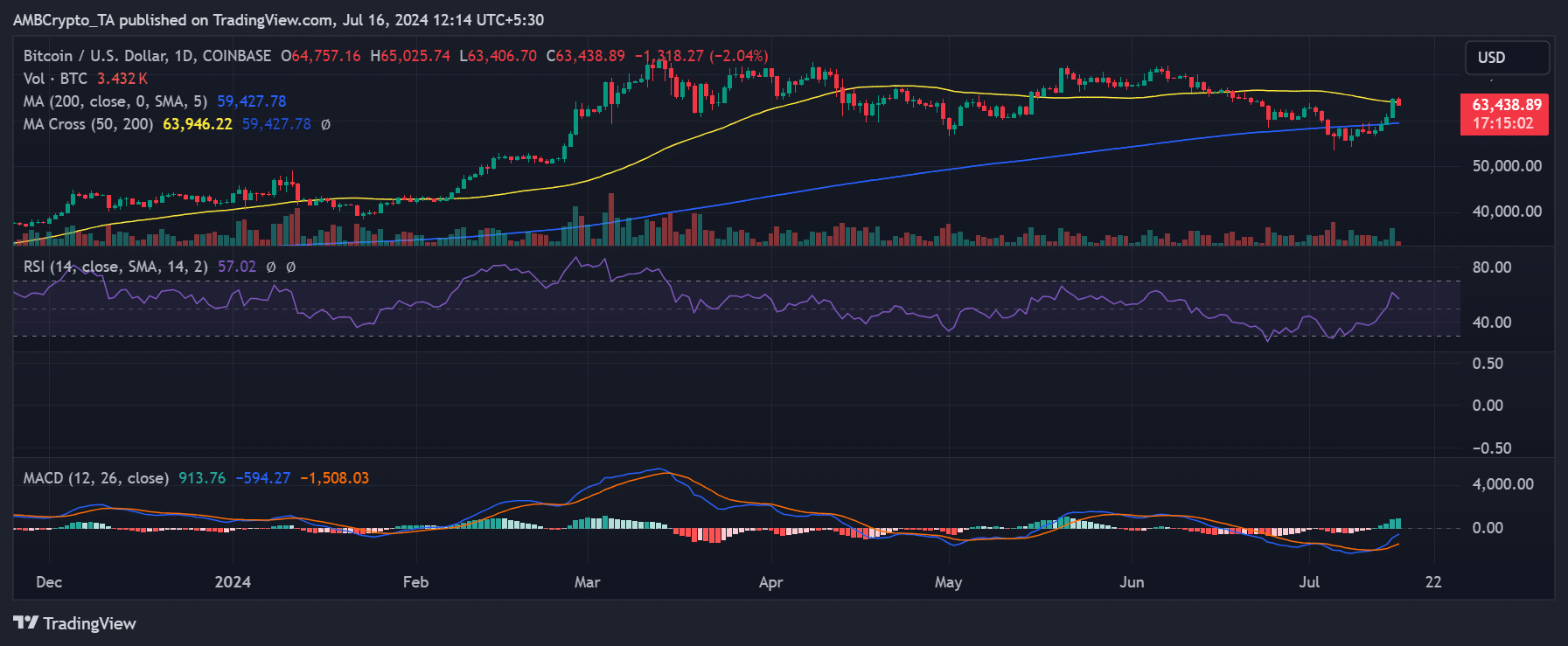

AskFX’s analysis shows that Bitcoin experienced a significant uptrend on July 15. BTC rose by almost 7% to trade at $64,757. This was also the first time in the last month that the price reached this level.

It was also the first time in almost a full month that Bitcoin surpassed its short-term moving average (yellow lines), which previously acted as a resistance level in this price range.

TradingView

BTC is currently trading at $63,400. This represents a decline of more than 2% from the recent peak.

Bitcoin (BTC) price prediction for 2024-25

The yellow line could now be a support level despite this slight decline.

If Bitcoin’s position remains above this crucial threshold, it could signal possible stabilization or even further gains.