How Base Can Use 3M Transactions to Outperform Arbitrum and Optimism

Investor

- Base has outperformed Arbitrum and Optimism in transaction volume and fees

- Memecoins have contributed to Base’s growth

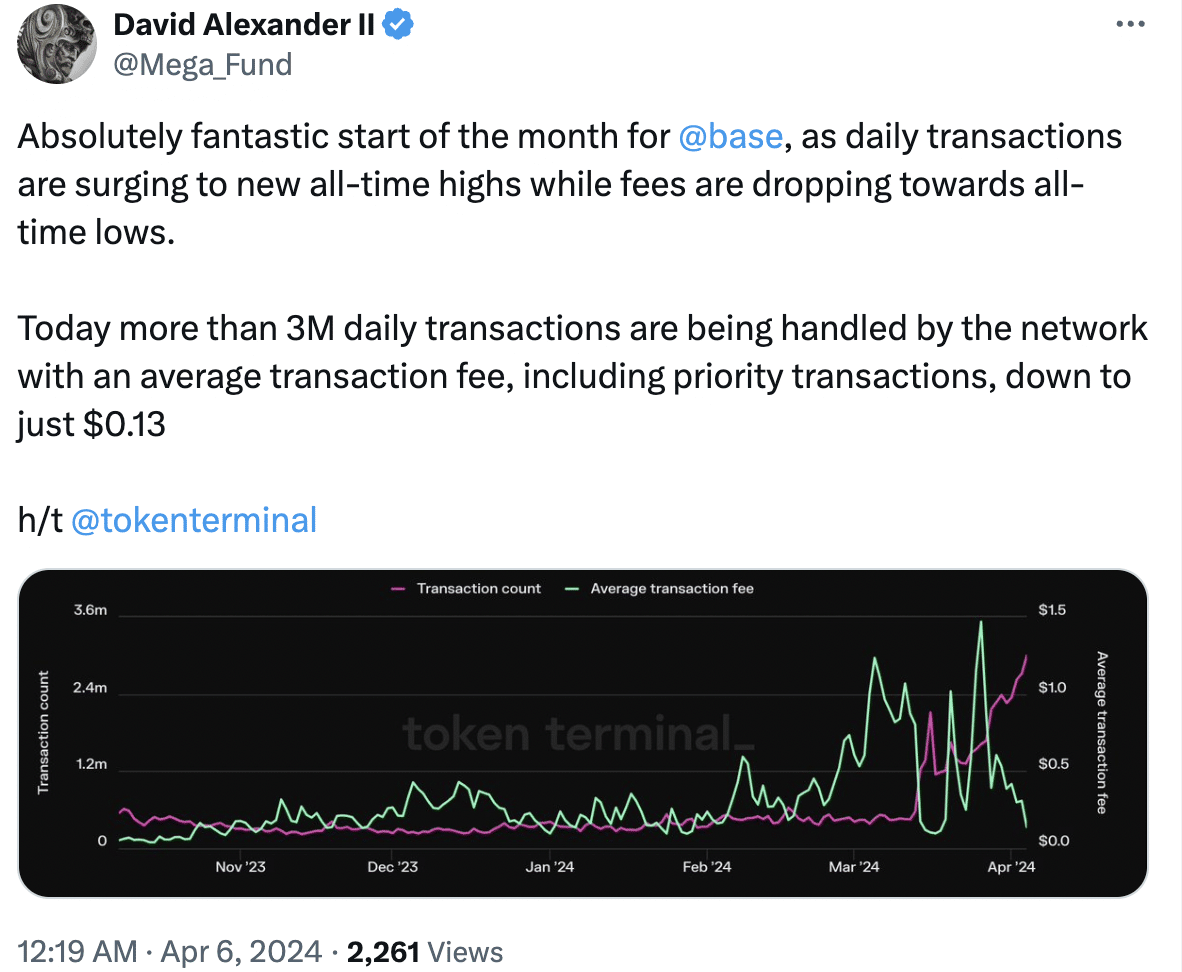

Although Base is relatively new in the Layer 2 (L2) sector, it has outperformed other L2 chains in the crypto market on several fronts. In fact, Base has started the month absolutely fantastically, with daily transactions hitting new all-time highs and fees dropping to unprecedented lows.

New highs for Base

At press time, the network is processing over 3 million transactions per day – a notable milestone. Despite this increase in transaction volume, the average transaction fee, which includes priority transactions, has dropped significantly to just $0.13.

Source: X

How has it fared compared to other L2s?

As for the DeFi sector, the Base network has performed relatively well. On March 14, for example, Decentralized Exchange (DEX) volumes on Base surpassed those of Optimism. A few weeks later, DEX volumes on Base also surpassed Arbitrum’s. Even though Base’s dominance was short-lived, it showed how Base could be so successful in such a short period of time.

Due to these factors, the revenue generated by Base skyrocketed. Daily revenue earned by the network increased from $135,000 to $405,000 in the past few weeks. Although Base has a lower TVL (Total Value Locked) than Arbitrum, it has been able to perform better than Arbitrum and Optimism in earning revenue.

Base’s significant revenue, combined with the fact that it is backed by Coinbase, can give the Layer 2 network a significant lead over its competitors.

Source: Artemis

Memecoin frenzy

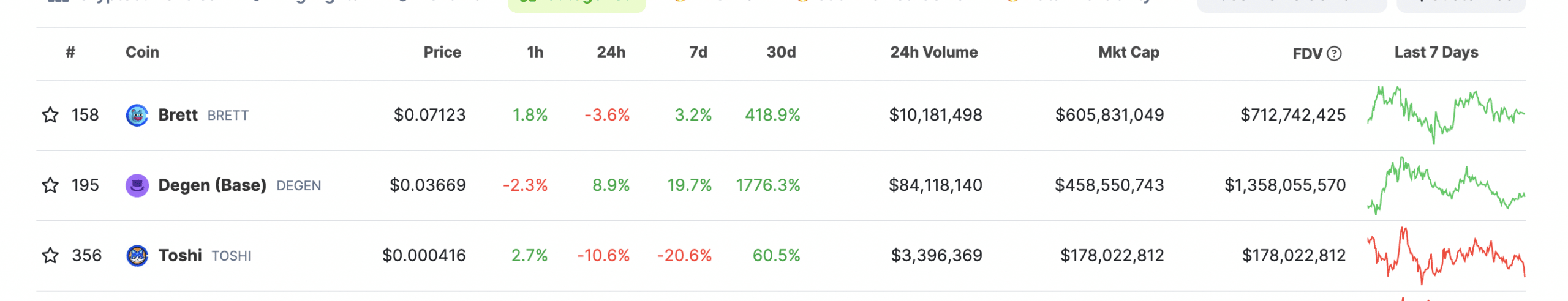

One of the reasons for the increased activity and revenue generated on Base has been the memecoin activity on Base. Apart from the Solana ecosystem, the Base ecosystem has also seen a massive surge in memecoin creation.

For example – Over the past month, the values of popular memecoins on the Base network have seen bullish trends ranging from 60.75% to 1776.36%. In fact, memecoins like Brett and DEGEN have performed relatively well compared to other memecoins in this space.

Source: Coingecko

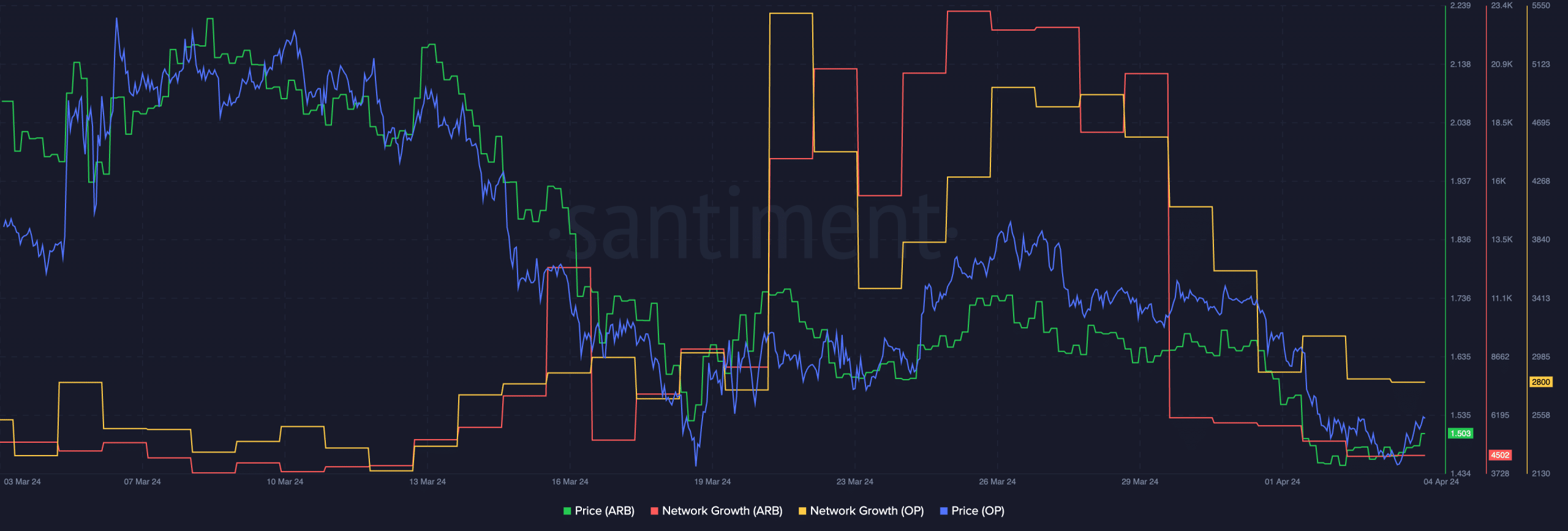

As for ARB and OP, both tokens have seen a significant drop in price. Moreover, the network growth for these tokens has also dropped significantly in the past few days.

This suggests that new users are not interested in these tokens. At least not in the short term.

Whether realistic or not, here is the market cap of ARB in BTC terms

Source: Santiment