How L2 Chains Increased Ethereum’s User Base

![]()

Journalist

Posted:

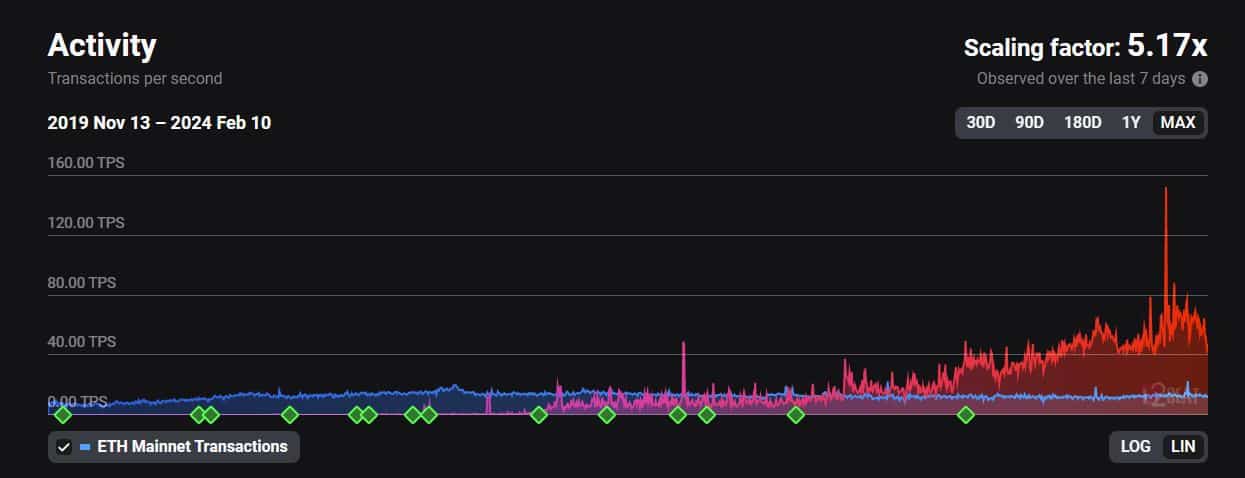

- Scaling solutions have processed 5.17 times more transactions than the base layer in the last seven days.

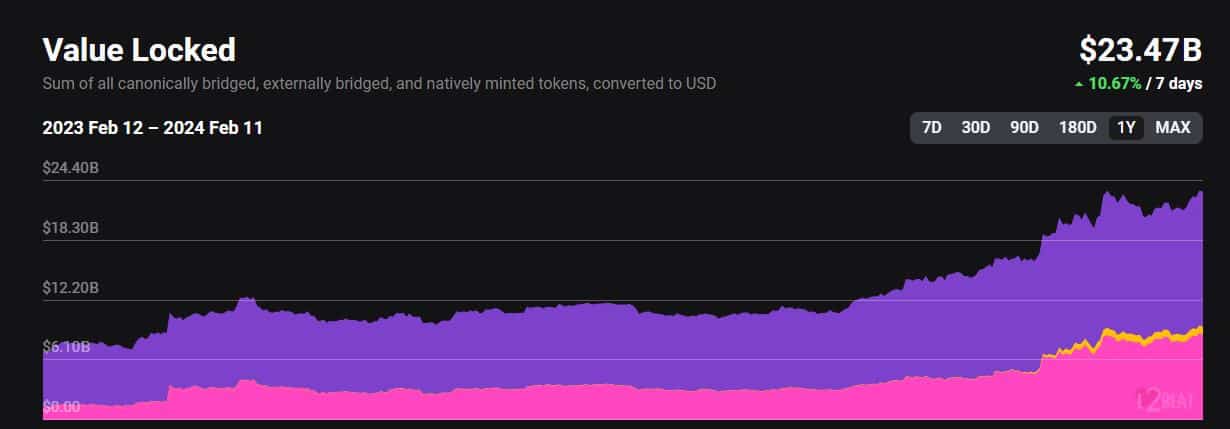

- The TVL on ETH L2s has quadrupled in the last year.

The Ethereum [ETH] Layer 2 (L2) landscape has expanded by leaps and bounds over the past year.

Blockspace’s demand for scaling solutions has skyrocketed, and users have jumped in to take advantage of the relative advantages.

L2s attract users to the Ethereum ecosystem

According to a recent post from on-chain analytics firm Token Terminal, the best ETH scaling solutions serve nine million monthly active users, a massive 9x increase year-over-year corresponds.

It was interesting to observe that this exponential growth occurred during the bear market, the time when on-chain activity on major L1s was stagnant.

L2 solutions based on Ethereum’s base layer should be the answer to the scalability question.

It was planned that over time these L2s would handle the majority of low-value transactions, with the base layer providing security and decentralization.

This disruptive vision, which was initially slow to take hold, finally paid off.

L2s clock five times more transactions than the mainnet

According to AskFX’s analysis of L2Beat data, the aggregate average transactions per second (TPS) across L2 blockchains as of this writing was 47.37, compared to the mainnet’s value of only 11.70.

In fact, scaling solutions have processed 5.17 times more transactions than the base layer in the last seven days.

Source: L2Beat

The dual benefits of higher transaction throughput and lower fees have also led many decentralized applications (dApps) to ETH scaling solutions.

This in turn has led to a significant injection of capital.

ETH L2s are becoming DeFi hubs

At the time of this writing, more than $23 billion was locked on L2 chains, as AskFX observed using L2Beats data. This was a nearly four-fold increase from the previous year.

Although this was still lower than Ethereum’s Total Value Locked (TVL) of $39.41 billion, the impressive growth trajectory reflected the growing demand for L2s.

It was a given that the expanding L2 sector would provide positive momentum to the ETH price. Users of all scaling solutions pay transaction fees in ETH.

Source: L2Beat

Is your portfolio green? Check out the ETH profit calculator

. So the higher the demand for L2 blockspace, the higher the demand for ETH coins will be.

At the time of this writing, the second-largest cryptocurrency was trading at $2,553, with double-digit weekly gains of 10%, according to CoinMarketCap.