How the Bitcoin Crash Caused the Biggest Losses for Short-Term Investors

![]()

Journalist

- The coin has suffered one of the worst losses since 2022.

- Long-term BTC holders are still more profitable than their short-term counterparts. This suggests that BTC is still in a bull market.

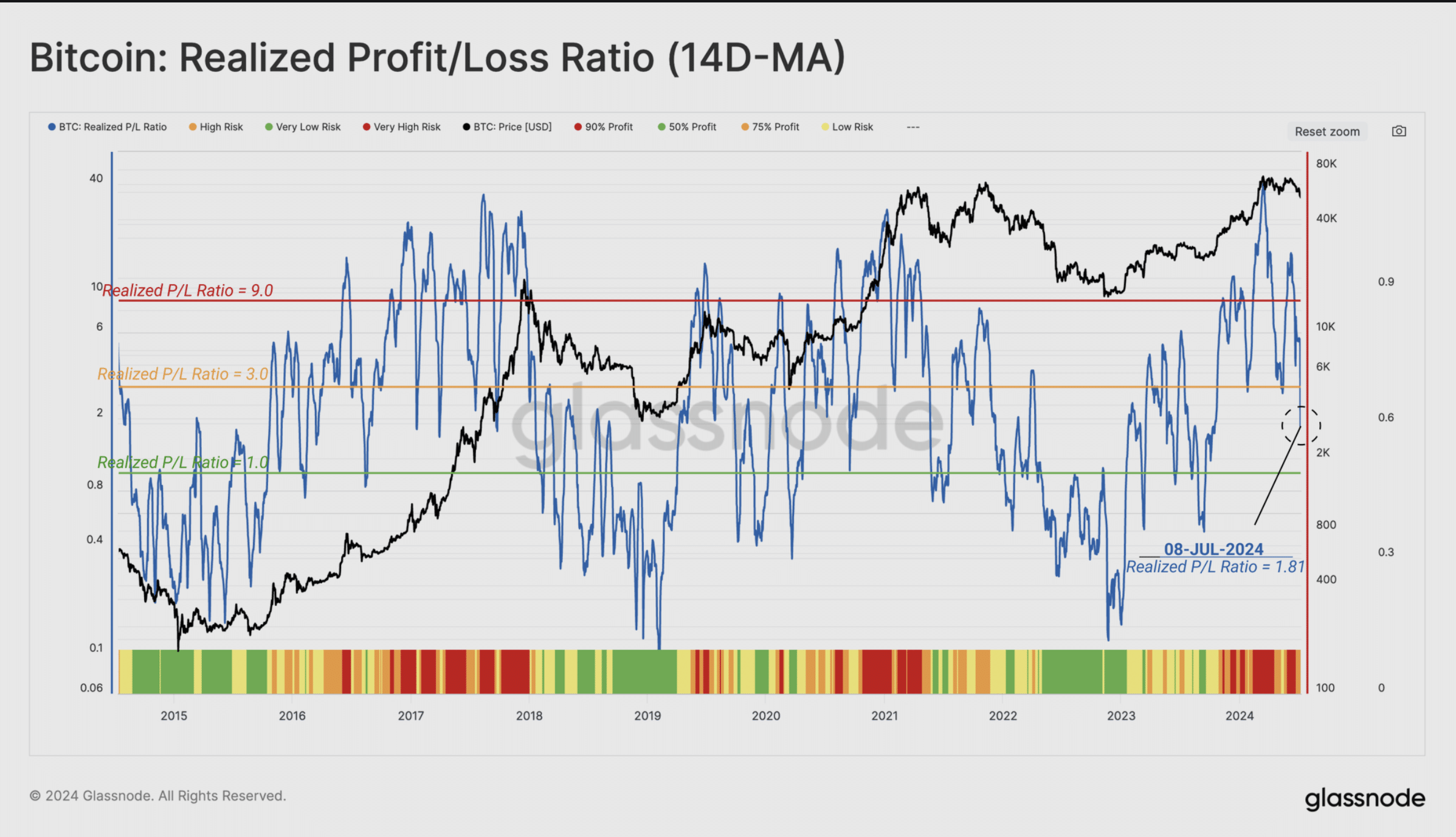

According to a recent report published by Glassnode, the Bitcoin crash [BTC] is responsible for the biggest losses since the 2022 bear market. BTC has actually fallen by 14.45% in the last 30 days.

The report focused on short-term holders (STH). These holders are those who have owned Bitcoin for less than 155 days. Many STHs are making losses due to the Bitcoin crash.

Short-term holders facing significant losses

Comparing the losses with the last three years, this is one of the biggest financial losses holders have ever experienced. Glassnode found that this has resulted in a financial loss.

If we compare market conditions in Q2 and Q3 2021 with Q2 and Q3 2019, there is a significant difference. Short-term holders faced acute financial stress for 70 days in a row. This period was long enough to shake investor confidence, leading to the 2022 bear market.

Source: Glassnode

This does not mean that Bitcoin has entered a bear market phase as a result of the Bitcoin crash.

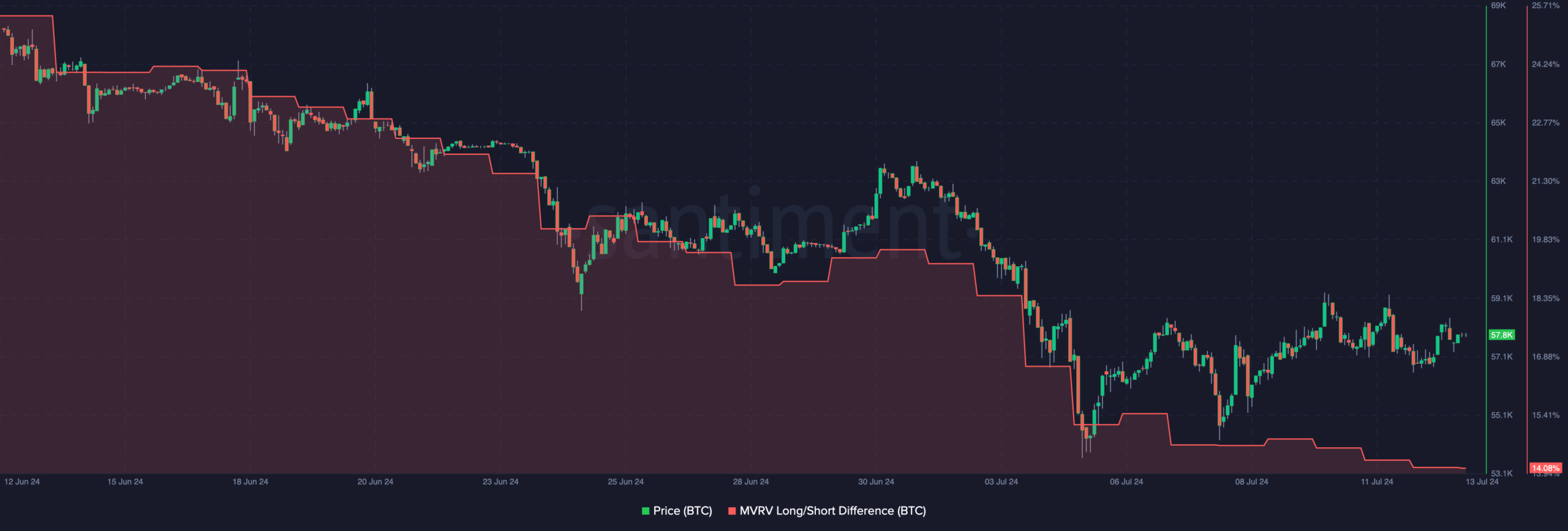

The MVRV long/short difference is a good indicator of this sentiment. MVRV is the market value to actual value. This metric is used to compare the profitability of long-term and short-term investors.

Long-term investors still holding strong

Negative values indicate that holders who hold for the short term will make more money than those who hold for the long term. If this is true, Bitcoin has entered a bear market.

If the difference is positive, long-term investors make more money if they decide to sell than short-term investors.

At press time, the long/short difference of MVRV was 14.08 percent.

Bitcoin has not entered a bear market as the price was lower than in previous months. The coin seems to be going through an inevitable correction within the bull market.

Source: Santiment

The report also highlighted the loss incurred.

If we take a closer look at the losses of short-term holdings this week, we see that a total realized loss of $595 million was locked in. This is the largest loss event since the 2022 cycle low.

Although the realized gain to realized loss ratio admitted that the bulls are under pressure, it showed that there were virtually no gains. If the ratio is typically between 0.50 and 0.75, it is likely that Bitcoin is currently in a corrective phase of the bull market.

Unfortunately, by July 8, the indicator had fallen to 1.81, suggesting that investors are skeptical about the cryptocurrency’s potential. If the price does not rise again or rebound, BTC could enter a bearish phase.

Source: Glassnode

Bitcoin was valued at $57,848, after a small increase in the last 24 hours.

Is your portfolio in the black? Check out the Bitcoin Profit Calculator

Bitcoin’s crash could soon be a distant memory if the price continues to rise. BTC holders risk losing value if it does not.