Is Ethereum’s Recent Price Drop a Sign of a New Rally?

Journalist

- More whale addresses have been accumulating ETH in recent weeks.

- ETH’s uptrend has continued to fade as the price has declined.

Ethereum [ETH]Large investors have a great buying opportunity as the price has been moving closer to a downtrend in recent days.

Recent data shows that large wallets bought more Ethereum as the price dropped, which is a positive sign.

Whale addresses are snapping up Ethereum

AskFX analyzed some of the top Ethereum addresses and found a small increase starting late last month. Wallets holding over 10,000 ETH started growing around May 19.

The number of wallets is approximately 952, with Ethereum trading for around $3,074.

At the time of writing, the number of wallets holding more than 10,000 ETH has increased from 952 to 980.

These addresses continue to accumulate more Ethereum despite the price of ETH increasing from around $3,700.

Source: Glassnode

AskFX also noticed a change in the Mega Whale chart over the past 30 days: the trend is now pointing upwards.

The increase in wallet count is a reflection of increased buying pressure.

These addresses are betting on an uptrend.

Ethereum is flowing out of exchanges in greater numbers

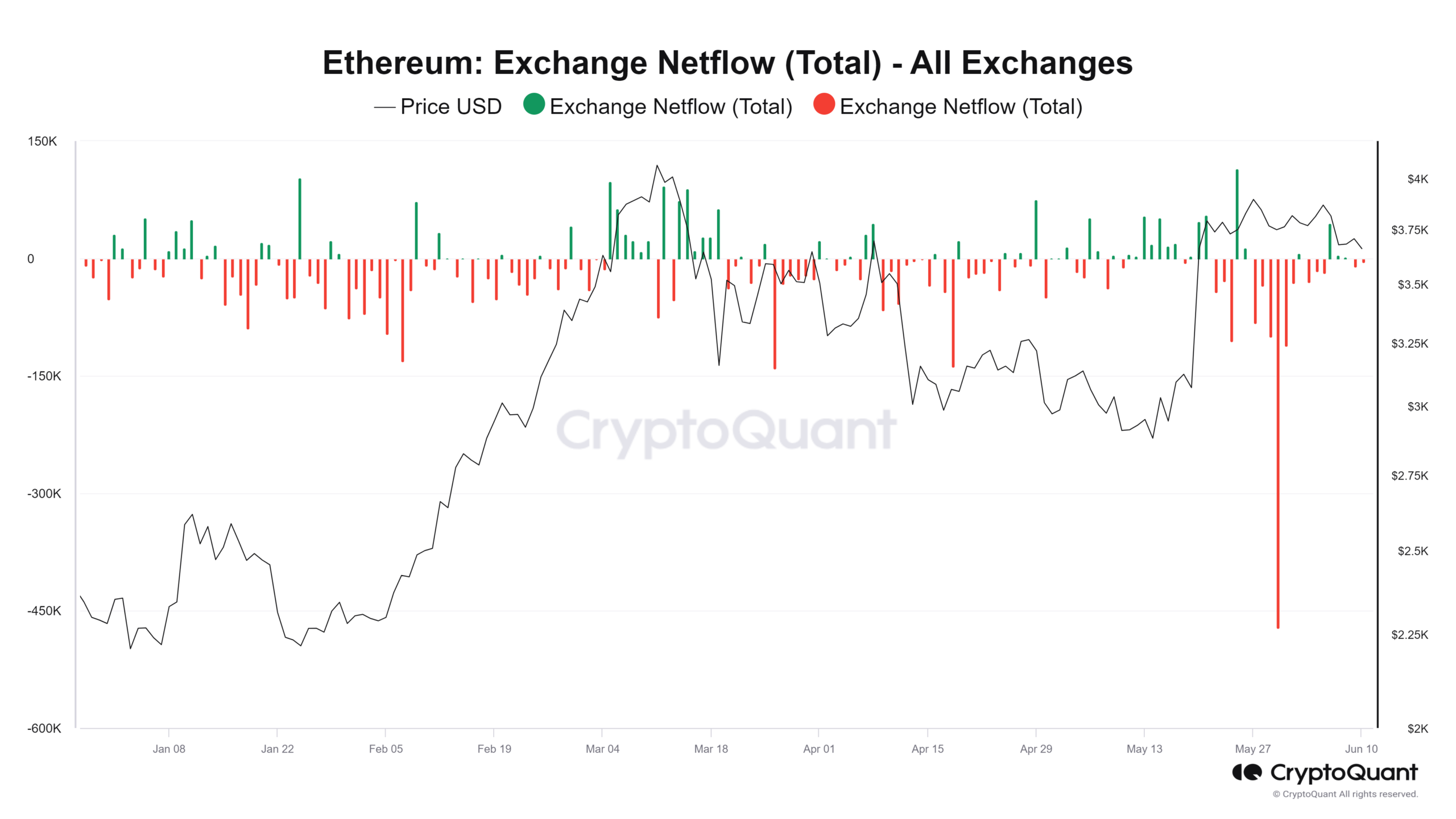

Ethereum’s netflow, as shown by CryptoQuant, has been dominated by negative flows in recent weeks. The chart showed that outflows consistently exceeded inflows for the new month.

Source: CryptoQuant

The chart shows that more ETH has left exchanges than flowed into them since the beginning of the month.

According to the analysis, the negative netflow volume from June 1 to date is over $354 million, while the positive flow volume is around $226 million.

This netflow pattern, coupled with the accumulation of large wallets, bodes well for ETH despite the recent price action.

ETH nears neutral

AskFX’s analysis of Ethereum on a daily time frame revealed that the price has been in the $3,600 range for the past three days.

It is currently trading at $3,670 and has seen a decline of about 0.8%. ETH had a small gain in its previous trading session. However, the recent decline has wiped out that gain.

TradingView

Here is the ETH market cap in BTC terms.

At the time of writing, Ethereum’s Relative Strength Index was above 52. However, the RSI is pointing downwards, suggesting that a sustained price decline could push it below neutral.

The trend is bullish but weakening.