Jupiter Rises 13%, Joins Solana in Price Rally – How

Journalist

- JUP rose to $0.59 as SOL rose above $100.

- JUP trading volume on exchanges has increased, indicating growing interest in the token.

Jupiter’s price surged to $0.59, while SOL rose above $100.

The trading volume for JUP on exchanges has increased, indicating a growing interest in the token.

Jupiter’s price [JUP] climbed to $0.59 on February 7th, marking a 13% increase. However, the price later fell to $0.53 at press time. This was the first time that JUP had reached $0.59 since its launch on February 3rd.

Arkham Intelligence revealed in a blog post that there was a specific reason for the price increase.

Arkham claims that the Jupiter exchange team removed liquidity from the JUP pool. At the time of publication, the team had already removed 90 million JUP from the pool.

In context, a liquidity pool is a collective cryptocurrency tied to a smart contract. This speeds up orders and transactions on a decentralized exchange.

JUP was a good example of this. By withdrawing liquidity from the pool, it is possible to reduce the pressure when selling the cryptocurrency.

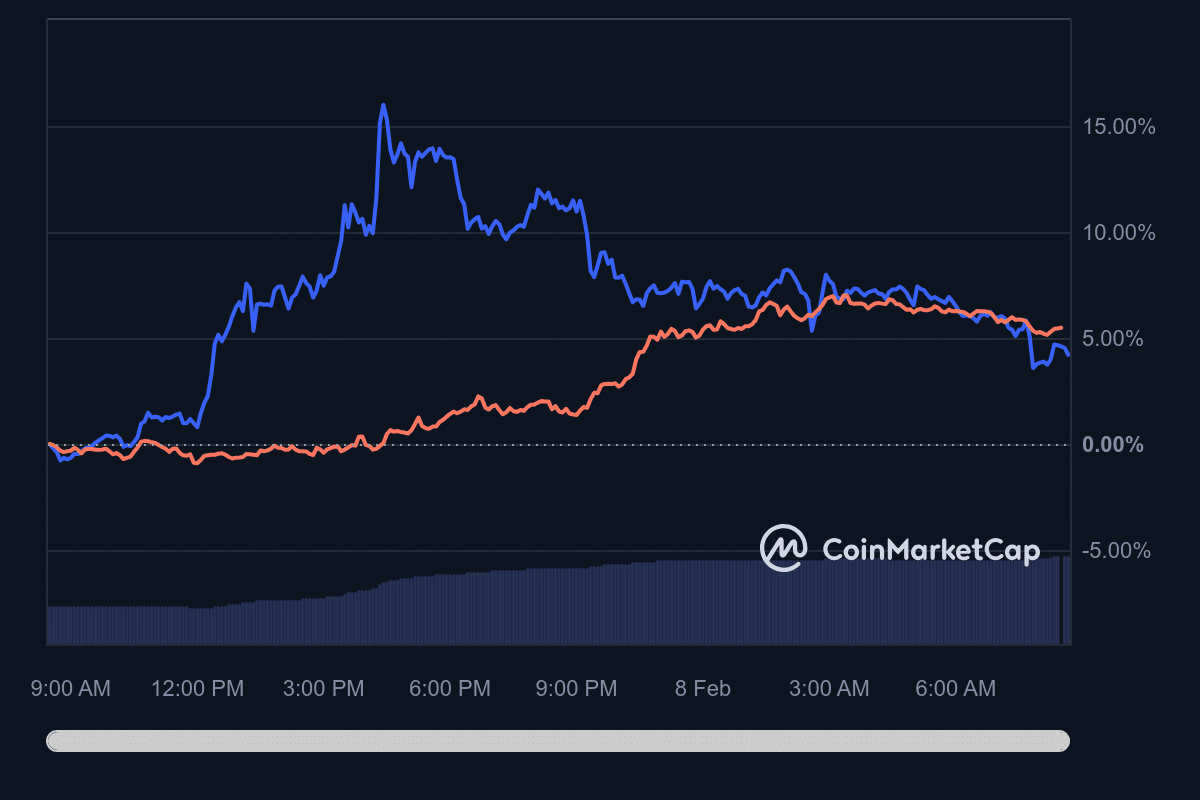

AskFX found that Solana also exhibited this behavior. [SOL] The rise of JUP was also influenced by this. SOL traded below $100 for a long time. The price of SOL rose to $102 around the same time JUP rose.

Source: CoinMarketCap

AskFX previously explained that Jupiter and Solana have a correlation because Jupiter is an exchange built on the blockchain. Recall that the exchange distributed millions of dollars in JUP tokens to its first users. The price of JUP at that time was $0.75.

The hype returns and then dies down

The value of JUP fell by 6%, while the value of SOL also fell. This is because the addresses that were eligible for the tokens claimed and sold them. The recent price rally also showed that market participants were taking advantage of the action. The reason for this was the increase in trading volumes on the stock exchanges.

As of early morning on February 7th, trading volume was approximately $265.95 million. A few hours later, the volume had increased to $465.12 million, showing that JUP was experiencing high trading volume.

Source: Santiment

On-chain data showed that social volume increased as price increased. Observations show that social volume increased dramatically to 16.95 at $0.59.

Social volume is the search rate of participants for an asset. The metric increases when a large number of people follow and discuss the token. When social volume drops, it means the hype has died down.

Here is the JUP market cap in SOL.

The chart showed that social volume fell after the initial spike. Market participants seemed to have shifted their attention from JUP to other cryptocurrencies.

This move can also provide participants with a long-term buying opportunity.