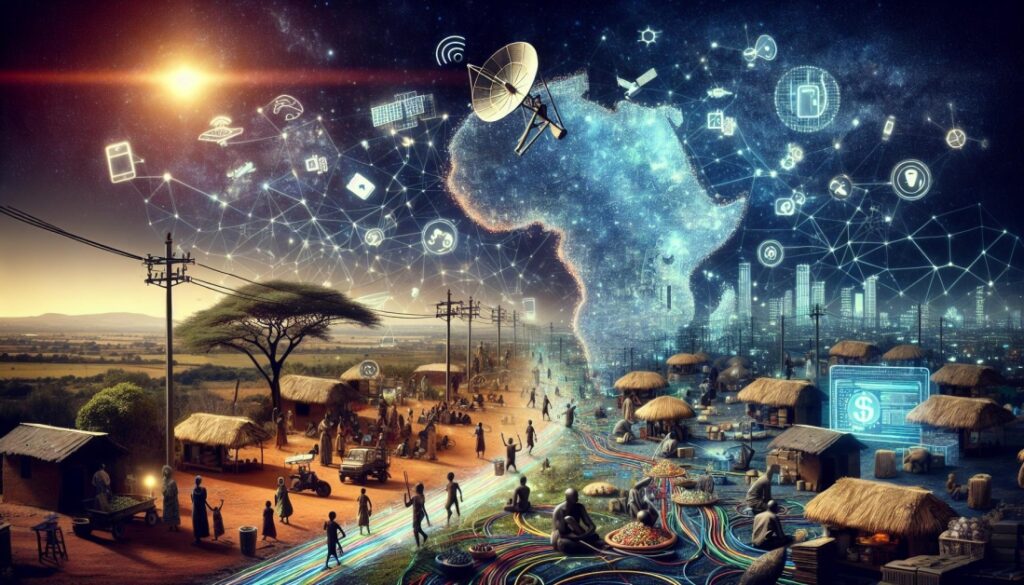

Mastercard and MTN Group Fintech are Collaborating to Promote Mobile Money Services in Africa

By: Jared Kirui

Mastercard and MTN Group Fintech have signed an agreement that will improve mobile payment services in Africa. This partnership spans 13 African countries and a combined subscriber base of 290 million. Additionally, 60 million MTN wallets are active every month. It offers digital solutions tailored to consumers and retailers.

According to a press release, Mastercard Fintech and MTN Group Fintech aim to: Launch a virtual prepaid card for MTN MoMo users. This article explains how to use a virtual prepaid card for MTN MoMo customers. Users can access over 100,000,000 branches worldwide. MoMo merchants can also accept card payments to enrich the platform’s international remittance service. Skills.

Strengthening financial inclusion for Africa

Collaboration is a key aspect of any successful collaboration. MTN has integrated virtual and physical Mastercard cards as companion cards across all of its services. Wallet. This gives users access to an extensive network of points of sale worldwide. This initiative aims to help merchants expand their service globally and improve cybersecurity. Digital solutions that drive customer engagement, trust and loyalty transactions.

Amnah Ajmal is Executive Vice President of Market Development at Mastercard for EEMEA. She explained: “Our innovation collaboration is the foundation of our strategy. We are proud of our partnership. MTN will enable millions of Africans to engage in digital commerce.”

Mobile money solutions are also available. SMEs can grow through seamless commercial transactions. Operations, greater acceptance of payments, affordable credit and secure digital tools.”

The partnership spans 13 African markets. These include Benin, Cameroon, Ivory Coast, Eswatini, Ghana, Liberia, Nigeria, Rwanda, South Africa and Uganda all part of the Republic of Congo. Zambia is a country that has a lot to offer.

Remittance solutions expand their reach

Collaboration goes beyond domestic transactions to include international remittance services to meet Africa’s growing demand for cross-border money transfers. Mobile money is a great way to transfer money across borders. Mastercard and MTN Group Fintech strive to offer secure transfers as the number of transfers increases. Ease of transactions promote financial inclusion, economic growth and the use of credit. Across the continent

The new service also allows SME owners to benefit from the ability to accept digital forms of payments to build an online presence Payments Enhance and enhance customer experiences. Features include QR code and tap-on-phone solutions.

rnrn