Near Hits $7.51: Why Ethereum Could Be in Danger?

![]()

Journalist

- The number of active addresses on the protocol is six times higher than Ethereum.

- NEAR could continue to be more expensive than ETH despite development differences.

The NEAR protocol has been a success in many ways. [NEAR] Price beaten by Ethereum [ETH] It has dominated the blockchain for the past seven days. But it has outperformed the blockchain on other fronts too.

NEAR was trading at $7.51 at press time, up 39.06% over the past seven days. ETH was trading at $3171 while NEAR was at $7.51, up 39.06% over the past seven days, down 6.02% over the past 30 days.

It didn’t stop there. Artemis data shows that the number of active Ethereum addresses was 406,200 at the time of writing. They were all in the same range.

Source: Artemis

What is the L1 Maestro?

It was a completely different story for NEAR. On April 7, the number of active addresses was less than 1 million.

Data on the developer analytics platform showed that the metric in question was 2.3 million.

NEAR uses the same Proof-of-Stake (PoS) consensus as Ethereum. However, it seemed that both users and developers preferred the on-chain abstraction provided by the latter.

NEAR is one of the few Layer-1 projects with such a high scaling capacity. Users can now transact faster and cheaper without having to wait for Layer-2.

The momentum of the protocol could make it difficult for ETH to keep up with the token in terms of price. The lively AI narrative is another catalyst for the token’s rise.

This has led to a dramatic increase in market capitalization. Until a few months ago, the market for the protocol was not in the top 25. However, at the time of writing this article, the project has a market cap of $7.36 billion, ranking 17th.

Source: CoinMarketCap

Both sides win on different ends

In the last 30 days, fees on the network have increased by 51% to an average of $40,000. This could help NEAR overtake ETH in market cap, but it could also push its revenue close to Ethereum.

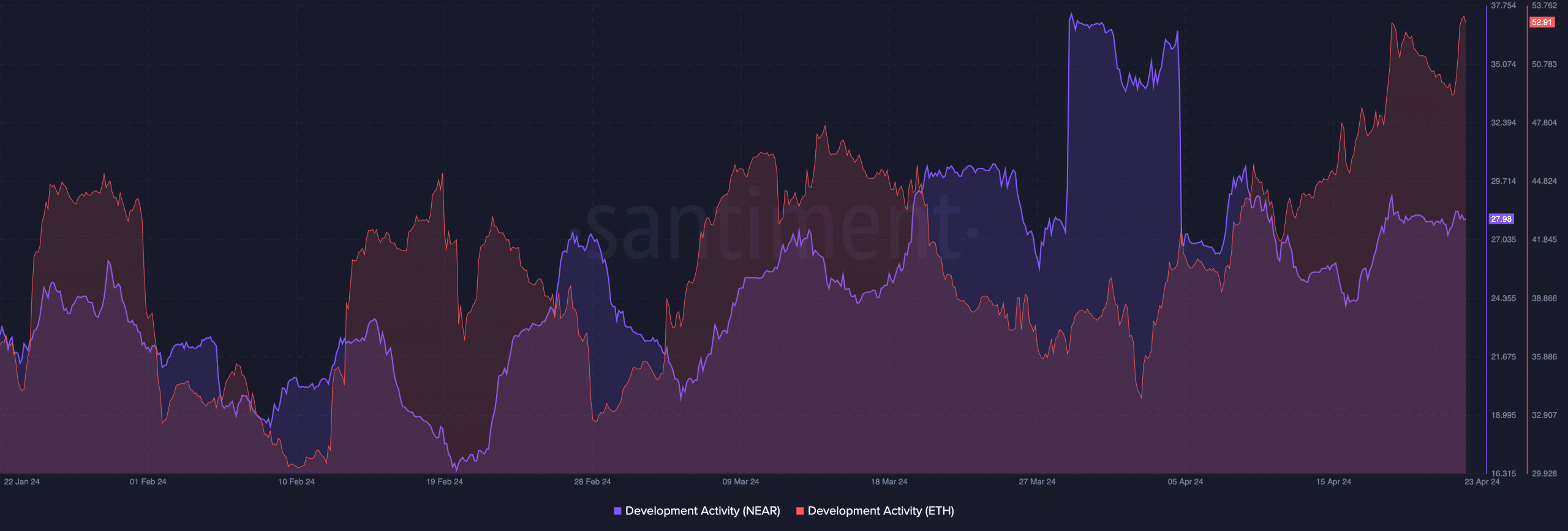

AskFX also looked at development activity. Santiment reported that development activity for the NEAR protocol was at 27.98, a significant increase from the April 16 reading.

The Ethereum reading was at 52.91, showing that the code dedicated to the blockchain’s new features and its security is larger than NEAR.

Source: Santiment

Based on this data, NEAR may not be able to overtake Ethereum in terms of public GitHub repositories. Prices might be different.

Here is NEAR’s market cap in ETH.

For example, ETH has been lagging for a long time. If this trend continues, the price may not be able to keep up with NEAR’s growth.

However, in the long run, things could change if ETH gets moving. NEAR could continue to outperform Ethereum’s metrics and price in the coming weeks or months.