Open Interest in Bitcoin Drops by $1 Billion: What Traders Need to Know

![]()

Journalist

- BTC contracts have been liquidated, suggesting BTC price could drop to $65,000.

- Social dominance has dropped to 7.07%, suggesting attention is shifting to other cryptocurrencies.

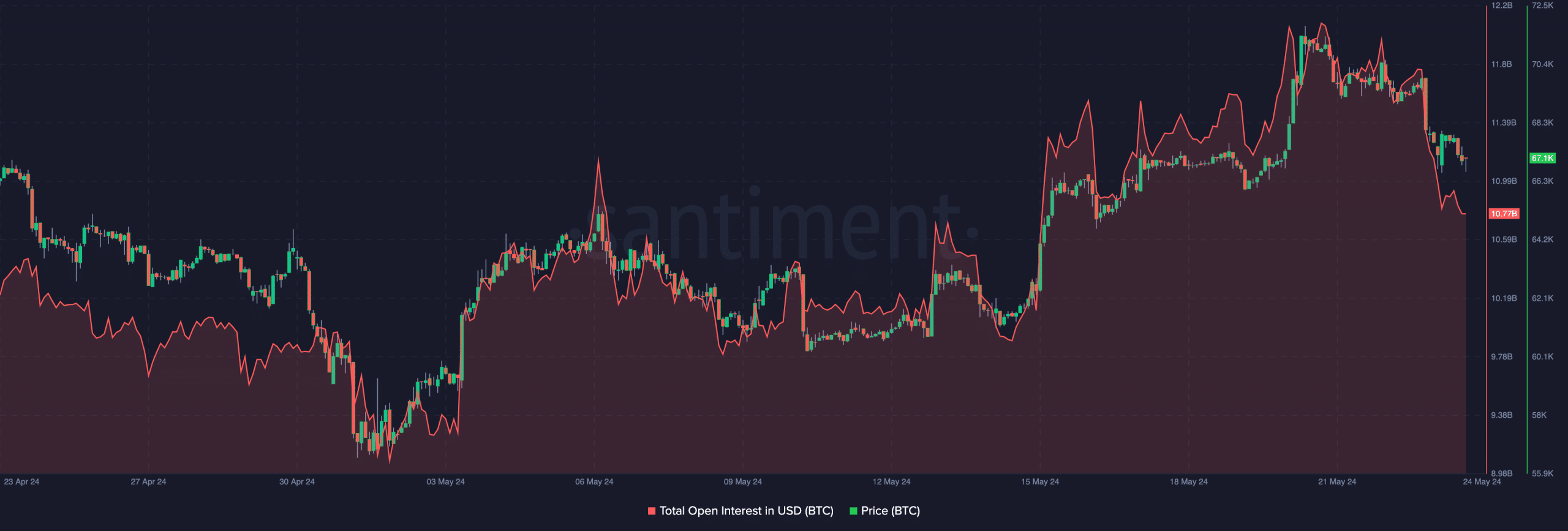

Total Bitcoin [BTC] Between May 23 and May 24, open interest lost nearly $1 billion. AskFX discovered this after using Santiment’s on-chain data to examine the metric.

Bitcoin’s open interest was $11.75 billion on May 23. However, at the time of publication, that number had dropped to $10.77 billion. OI is the total value of all open positions within a contract.

In crypto trading, there are two sides: a buyer and a seller. OI is a measure of new money entering the market to the benefit of buyers.

Bitcoin’s Open Interest in Steep Decline

This trend suggests a bullish direction. If OI gets too high, it could be a bearish signal. A drop in open interest, on the other hand, suggests that more positions have been closed in favor of sellers.

The trend shown above shows that the majority of traders are not opening new positions. This was a bearish signal for Bitcoin price and had started to reflect the price.

Source: Santiment

BTC was valued at $67,123 at the time of publication, representing a 3.52% drop in the last 24 hours. Bitcoin’s drop could also be due to the recent approval of Ethereum spot ETFs.

AskFX noted that traders appeared to be reinvesting capital in ETH and altcoins. If this continues for a while, BTC could fall even further. A rise to $65,000 is possible in the near future.

Recent reports have suggested that Bitcoin could fall before returning to $70,000. This suggests that this may already be happening.

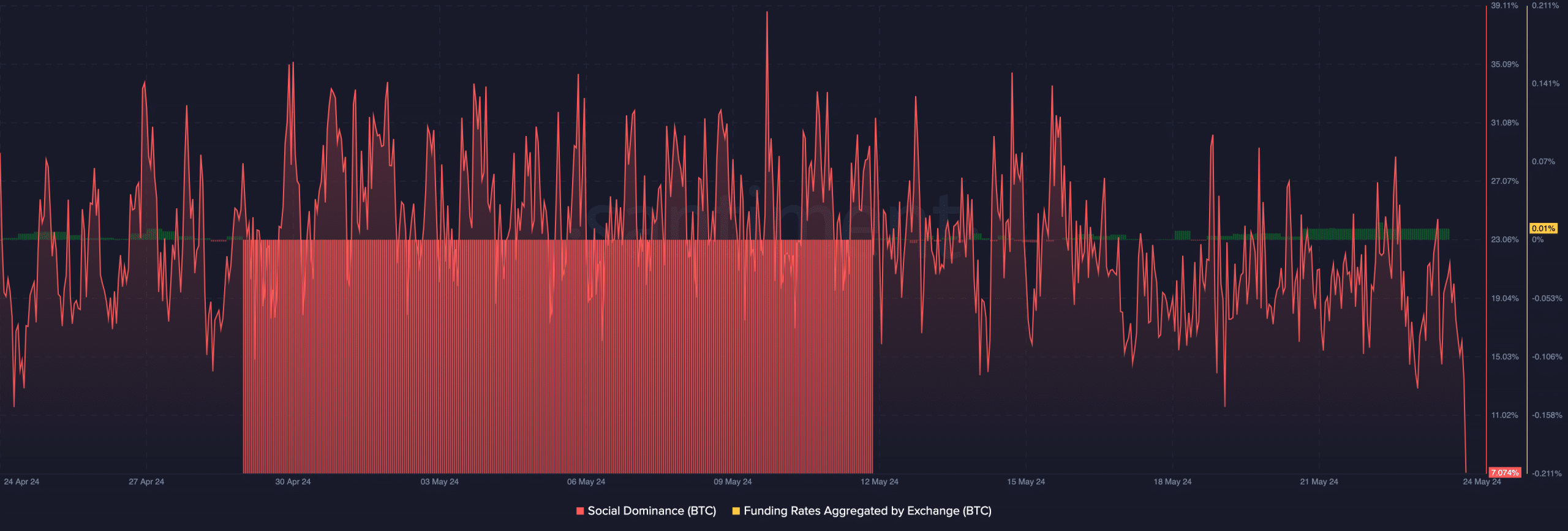

Market Attention Shifts Away from Bitcoin

Social dominance was also a value being evaluated. Bitcoin’s social dominance has dropped to 7.07% at the time of writing this article. A few days ago, this value was above 28%.

This drop shows that the cryptocurrency has been talked about less and that the market’s attention is shifting to other topics.

If social dominance continues to drop, the $65,000 prediction could come true. A further drop could signal a BTC bottom.

Bitcoin’s funding rate was also 0.01%. The funding rate is a measure of the cost of keeping an open contract in the market. When the funding rate is positive, the contract price trades at a premium to the spot value.

Source: Santiment

Bitcoins: Read the Bitcoins [BTC] Price Predictions 2024-2025

When the price is positive, the contract price is below the index. Bitcoin price could continue to fall in the short term as funding wanes.

It might not be long before prices start to rise again.